With the publication of the employment situation, we have a first reading on the conditions for the month of April.

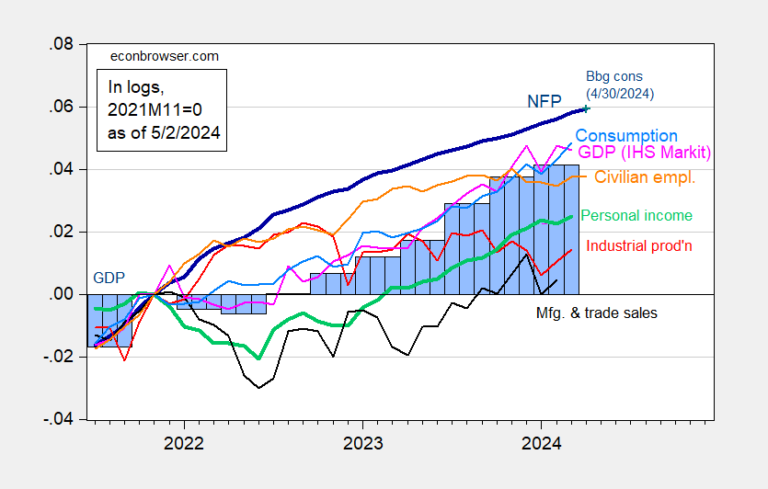

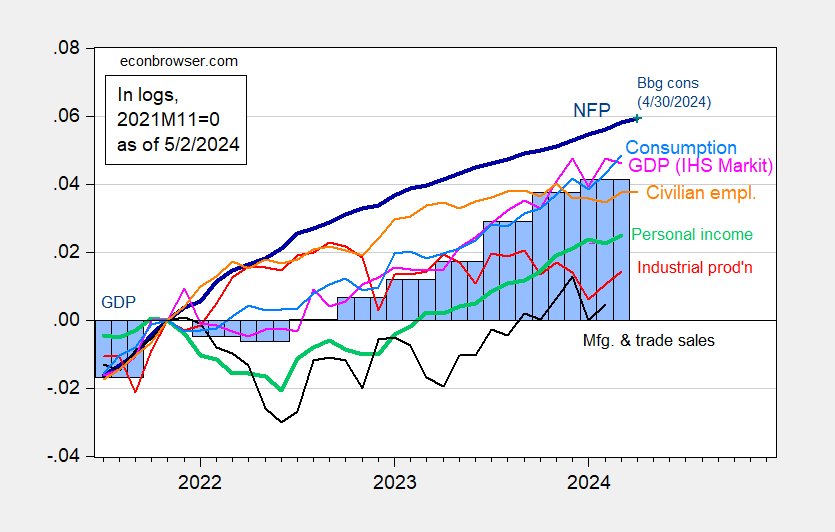

Figure 1: Non-agricultural employment (NFP) from the CES (bold blue), civilian employment (orange), industrial production (red), personal income excluding current transfers in $ Ch.2017 (bold green), manufacturing and commercial sales in $ Ch.2017 ( black), consumption in $Ch.2017 (light blue) and monthly GDP in $Ch.2017 (pink), GDP, 3rd version (blue bars), all logarithmic normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q1 advance release, S&P Global Market Overview (nee Macroeconomic Advisors, IHS Markit) (5/1/version 2024) and calculations by the author.

Average net employment growth is 242,000 compared to 276,000 in March (before revision). Annualized monthly GDP growth in m/m fell from 11.5% before revision in February to -1.9% in March.

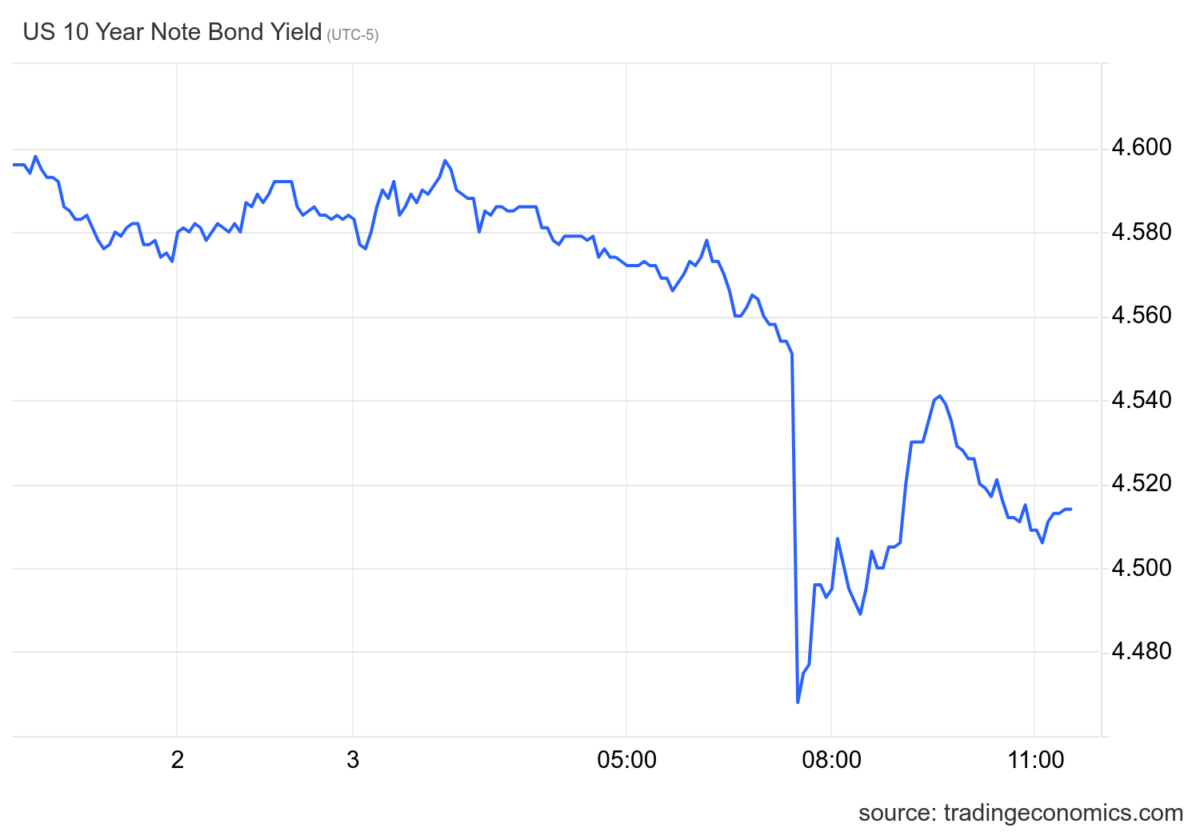

The bond market viewed the details of the job release as a whole as indicating a deceleration (compared to pre-publication). Yields have fallen, while futures indicate a higher likelihood of a federal funds cut at the September FOMC meeting.

Source: TradingEconomics, accessed on 03/05/2024. Times are central.