JL Gutierrez

Inflation relief with a “weak” 0.1%

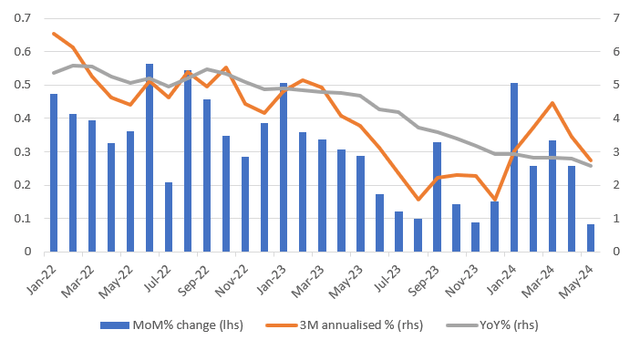

The May personal income and spending report provides some encouragement that inflationary pressures are easing again, after being far too high in the first three months of the year. the year. The core personal consumption expenditures deflator, a broader measure of inflationary pressures than the CPI that the Fed prefers to focus on, came in at 0.1% month-on-month/2.6% year-over-year. This was expected given reading the components of the CPI and PPI reports, but after many positive surprises this year, it’s a relief. The primary metric (including food and energy) was 0.0% month-on-month/2.6% year-over-year, as expected.

Looking at the unrounded figures, the monthly change in core inflation was actually a “low” 0.1%, standing at 0.083% to 3 decimal places, although April was revised slightly upwards from 0.249% to 0.259%, making it a rounding of 0.3% MoM, which is a tiny a bit disappointing. Overall, this supports the argument that inflation appears to be better controlled, which could well open the door to interest rate cuts later in the year.

PCE Base Deflator

Consumers’ cooling time continues

Household incomes were stronger than expected, rising 0.5% month-on-month in nominal terms, with real household disposable income also increasing by 0.5%. Spending also picked up, rising 0.3% month-on-month in real terms, following the 0.1% decline in April and downward revisions to the first quarter figures. However, the trend appears to be slowing. Consumer spending averaged real annual growth of 3.2% in the second half of 2023, but assuming a real increase of 0.2% month-on-month in spending in June, this will mean annualised consumer spending growth of just 1.5% in the first half of 2024. As such, inflation and spending suggest that tight monetary policy is cooling the economy and limiting price increases.

The Fed does not want to cause an unnecessary slowdown – rate cuts from September

The Fed estimates monetary policy to be restrictive at 5.25-5.50% in an environment where it estimates the neutral interest rate to be around 2.8%. The Fed doesn’t want to cause a recession if it doesn’t have to, and if the data allows it to start easing monetary policy slightly, we think it will seize this opportunity, potentially as early as September. For policymakers to be comfortable with this course of action, we think the Fed needs to see three things:

- Further evidence of weakening inflationary pressures. If we can get two more core inflation numbers of 0.2% or less month-on-month in quick succession, that will be a necessary, but not sufficient, factor to drive a rate cut.

- New evidence of labor market slowdown. The unemployment rate increased from 3.4% to 4.0%. If that figure convincingly rises above 4% with more evidence of slowing wages, it will also help swing the argument in favor of rate cuts: the jobless claims data and weak surveys on hiring in companies suggests that the job market is slowing down.

- Slowdown in consumer spending. It has been the main driver of growth in the US, but as noted, the growth rate has halved between the second half of 2023 and the first half of 2024. The Fed must ensure that this continues into the third quarter. The weak growth in real household disposable income, the depletion of savings accumulated by millions of households during the pandemic, and the increase in loan delinquencies suggest that financial difficulties are materializing for many low-income families, which suggests that this situation will indeed continue.

If we get all three of these outcomes, we think the Fed will seek to shift monetary policy from “tight” to “slightly less tight,” with 25 basis point rate cuts at the September, November, and December FOMC meetings.

Content Disclaimer: This publication has been prepared by ING for information purposes only, regardless of the user’s means, financial situation or investment objectives. The information does not constitute an investment recommendation, nor does it constitute investment, legal or tax advice, or an offer or solicitation to buy or sell any financial instrument. Learn more

Editor’s Note: The summary bullet points in this article were chosen by the Seeking Alpha editors.