Nikada

By Lynn Song

Weak confidence continues to weigh on growth

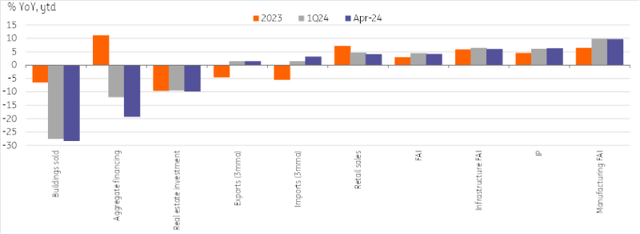

China has seen mixed results in terms of data releases over the past month, but most indicators have come in below market expectations.

The key theme of the month was the private sector and households remain cautious. Credit data showed that overall financing declined for the first time since 2005, and M2 growth also fell to historic lows. After a strong year in 2023, credit contracted sharply in 2024. We believe that real interest rates remain too high for the current state of the economy and that the likelihood of monetary easing over the next few years months increase.

Retail sales showed consumers also remained cautious, falling to a new post-pandemic low of 2.3% year over year. Consumers have eschewed expensive purchases in favor of “eat, drink and play” categories.

Investment in fixed assets also disappointed during the month, falling to 4.2% year-to-date, largely due to the drag on private sector investment, which saw a moderate growth of 0.3% year-on-year since the start of the year. With property prices falling sharply in April and developer confidence hitting new lows, it is no surprise to see that property investment remains a major overhang at -9.8% in year-on-year since the start of the year.

China’s high-tech transition offers a silver lining

A positive side could be the transition towards high-tech development, which continues to generate pockets of strong growth.

One aspect of this transition can be observed in the resumption of industrial activity. Industrial production increased to 6.7% year-on-year in April, led by high-tech manufacturing (11.3%), computers, communications and other electronic equipment (15.6%), and automobiles (16.3%). May manufacturing PMI data showed conflicting signs about the dynamics ahead, with the official PMI notably falling into contraction at 49.5, while the Caixin PMI rose to a seven-month high at 51, 7 – although both surveys indicate a slowdown in new orders.

Imports also beat expectations for the month, rising 8.4% year-on-year, as AI-related demand drives imports of automatic data processing equipment, integrated circuits and high-tech products. technology. As China’s economic transitions continue, these areas are expected to continue to experience relatively robust growth.

Chinese growth has been unbalanced this year

Policy implementation has accelerated in a context of stabilizing growth

Political announcements stole the show during Data Dump Day in China. Policymakers stepped up support measures to try to stabilize the real estate market, and the central government launched its ultra-long-term bond issuance amounting to RMB 1,000,000.

New measures taken last month included removing the floor on mortgage rates, reducing down payment rates, removing purchasing restrictions and announcing direct home purchases to help absorb excess inventory. Banks continued to provide support to property developers in difficulty.

The increased aggressiveness of policy support supported markets over the past month and showed increased commitment to stabilizing growth. Markets are increasingly optimistic that property prices in tier 1 and 2 cities could bottom out in the coming months. While this is arguably the most important development in stabilizing domestic confidence, it is also the first step and there is still much to do. The third plenary meeting in July is likely to provide more details on the long-term policy direction, with aims to further deepen reforms and promote China’s modernization. President Xi’s comments indicated that the meeting could include measures to support homeownership, employment and child care.

Content Disclaimer

This publication has been prepared by ING for information purposes only, regardless of the user’s means, financial situation or investment objectives. The information does not constitute an investment recommendation, nor does it constitute investment, legal or tax advice, or an offer or solicitation to buy or sell any financial instrument. Learn more