The BYD Atto 3 electric vehicle was parked on the street Editorial ESezer/iStock via Getty Images

During a recent trip to Israel, I was quite surprised to learn that BYD (OTCPK: BYDDY), a little-known car manufacturer based in China, for the for the first time, had reached the No. 1 brand status among consumers in the Jewish State based on unit sales for the month of April. Previously, Hyundai Motor held this distinction.

A few years ago, the Israeli government lowered the motor vehicle sales tax from up to 50% on internal combustion engine (ICE) models to 10% for BEVs, in an effort to boost sales. sales of emission-free models. Consumers responded instantly, flocking to vehicles such as BYD’s Attos 3 crossover, Geely’s Geometry C and Tesla models.

A few impromptu interviews with owners and a trade group convinced me that Israeli car buyers so far are quite happy driving and owning BEVs. Further research convinced me that the Chinese auto industry is consolidating global leadership in BEVs – and that it could one day soon dominate the global market and possibly propel an automaker like BYD to the top ranks of global automakers.

Western test market

Israel is a relatively small Western-style market; its receipt of Chinese-made vehicles provides valuable research and experience that can be useful to other Western countries.

At present, China is the world’s largest automobile market, largest producer and largest exporter of vehicles. Led by the country’s central government, production is rapidly shifting from ICE models to BEV models and plug-in gasoline-electric hybrids – or what China calls “new energy vehicles.”

In 2023, NEVs represented 35% of the Chinese market.

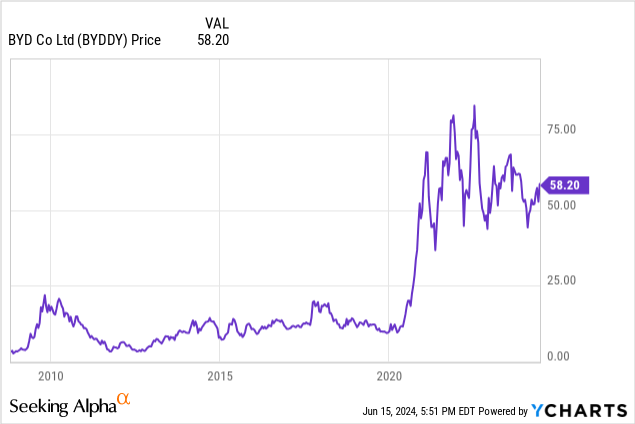

As a result, investors with a long-term perspective, interested in fast-growing mobility companies – and aware of the risks – should keep a close eye on BYD, as well as other Chinese producers, and add shares to their portfolio opportunistically.

BYD’s sales totaled $85.1 billion in 2023, representing a compound annual growth rate (CAGR) of 24.3% for the previous decade. Earnings per share for 2023 came in at $2.92, representing just under 30% CAGR. (For comparison purposes, Tesla (TSLA) sales were $96.8 billion in 2023; Volkswagen AG (OTCPK: VWAGY) annual sales were $348.8 billion.)

Over the past five years, BYD’s pre-tax profit on sales has increased, reaching 6.2% in 2023. For comparison, Tesla’s pre-tax profit for the year was 10.3% and that of VW by 7.2%.

The current P/E for BYDDY is 19. The P/E for Tesla is 45; VW’s P/E is 4.

Relative newcomer

BYD is a notable company in that it has been around since 1995 and operated for a decade as a battery manufacturer before moving into the automotive business. Berkshire HathawayBRK.A) (BRK.B) noticed this in TK and bought a stake, which became very valuable. The company migrated from batteries to automobiles to electric vehicles exclusively in 2022 and currently ranks among the top global players, based on metrics.

BYD’s only U.S. presence is a 550,000-square-foot manufacturing site in Lancaster, California, where the company employs 750 people and builds battery-powered buses.

Although the company has given up on any short-term plans to enter the US market, it can be assumed that when the time is right it will do so, as the US remains the most profitable location for car sales and the most competitive in the world. When that time arrives, America’s domestic industry could face the same type of threat posed by Honda, Nissan, and Toyota when they began building and selling cars in the United States. Only this time, Honda, Nissan and Toyota – as American manufacturers – could be equally threatened.

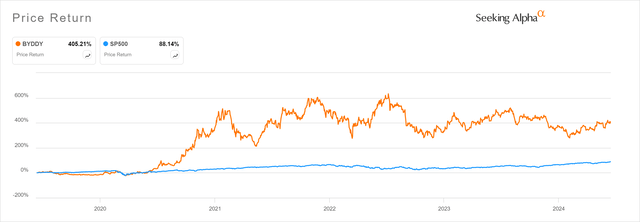

Price return (Searching for Alpha)

Stella Li, CEO of BYD Americas, told Electrek that the Chinese automaker has no plans to sell passenger electric vehicles in the United States. Li called the market “interesting” but too complicated due to political conflicts. She said the automaker would likely announce a vehicle assembly plant in Mexico later this year. She denied speculation that the Mexican factory would be used to export to the United States.

Tariff protection

In May, President Biden imposed 100% tariffs on Chinese car imports. The so-called Inflation Reduction Act places restrictions on BEVs sold in the United States and built with parts and materials from China.

The European Union turns out to be China’s auto industry and BYD’s first major foray into modern Western markets, which was not well received. BYD’s new low-cost model, Seagull, currently sells for less than $10,000 in China. anything close to that price in the West for a BEV would likely cause a panic in the market.

Seagull BYD (Inside electric vehicles)

This week, the EU imposed additional tariffs of 17% on BYD (and varying amounts on other Chinese automakers) on top of existing tariffs of 10%. Analysts believe that the tariffs will not slow down BYD much, since BYD has already committed to building an assembly plant in Hungary whose production will be exempt. Chinese industry is also looking to global production sites that have free trade agreements with the EU.

By Reuters: “Everything Chinese automakers do will be closely monitored: European imports of electric vehicles from China increased from $1.6 billion in 2020 to $11.5 billion in 2023.”

The appeal of Chinese electric vehicles lies in their incredibly low manufacturing cost compared to that of incumbent automakers, which translates into low prices for consumers. Because Chinese vehicles sell at low, heavily subsidized prices in the People’s Republic, selling abroad – even at higher prices than at home – allows Chinese automakers to reap greater profits.

In some overseas showrooms, BYD charges more than double or even triple the price it gets for three key models in China, according to a Reuters study of the automaker’s prices in five of its largest export markets.

Cheaper at home

BYD’s Atto 3, for example, a BEV compact crossover, sells in its home market for $19,283 – according to Reuters. In Germany, the same vehicle sells for $42,789, a competitive price compared to non-Chinese BEVs from European manufacturers. The pricing strategy for Chinese BEVs in export markets represents a remarkably inverted model from the usual policy of subsidizing overseas sales to gain market share, sparking complaints that the products are unfairly ” undervalued.”

Volkswagen, Mercedes-Benz, BMW, Renault, Stellantis and others must now figure out how to compete with BYD and other Chinese automakers. This won’t be easy, as trying to cut costs will immediately put local people in conflict with unions, suppliers and governments.

However, for investors, purchasing BYD stock may represent an opportunity to capitalize by gaining an attractive entry point into the stock at an early stage of the company’s growth. The risks should not be overlooked. Significant political risk is triggered by the election of right-wing politicians in Europe who could increase tariffs and/or relax regulations to promote a longer transition away from combustion engine vehicles, in order to give more room for maneuver to European car manufacturers.

BYDDY represents ADR that trades on global markets. BYDDFs are so-called H shares that trade in Hong Kong at twice the price of ADRs.

A word of warning: BYD and other Chinese-built vehicles are advanced from a connectivity standpoint, meaning they have lots of cameras and sensors capable of collecting all kinds of data. Additionally, they can receive data for live updates and maintenance purposes. Because China has increasingly tense economic and diplomatic relations with the United States and other Western countries, some analysts insist that Chinese-made vehicles pose a danger as surveillance devices — a an allegation that has not yet been proven.

Despite possible countermeasures and regulatory controls, national security concerns over Chinese-built cars could prove to be an export barrier for some companies or the entire industry.

Editor’s Note: This article discusses one or more securities that are not traded on a major U.S. exchange. Please be aware of the risks associated with these actions.