Marilyn Nieves

By Douglas R. Terry, CFA

Strong points

- Growth will slow

- Sticky inflation

- Business in dollars

- Interest rates peaked but stayed higher for longer

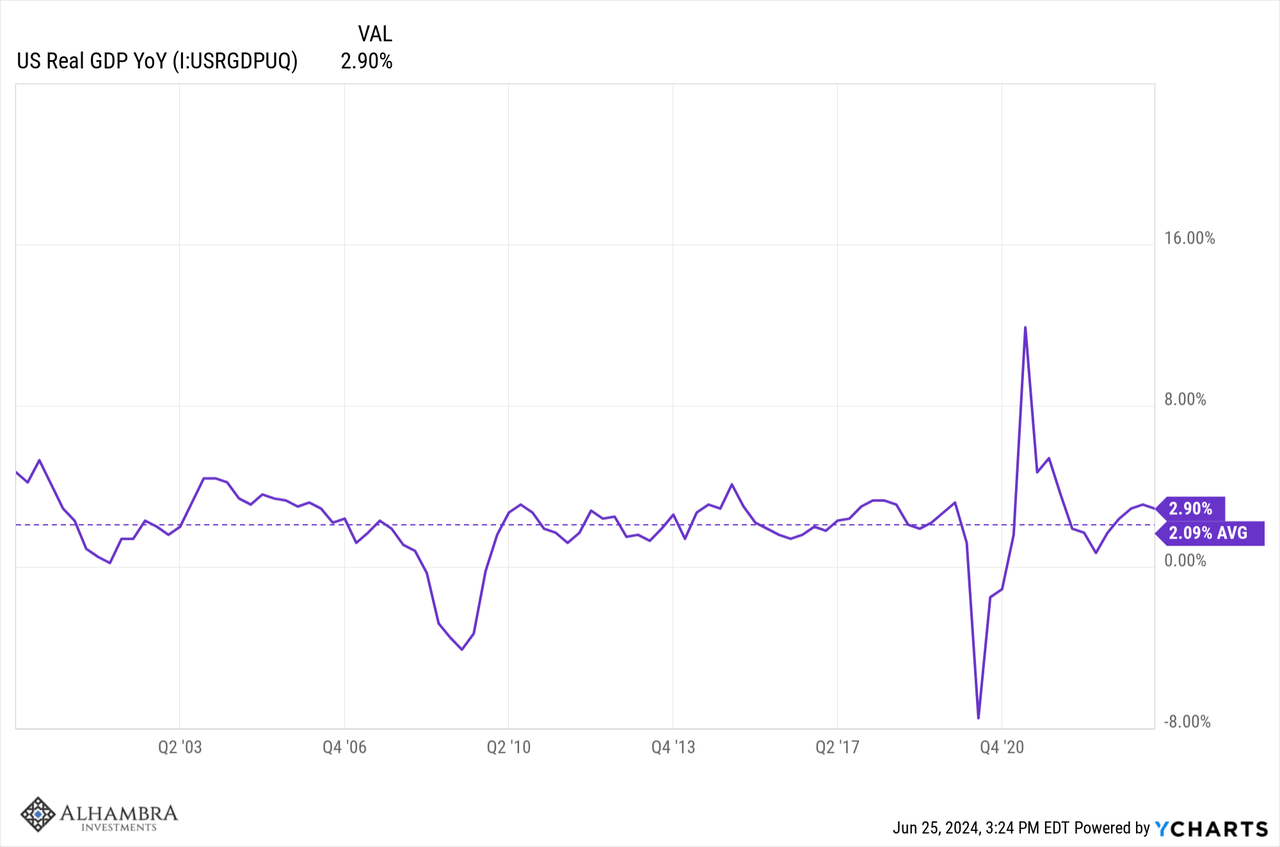

Growth peaked at the seasonally adjusted annual rate quarter-over-quarter in the third quarter of last year in 4.9%. The preferred reading is on an annual basis, where growth peaked in the fourth quarter of last year at 3.13%.

The growth in the first quarter was 2.88% and that in the second quarter increased somewhat and is around 3%. Given recent data trends and the fact that we are comparing Q3 2023 figures, we expect growth to decline in Q3 2024, towards 2.5%, and a further slowdown towards 2% (long-term trend ) over the next few quarters.

One area of uncertainty is the spending rate for the IRA and the CHIP Act. Although we believe that the current administration will maintain high spending until the elections, next year is more uncertain.

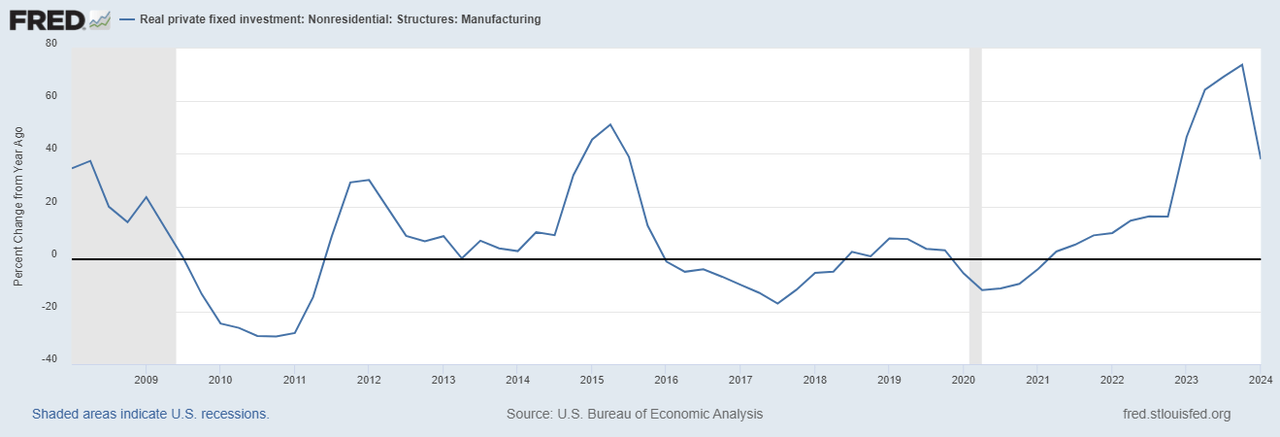

Much of this spending came in the form of nonresidential investment in structures, which fell to a gain of just 0.4% in the first quarter of 2024 from 10.9% in the fourth quarter of 2023. This spending offset weakness in equipment investment, which has been negative for 4 of the last 6 quarters.

Real Private Fixed Investment: Non-Residential – Structures – Manufacturing

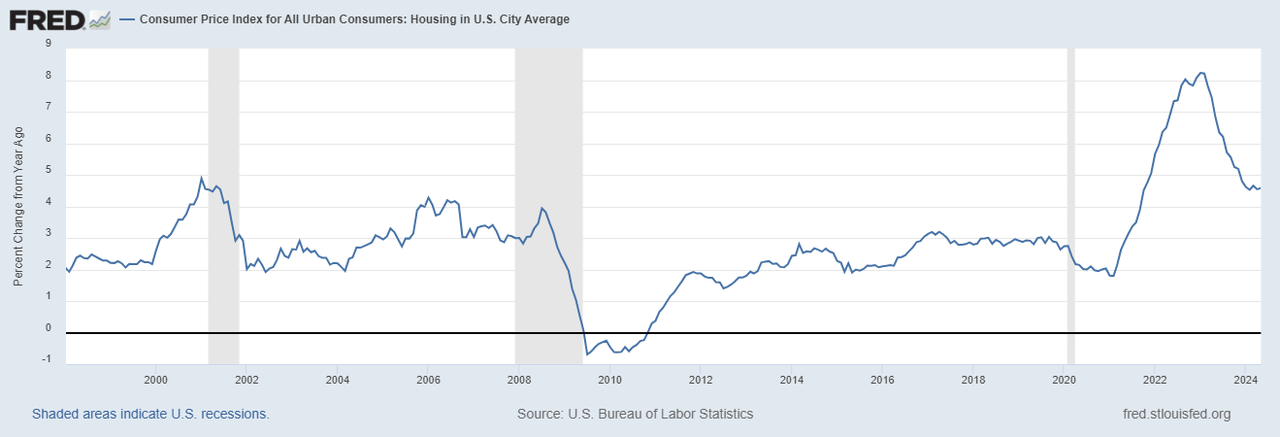

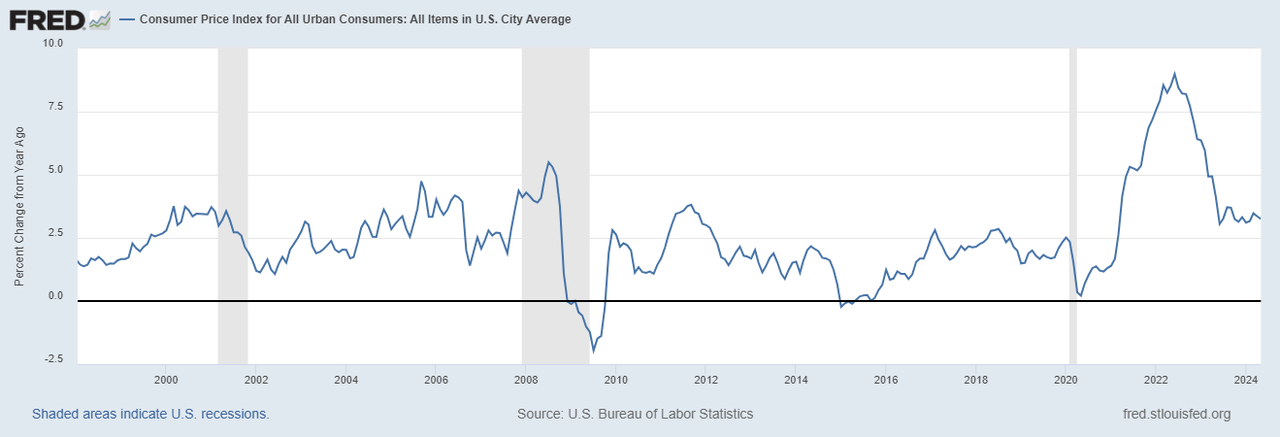

Inflation, on the other hand, remains firm and seems likely to accelerate. The CPI in May stood at 3.25%. Unfortunately, housing, which makes up the biggest slice of the pie, is no longer contributing to the falling numbers.

House prices continue to rise by more than 6% per year and last month the cost of housing in the CPI calculation increased by 4.55%. For now, we expect CPI to be flat to slightly higher in the third quarter.

Energy is expected to offset strength in the real estate sector in the third quarter, as the third quarter of 2023 was a very hot quarter for oil and energy. But after that, inflation is poised to rise, as housing and energy will likely contribute to inflation.

Consumer price index for all urban consumers: housing in the average US city

The dollar remains firm. Interest rates likely peaked for the cycle when growth peaked in the third quarter of last year, but are likely to remain high for longer as inflation is persistent and expected to rise by the end of the year. year.

For now, the Fed seems determined to cut rates. With growth slowing and inflation stable in the third quarter, the September meeting appears to be where they will get their opportunity. There has been widespread speculation that the Fed will not approach the election, but we do not share this view.

There will be no meeting in October and it would take a drastic deterioration in economic growth prospects to put an end to interim meetings. But we think November is a live meeting because that’s where the day begins After the election.

We think the Fed will focus more on the evolution of inflation data than on the elections. However, as we believe inflation could accelerate again at the end of the year, we do not expect it to be able to cut rates again in 2024.

The change in growth is a return to a long-term average and is not cause for concern. The slowdown in growth would only become a concern in the event of any shock. The places to look for a shock are the usual suspects, employment, geopolitics and the financial system. Inflation is going to be the bugaboo.

The CBO has just published a revision of its estimates. The deficit for 2024 is now expected to be $1.9T, up from $1.5T, mainly the result of executive actions (student loan cancellations) and increased interest costs. If the cost of capital rises faster than growth, that poses a problem.

While the United States is slowing slightly, manufacturing and global trade are picking up, particularly in Europe. India remains the darling economy. Asia seems to be slowing down slightly. Manufacturing and international trade were negative in 2023 but are expected to grow by more than 2.5% in 2024 and by more than 3.25% in 2025 according to the WTO. This will offset the slowdown in the United States.

Rebalance and favor: commodities, gold, ST fixed income, secular growth, quality, dynamics, midcaps, energy, utilities, technology, industries.

Disclosure: None

Editor’s Note: The summary bullet points in this article were chosen by the Seeking Alpha editors.