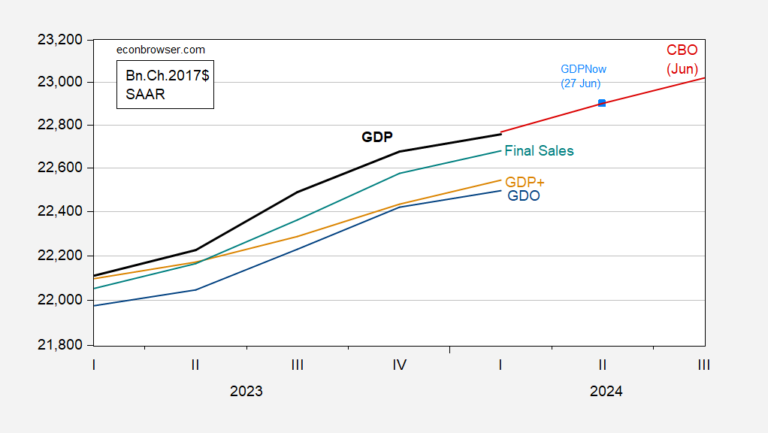

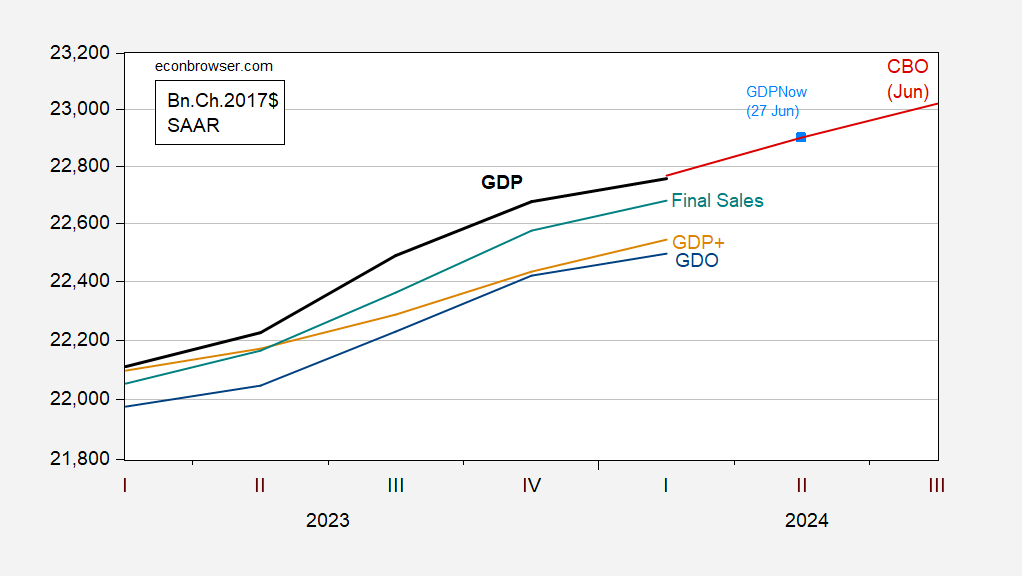

With the third publication of the first quarter, as well as GDP+, we have the following image (in levels):

Figure 1: Reported GDP (bold black), GDO (blue), GDP+ (beige), final sales (light blue), CBO June projection (red), and GDPNow (June 27), all in billions of 2017 SAAR dollars. GDP+ level repeated on Q4 2019 reported GDP level. Source: BEA 2024Q1 3rd version via FRED, Federal Reserve Bank of Philadelphia, Atlanta Federation, CBO (June)and the author’s calculations.

Reported GDP is significantly higher than GDP or GDP+ (1.1% and 0.9%, respectively), but the growth rates are not too different. GDPNow follows the CBO’s June projection (based on early May data).

Final sales are a measure of overall demand; this measure maintains the rhythm.

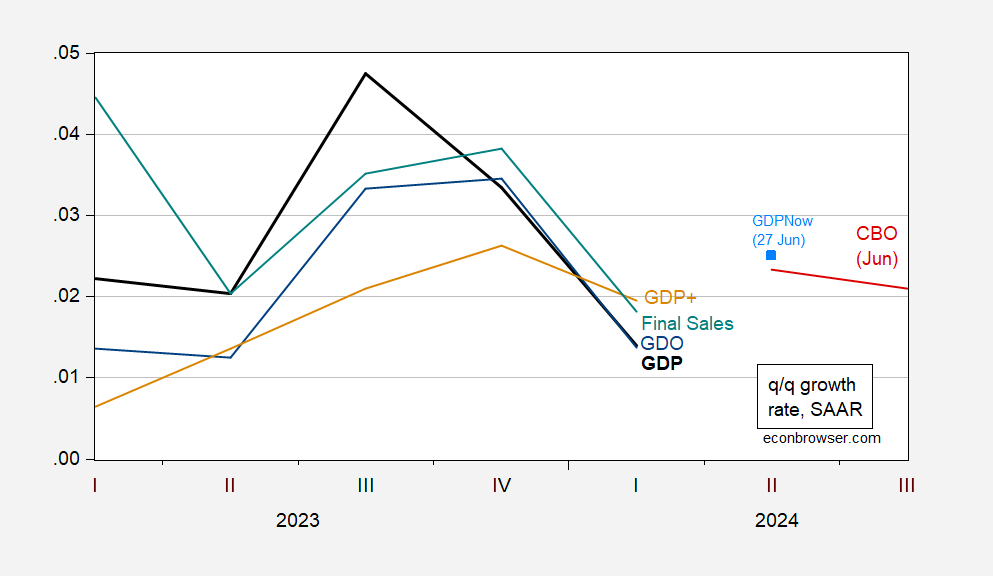

It’s easier to see some of these trends in growth rates.

Figure 2: Quarterly annualized growth rate of reported GDP (bold black), GDO (blue), GDP+ (tan), final sales (light blue), CBO June GDP projection (red), and GDPNow (27 June). Growth rates calculated as first logarithmic differences. Source: BEA 2024Q1 3rd version via FRED, Federal Reserve Bank of Philadelphia, Atlanta Fed, CBO (June)and the author’s calculations.

What is also true is that all measures slowed in the first quarter, with both GDP and GDP growth rates corresponding.

At a higher frequency we have a slight acceleration, since the Lewis-Mertens-Stock/NY Fed WEI index shows 2.53% (for data through 06/22), while the Baumeister/Leiva index -Leon/Sims is at -0.16% (i.e. -0.16% below trend growth)