Hardly a day goes by without the world moving towards authoritarian nationalism à la Viktor Orban. Here is the final piece of evidence, the WSJ:

A small group of the former president’s allies — whose work is so secret that even some of Trump’s former economic advisers were unaware of it — produced a roughly 10-page document outlining a policy vision for the central bank, according to close sources. with the case. . . .

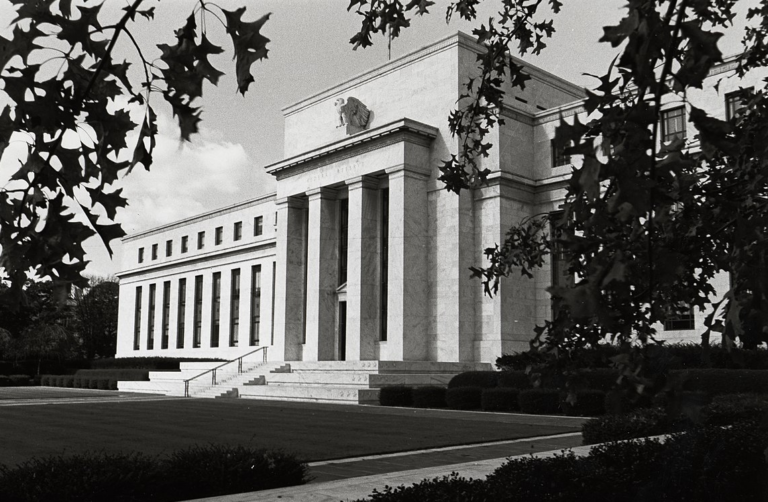

Several people who spoke with Trump about the Fed said he appears to want someone at the helm of the institution who will, in effect, treat the president as an ex officio member of the bank’s rate-setting committee central. Under such an approach, the president would regularly seek Trump’s opinion on interest rate policy and then negotiate with the committee to guide policy on the president’s behalf. Some advisers to the former president have considered requiring that nominees for Fed chairman agree privately to consult informally with Trump on the central bank’s decisions, people familiar with the matter said.

These things usually don’t end well. (Remember the Nixon/Burns Fed of the early 1970s.)

Here is Patrick Horan (who was my colleague at the Mercatus Center) in the National review:

A few Donald Trump’s economic advisors are would have discuss ways to devalue the U.S. dollar if the former president is elected again this year. Chief among those advisers is Robert Lighthizer, who led the Trump administration’s trade war with China and who could be Treasury secretary in a second administration. Proponents of the idea argue that a weakening of the dollar against other currencies would make U.S. exports relatively cheaper, leading to a reduction in the trade deficit.

They might want to check with some Latin American economists how the “devalue to prosperity” approach has worked in that region of the world.

Journalists often reason from a price change, but Horan does a good job of avoiding this mistake. He emphasizes that any analysis of the impact of devaluation must start with the question of how to achieve it:

To begin, consider a crucial concept in international economics: the “impossible trinity.” According to this principle, a country cannot have the following three elements at the same time: a fixed exchange rate, the free movement of capital or investments, and monetary sovereignty (the ability to conduct monetary policy independently). He can only choose two at most.

Since 1971, the United States has chosen the free movement of capital and monetary sovereignty while allowing exchange rates to float based on market fundamentals. This choice is the norm among major developed economies. To weaken the dollar to a desired rate relative to other currencies, the exchange rate must be fixed. This means that either the free movement of capital or monetary sovereignty will have to disappear.

(1 COMMENTS)