GoodLifeStudio/E+ via Getty Images

Introduction

Camping World Holdings (NYSE:CWH) is a supplier of recreational vehicles (RVs) and camping equipment. Over the years, the company pursued a strategy of consolidating RV dealerships and pushing to rely more on the less cyclical used RV market. walk. Facing challenges in the RV industry, including weaker demand post-pandemic, the company’s recent quarters have shown lower EBITDA as the company faces cyclical headwinds. In this article, I’ll explain why I see an opportunity here for Camping World, given weak investor sentiment and a potential trough in consumer demand for RVs.

Company presentation

Camping World, as its name suggests, specializes in the sale of recreational vehicles, camping equipment and related outdoor products. It operates as both a retailer and service provider to RV enthusiasts across the United States. Founded by Marcus LemonisCamping World has become one of the largest RV dealerships in the country, offering a wide range of RVs, from campers and travel trailers to camping accessories and supplies. The company also offers interview and RV repair services, making it a comprehensive resource for new and experienced RV owners.

Camping World has over 100 dealers, making it the largest player in the RV sales and supplies market. Operating in a fragmented industry, the company has a competitive advantage whereby its size gives it several advantages over its smaller peers. This includes a wider assortment of inventory, better gross margins (even with volume discounts), and more favorable terms with lenders.

Background

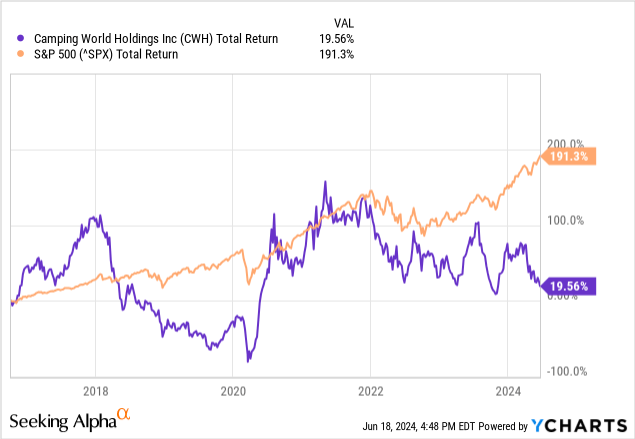

Camping World shares are trading near a 52-week low, delivering a disappointing 29% year-to-date return for investors. Over the past ten years, shares have remained essentially stable, having generated a total return of 191%, most of which came from the company’s 2.7% dividend. Compared to the -20% return of the S&P500 over the same period, Camping World shares have significantly underperformed.

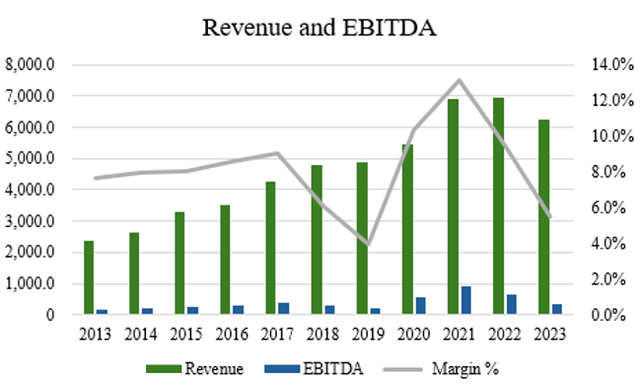

Looking at Camping World’s financial performance over time, the company is growing its revenue and EBITDA at a CAGR of 10.2% and 6.7%, respectively. Over the past five years, the company has shown a decelerating growth rate, with revenue and EBITDA growing 5.4% and 3.2%, respectively (source: S&P Capital IQ). With revenue CAGR higher than EBITDA CAGR for both periods, this shows that Camping World has not been able to grow its margin consistently over time.

Author, based on data from S&P Capital IQ

So what’s going on? One of the biggest challenges is that the camping industry in general is very cyclical. After all, you’re not going to buy an RV if you’ve lost your job to a recession or food inflation is hitting your wallet. Thus, Camping World does well when the economy is doing well (disposable income increases) and does poorly when the economy suffers (disposable income decreases).

Another factor is that there was a surge in demand during the pandemic period, when people were at home (or camping!) and wanted to spend money. Today it’s a buyer’s market for RVs as sales of new RVs have plummeted 20% in 2023, according to a dealer association in Canada. Although rentals are still strong, there is still plenty of used inventory at dealerships right now and demand has been weak for new RVs.

In the United States, demand is slightly better, but it remains big dollar items for individuals and families, with a small towed pop-up trailer costing between $12,000 and $15,000, up to others costing $250,000 and up for a motorhome or luxury offering . With higher interest rates and borrowing costs, consumers are more sensitive to the overall price of RVs, making careful financial planning and decision-making increasingly crucial.

Recent results

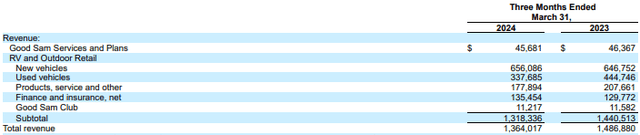

Looking at the last First quarter results for Camping World, the company reported revenue of $1.36 billion, down 8.3% year over year and missing estimates by $62.5 million. Earnings per share came in at -$0.38, missing estimates by a penny.

On the call for results, management noted that new RV units delivered increased by 21.35 on a year-over-year basis. Although revenues exceeded expectations with lower prices on new motorhomes (the shortfall compared to our model was largely due to lower prices in the first quarter for both new motorhomes ( -16.4% year over year), I think this data point illustrates that a lot of inventory is on sale right now.

Based on management feedback, approximately 90% of CWH’s new RV inventory is for model years 2024, so inventory has been properly sized to match revenue. Additionally, with sales of new RVs increasing, I think it’s possible that the revenue decline is behind us as prices are guided to follow a more stable path from here. In my opinion, the combination of volume increases and moderate pricing could also result in better EBITDA growth in the coming quarters.

Regarding EBITDA, adjusted EBITDA was $8.2 million, mainly due to used vehicle gross margin pressure. Overall, EBITDA isn’t that meaningful this quarter, but normalizing a mid-year EBITDA margin to current revenue makes the math around current revenue less bad. Management is targeting adjusted EBITDA growth of 30% for the year, most of which will be achieved in the second half.

Finally, during the publication of the results, management also took the opportunity to announce that the company was divesting from its motorhome furniture manufacturing business, which is scheduled to close during the second quarter. This is expected to have an impact of approximately $30 million for fiscal 2024, but will be accretive to the segment’s margin, given the better margin profile of existing operations. I would expect the company isn’t done with these kinds of deals. Last quarterthe company announcement it considered strategic alternatives for the Good Sam business, including allowing the segment to expand its operations into the boating and powersports end markets, as well as possibly selling the business. Although a possible sale is not yet in the works and it is too early to say what they will do, they are encouraged by the strong interest shown so far from potential buyers.

Evaluation and conclusion

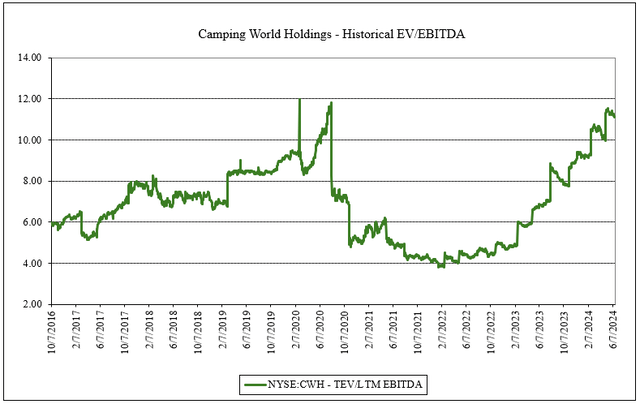

From a valuation perspective, Camping World trades at 11.1x EV/EBITDA. Ultimately, the company trades at 14.3x FY2024 EBITDA and 10.9x FY2025 EBITDA (source: Bloomberg). Compared to the ten-year historical average EV/EBITDA of 6.9x, Camping World is trading above its historical multiple. In my opinion, given that the company outperformed in 2021-2022, this drove the multiple down over that period, bringing the ten-year average down. Although, using forward EV/EBITDA multiples, Camping World is close to the highest valuation multiples ever traded in the last decade.

Author, based on data from S&P Capital IQ

Although Camping World may seem expensive today, I don’t think the valuation is particularly rich. Investors appear to have very low expectations given the low valuation, even despite potentially low RV volumes across the industry. Even though prices remain low, Camping World is managing to increase volumes, which in my opinion signifies a turnaround and the end of the pull effect we saw during the pandemic. With the potential to quickly improve EBITDA if management can achieve its 30% margin target for the year, I view the shares as a “buy” and would consider taking a position on any weakness.