On the Marginal Revolution, Tyler Cowen quotes from a press article in the The Financial Times:

“Trump’s return to the White House will have several implications for investment,” said Jack Ablin, chief investment officer at Cresset Capital. “(The most notable would be) a continuation of elevated Fed interest rates for an extended period of time as policymakers increase the likelihood that corporate tax cuts will be extended next year.”

Did you spot the error in Jack Ablin’s quote? Neither Tyler nor, as far as I know, any of his many commentators did.

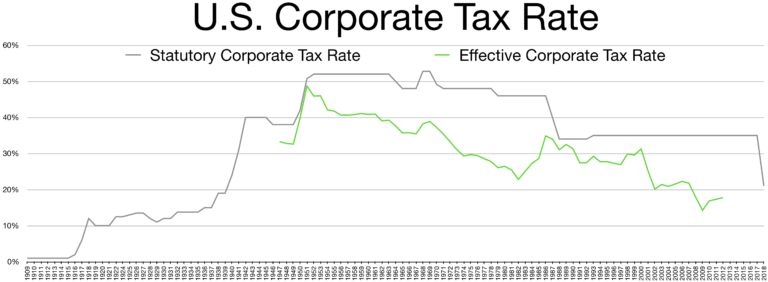

The corporate tax cuts, if you mean lowering the corporate tax rate to 21%, don’t need to be extended next year because they don’t expire next year. They’re one of the few parts of the 2017 tax cut that are permanent unless Congress explicitly changes them. And thank goodness for that, because they’re one of the best parts of the 2017 law. (The other is the restriction on the state and local tax deduction, which expires next year.)

I’ve seen a number of people claim online that the corporate tax rate cut is temporary. I’ve corrected one Reason The author of this statement deserves credit for updating his post to reflect the truth.