Bennett Raglin

Trends Citi, Inc. (NASDAQ:CTRN) is a specialty retailer focused on low-income African-American customers in the United States.

This article covers the company’s 1Q24 results and call for results. Results were mixed, with a slight revenue mix and pace on EPS (negative). Revenue increased for the second consecutive quarter, which is a tremendous development. Gross margins also increased year-on-year. However, the company still generates operational and net losses.

The article also analyzes recent developments at the company, including a shareholders’ agreement with a shareholder owning 22% of the shares and the introduction of a new CEO.

I’ve previously covered Citi trends in February 2024 with a Hold rating. The article contains more details on my long-term reading of the company. The Hold rating was based on deteriorating business indicators and a challenge to the model by ultra-cheap retailers like Temu and Shein. The potential discount to normalized earnings presented in Citi Trends’ valuation was insufficient to offset the risk of a fundamentally challenged model.

Today, the company trades at a market cap 15% lower than my last article and has seen revenue growth of two quarters. I think the EV/NOPAT multiple of 10 for a potential recovery is fair, but not low enough to offset a negative scenario (also likely). For this reason, I think Citi Trends is not a bargain today, but I would reconsider trading at a price below $17.15.

A mixed first quarter with positive data

The first quarter results cannot be called good, given that Citi Trends recorded operational losses. However, they have positive data.

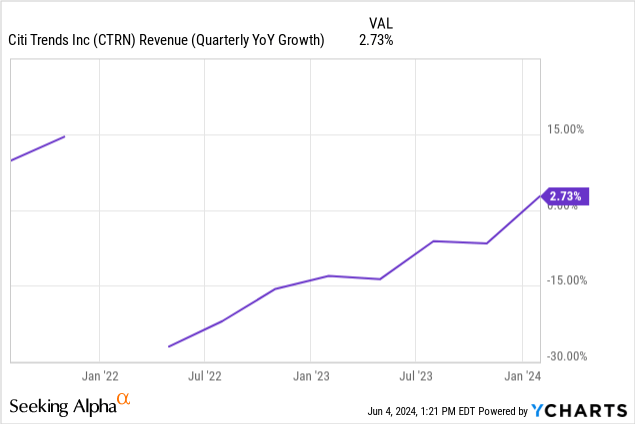

The most promising data point is revenue, up 3.7% year-on-year (3.1% like-for-like). After nearly two years of dismal results, 1Q24 is the second consecutive quarter of revenue growth (the chart below ends at 4Q23).

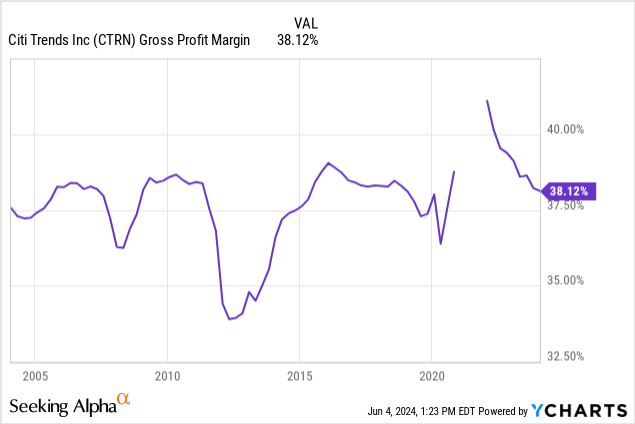

The second bright spot was a 160 basis point recovery in gross margins, driven by lower transportation costs and fewer markdowns (meaning better merchandise management). This led to an increase in gross profits of 9% year-on-year. The gross margin improvement is also positive after two years of margin deterioration (chart below ends in 4Q23).

Unfortunately, general and administrative expenses rose 4.8%, eating up much of the improvement in revenue and gross margin. Operating income remains negative at nearly $7 million (margin of -3.75%). The loss narrowed from $9.5 million a year ago (-5.2% margin).

However, of the $3.4 million in higher general and administrative expenses, $1.4 million came from one-time charges (which I believe are related to the CEO transition and shareholder agreements, but this was not indicated by management). If we remove these one-time charges, general and administrative expenses increased by 2.8%, providing the company with much-needed operational leverage. In fact, when removing one-time charges, the company was close to break-even on EBITDA (-$800,000 adjusted EBITDA). This is a very positive development if it can be sustained in the future.

New board of directors, new CEO

In February, Citi Trends announced a shareholders’ agreement with the investments of Fund 1. The fund was authorized to appoint 3 of the 9 directors proposed by the Board of Directors at the general meeting of June 20 (Proxy). Fund 1 owns 22% of the company’s stock as of the proxy date and is allowed to purchase up to 30% of the stock without triggering a poison pill.

This means the company will have a board of directors made up of members nominated by a major shareholder in June. Citi Trends did not have this feature in the past. I believe that having a significant shareholder with a stake in the company and holding key governance roles is important for the long-term development of the company.

In at the end of May, the company announced the resignation of its CEO. The new interim CEO has no ties to Fund 1, but I assume the large shareholder had some leeway to intervene in the decision. Otherwise, a new permanent CEO could be announced after the new board is in place.

The new CEO commented on the strategic actions in the Call 1T24. In my opinion, the two main areas will be merchandise efficiency and SG&A. On the goods side, he called for “putting more treasure into the treasure hunt of product choices” and “refining the value equation.” I think this involves offering products or focusing on categories that are cheaper than the competition (e.g. Temu). On the effectiveness of selling and administrative expenses, he estimated that “our total sales have declined while our sales, expenses and administrative expenses have increased steadily” and that “the increase in sales will be useful, but we also need to find cost savings to offset inflationary pressures.”

Scenarios

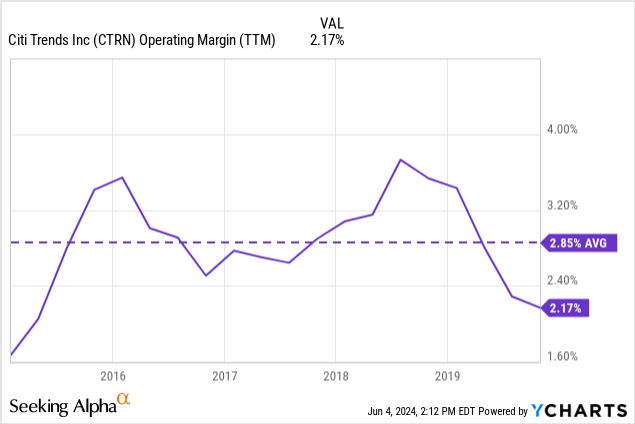

The first scenario, the most optimistic, is a return to pre-pandemic profitability. At a 2.85% operating margin (2015-2020 average, below), with current TTM revenue of $753 million, the company would generate $21.5 million in operating profit, or NOPAT of $16 million (using an effective tax rate of 25%). .

We estimate that fixed selling and administrative expenses will be approximately $287 million and gross margins will be 38%. Citi Trends would need to post revenue of $808 million to generate NOPAT of $15.2 million in this case. This represents revenue growth of 7.3% compared to TTM revenue.

Management’s guidance for the year (reaffirmed on the 1Q24 call) was for the company to post EBITDA between $4 million and $10 million. This would imply negative operating margins, since annual expenses and acquisitions are around $20 million (as are CAPEX expectations). This is an intermediate scenario, with short-term losses and potential to restore operational profitability (perhaps towards the second positive scenario above).

On the other hand, a pessimistic assumption is that the company will not be able to return to profitability in the future and that recent results have been temporarily good. Given the challenge posed by discount retailers like Temu, who focus on the same type of impulse, cheap treasure-hunt buying that the company offers, I think this scenario is still very likely. The company could eventually decide to change its assortment model to avoid competing with Temu or Shein, but this remains too speculative.

Assessment

Today, Citi Trends trades at a market cap of $210 million, which, adjusted for cash of $58 million and no borrowings, implies an EV of $152 million. We can compare this to several scenarios.

In the first positive scenario (return to pre-pandemic profitability), the EV/NOPAT multiple is around 9.5x. For the second positive scenario (fixed SG&A and gross margin with revenue growth of 8%), the multiple is around 10x. Finally, there is no multiple in the downside scenario in which the model is challenged and unrecoverable, and Citi Trends would have low going concern value.

I think a 10x EV/NOPAT multiple for Citi Trends is fair, and given the two quarters growing at 2/3% rates, seeing 7% revenue growth over the next two years is not not impossible either. However, Citi Trends’ current EV already rules out this positive scenario.

Furthermore, as noted above, I believe the likelihood of a negative scenario remains significant. Low-cost retailers on the Internet (like Temu) or B&M (like TJ Maxx) are not going away and so Citi Trends needs to find a niche where it can compete at lower prices than these giants. It’s difficult to achieve, but two consecutive quarters of growth are a good signal.

For these reasons, I believe Citi Trends, Inc. stock is not an opportunity at these prices. However, with the information available today, I would view the stock as an opportunity at an EV/NOPAT of 7x versus a positive scenario, coinciding with a stock price of $17.15 or less.

Conclusions

Citi Trends’ 1Q24 results still show bottom-line challenges, but also promising top-line results, accumulating two-quarters of the annual growth. Revenue growth, coupled with operational leverage, is what the company needs to return to operational profitability.

In the longer term, the company must show that it can offer an attractive assortment to customers who may choose other options, such as that of PDD Holdings (PDD) Temu or TJ Maxx (TJX). The company’s new CEO seems to be moving in this direction.

In terms of valuation, I think the likelihood of Citi Trends returning to its historical profitability levels is not low. In this case, the company’s current electric vehicle would offer a fair EV/NOPAT multiple of 10x. However, I also think that the likelihood that the company’s model will be fundamentally challenged is also high. Therefore, I need a higher discount on the positive scenario to bear the risk of the negative scenario.

For this reason, I continue to believe that Citi Trends, Inc. stock is a stock I would reconsider at prices below $17.15.