Talk about the dollar as a reserve currency next week (2)and I noticed these interesting trends.

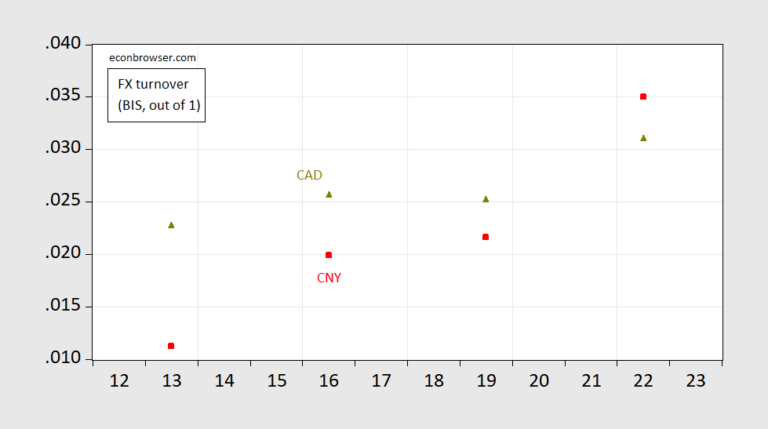

Figure 1: Share of FX turnover in CNY (red square), in CAD (chartreuse triangle), in April. Stocks normalized to 1.00. Source: BIS triennial surveys.

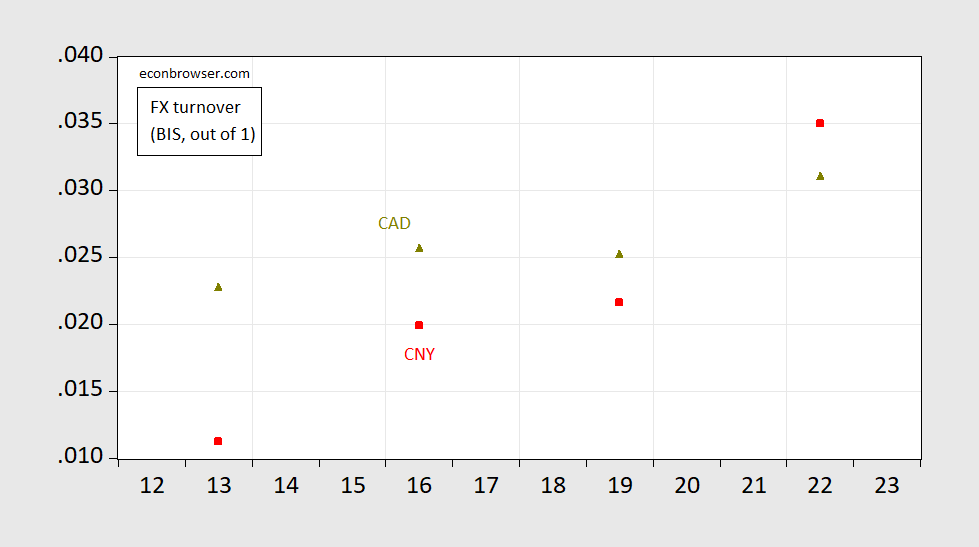

A similar trend applies to central bank reserve assets, as noted in the IMF’s COFER.

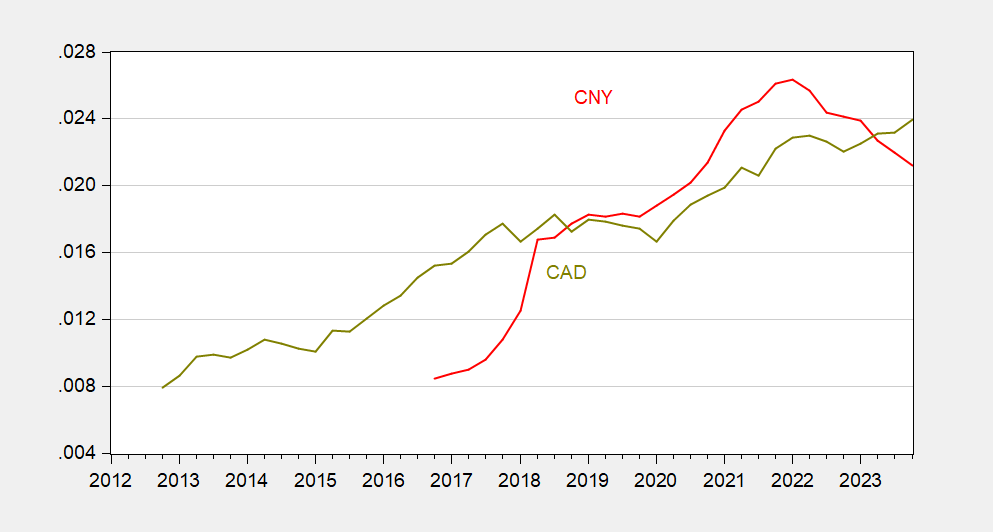

Figure 2: Share of central bank reserves in CNY (red), in CAD (chartreuse). Source: IMF.

Although there has been some decline in the share of CNY holdings since 2022, the interpretation of this trend remains complex. Most, if not all, of the reduction can potentially be explained by the depreciation of the CNY against the US dollar (9% in logarithmic terms, while the ratio fell by around 5 points).

However, I don’t think the CNY will become a major international currency anytime soon, as we have discussed. here (remember that the euro represents 18.5 ppts of the total foreign exchange reserves of central banks at the end of 2023).

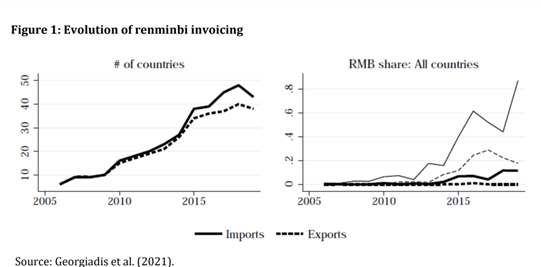

The area where the CNY has become important is in invoicing, which is not surprising given China’s dominant role in trade. Ito and Chinn (2014) address this issue, but more recent estimates are provided by Georgiadis (2021).

Remarks: The left panel shows the number of countries with renminbi billing data. The right panel shows the share of exports and imports invoiced in renminbi, with the median (thick lines) and the 75th percentile (thin lines).