Positive surprise in terms of NFP employment.

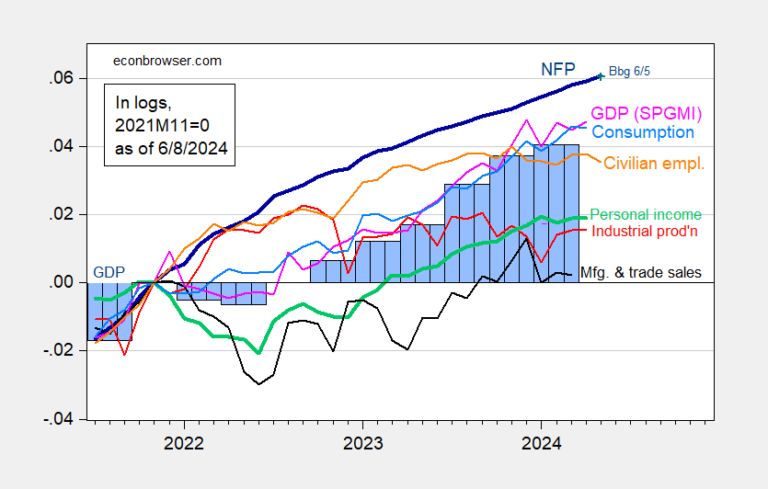

Figure 1: CES non-agricultural employment (NFP) (bold blue), civilian employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017 $ (bold green), manufacturing and commercial sales in Ch.2017 $ ( black), consumption in $Ch.2017 (light blue) and monthly GDP in $Ch.2017 (pink), GDP (blue bars), all logarithmic normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, second version of BEA 2024Q1, S&P Global Market Overview (née Macroeconomic Advisors, IHS Markit) (6/1/version 2024) and calculations by the author.

As discussed in previous articles, give almost all importance to the CES series in assessing business cycle fluctuations.

Here are different job series:

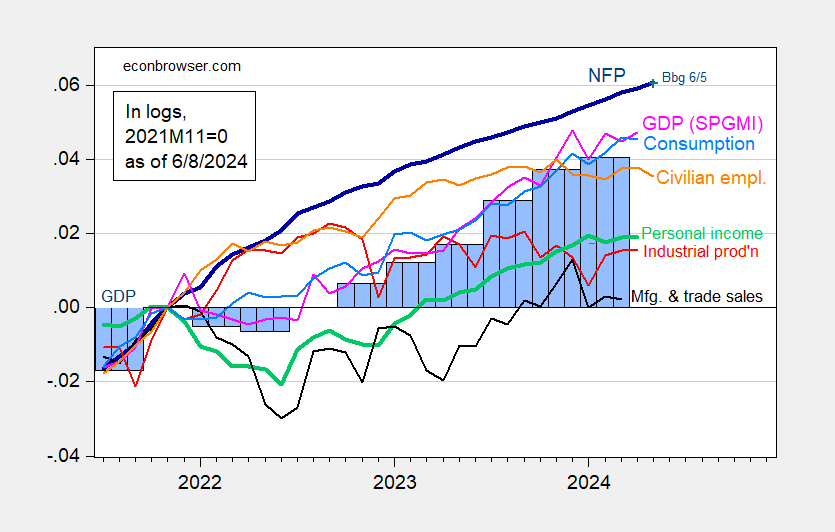

Figure 2: NFP employment (blue), first Philadelphia Fed benchmark (beige), CPS series adjusted to the NFP concept (green), implicit employment of business employment dynamics based on the level of the NFP of the fourth quarter of 2019 (pink ) and cumulative hours (red), all seasonally adjusted, in logs 2021M11=0. Source: BLS, via FRED, Philadelphia Fed and author’s calculations.

I would downplay the adjusted CPS series, given population control issues. The Business Employment Dynamics series is sobering, although early benchmarks from the Philadelphia Fed suggest continued growth through December.