RobsonPL

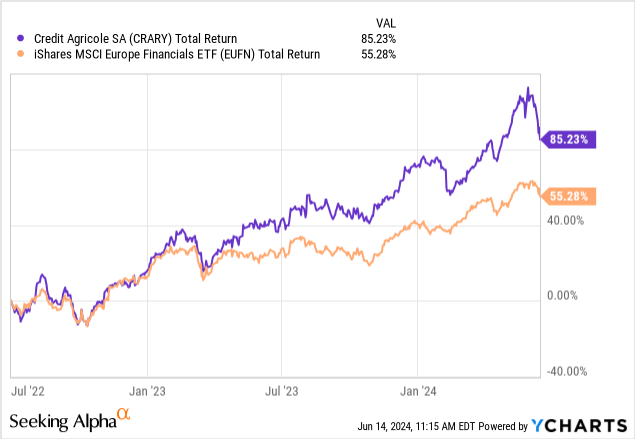

Political developments in France may have weighed on the shares of French banks tumble this week, but Crédit Agricole SA (OTCPK:CRARF)(OTCPK: CRARY) has nevertheless recorded solid performances in recent years, outperforming all European financial stocks (EUFN) by approximately 30 percentage points since the European Central Bank (“ECB”) started raising interest rates in the second quarter of 2022.

Although it has outperformed its peers over this period, Crédit Agricole is actually one of the least sensitive banks in Europe to interest rate movements, and this feature of its business should support profitability now that the ECB has started to Cut rates. With the stock trading at a discount to tangible book value, resilient earnings imply an earnings yield of around 15% and a high single-digit dividend yield, which should help lift the stock higher over time . I open the bank with a “Buy” rating.

Limited sensitivity to interest rates

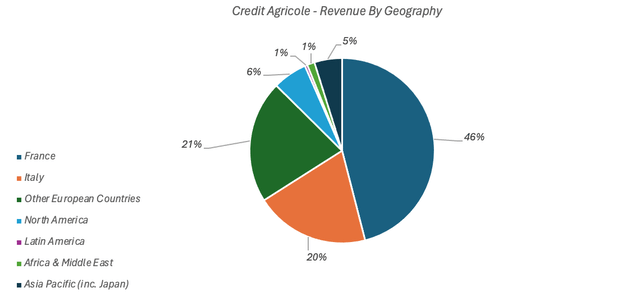

Crédit Agricole is a French universal bank with 2.2 trillion euros in assets. Around 46% of its turnover is generated in France, and a further 41% in other European countries. Its footprint outside of Europe is relatively light, with other geographies accounting for less than 15% of revenue and around 21% of net profit last year.

Data source: Crédit Agricole 2023 annual report

Crédit Agricole is one of the least sensitive banks in Europe to interest rate variations. This is explained by the diversity of its revenue composition, the country-specific characteristics of the French retail banking market, as well as the composition of its domestic loan portfolio.

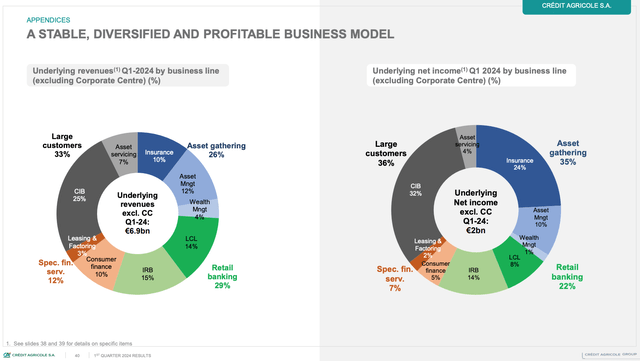

Crédit Agricole’s revenue mix incorporates significant contributions from non-interest-based businesses, including asset management, insurance, asset servicing and investment banking. Below is the breakdown of total revenue and net profit by business sector (as of first quarter 2024):

Source: Presentation of Crédit Agricole results for the 1st quarter of 2024

Crédit Agricole also has important activities of interest, notably retail banking, which represented just under 30% of its turnover in the last quarter. This is split approximately equally between French Retail Banking (“LCL”, ~14% of 1Q24 revenue) and International Retail Banking (~15% of 1Q24 revenue). 1Q24 business).

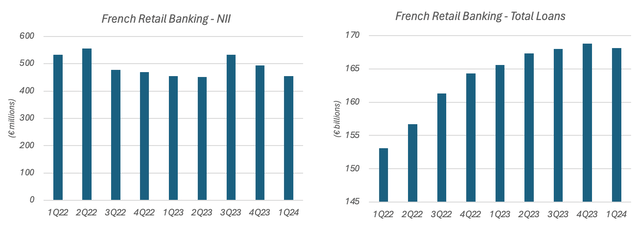

The national specificities of the retail banking market in France, as well as the composition of LCL’s loan portfolio, have further limited Crédit Agricole’s sensitivity to interest rates. These country-specific features include government-regulated yields on certain customer deposits, while LCL’s loan portfolio is dominated by long-term, fixed-rate residential mortgages, which are understandably slow to re-rate at rates higher interest rates. These represent approximately €104 billion, or 62%, of LCL’s credit portfolio at the end of 1Q24.

As a result, French retail banking net interest income (“NII”) actually declined even as eurozone interest rates increased. This occurred despite a growing loan portfolio, implying a contraction in net interest margin.

Data source: Publication of Crédit Agricole results for the first quarter of 2024

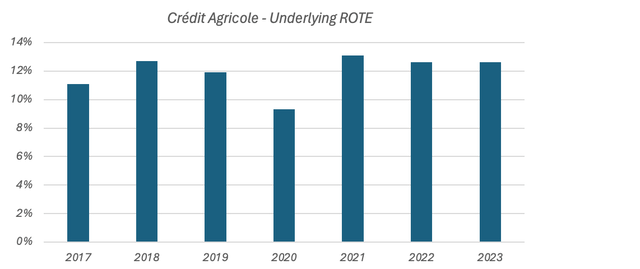

Limited sensitivity to interest rates means that Crédit Agricole has not benefited from the profitability tailwind enjoyed by some eurozone peers in this upcycle. While underlying net income has increased by around 8% since 2021 (the year before interest rates began to rise in the Eurozone), this has happened on a growing capital base. Profitability has actually been quite stable, with underlying annual ROTE reaching 13.1% (2021), 12.6% (2022), and 12.6% (2023) during this period.

Data source: Crédit Agricole annual reports

While Crédit Agricole’s lack of sensitivity to interest rates has not led to an expansion in underlying profitability, it also means that profitability is generally stable in different interest rate environments. This has been the case in recent years, with the bank averaging an underlying ROTE of around 11.6% between 2017 and 2021 (when the ECB deposit facility rate was negative) and a ROTE of 12.6% between 2022 and 2023 (when the deposit facility rate increased). of 450 basis points). As such, I expect relatively stable profitability now that the ECB has started to cut interest rates.

Assessment

At €12.80 in Paris (~$6.80 per ADS), Crédit Agricole shares are at 0.79x the tangible book value per share (“TBVPS”), which was €16.19 at the end of the 1Q24 (~€15.14 per share excluding 2023 dividend). , which was paid in the second quarter). This implies a P/E of around 6.7x, or an earnings yield of 15%, based on a through-cycle ROTE of 12%, which Crédit Agricole has achieved historically.

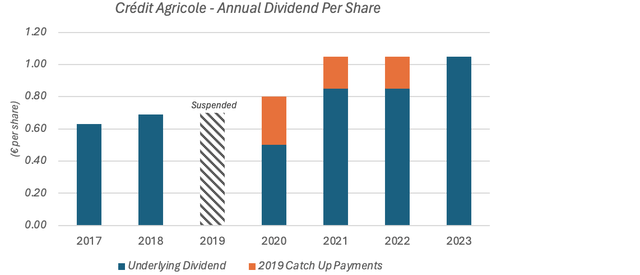

Management’s stated dividend policy is to distribute 50% of net profit each year. On a P/E of ~6.7x (~15% earnings yield), this implies a dividend yield of ~7.5%.

Based on the 2023 effective dividend of €1.05 per share ($0.57 per ADS), the dividend yield is 8.2%. This return is higher than the implied return since Crédit Agricole achieved a slightly higher ROTE last year (12.6%), while the payout ratio was also slightly higher than management’s target (~54% in 2023).

It is prudent to allow a slight contraction in ROTE, as Crédit Agricole still benefits from better than expected asset quality. The cost of risk, for example, which is bad debt provisioning expenses relative to total loans, was 33 basis points last year and 29 basis points in 1Q24, below the target of 40 basis points of management over the entire cycle. Normalizing this figure would put downward pressure on ROTE, although it would remain around 12%.

With 50% of net income earmarked for growth, Crédit Agricole should theoretically be able to achieve annual profit growth of around 6% assuming a through-cycle ROTE of 12%, which all things considered otherwise equal, would result in a similar level of annual dividend growth.

It should be noted that although the dividend per share has remained stable over the past three years, the overall figures are somewhat misleading, as the 2021 and 2022 payouts also contained “catch-up” payments arising from the dividend awarded in 2019 (which was suspended in 2019). 2020 due to COVID). The 2023 dividend per share was actually around 24% higher than 2021 on an underlying basis, while Crédit Agricole increased its dividend per share at an annualized rate of around 8.9% over the last five years.

Data source: Crédit Agricole annual reports

A payout ratio of 50% seems low given the limited growth prospects of its core European presence, although Crédit Agricole also has a history of making acquisitions, the most recent being the purchase of the European services company of assets. business of the Royal Bank of Canada (R.Y.) and Belgian bank Degroof Petercam. Mergers and acquisitions financed from retained earnings can also help increase net income over time.

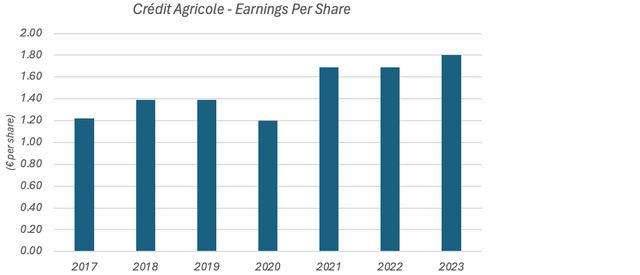

Data source: Crédit Agricole annual reports

It is worth noting that Crédit Agricole has grown its EPS at an annualized rate of around 6.6% since 2017, roughly in line with the 6% annualized rate implied by a 12% ROTE and profit retention by 50%.

Conclusion

With a high single-digit dividend yield and annualized growth of around 6%, Crédit Agricole shares can offer investors pre-tax annualized returns of less than 15%, even on a stable valuation multiple. ROTE sits comfortably above 10% and is generally resilient regardless of the broader interest rate environment, which could drive shares up to 1x TBVPS while leaving them with an earnings yield at two digits. While this would provide investors with an additional source of upside, it is not necessary to achieve acceptable returns, with the current dividend yield and implied growth being sufficient to generate attractive double-digit annualized returns on their own. As such, I am opening on Crédit Agricole with a “Buy” rating.

Editor’s Note: This article discusses one or more securities that are not traded on a major U.S. exchange. Please be aware of the risks associated with these actions.