Monthly GDP has increased for two consecutive months. Final sales in May increased, but did not fully offset April’s decline. Here’s a look at the key indicators tracked by the NBER BCDC, as well as monthly GDP from SPGMI (formerly IHS-Markit, and Macroeconomic Advisers before that).

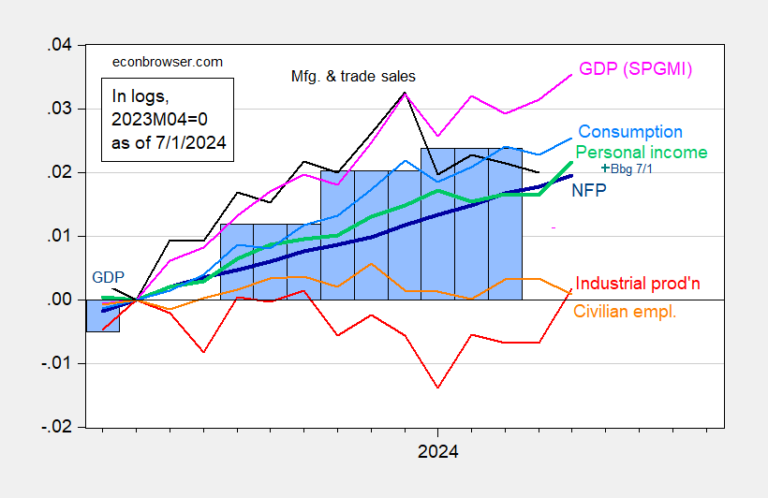

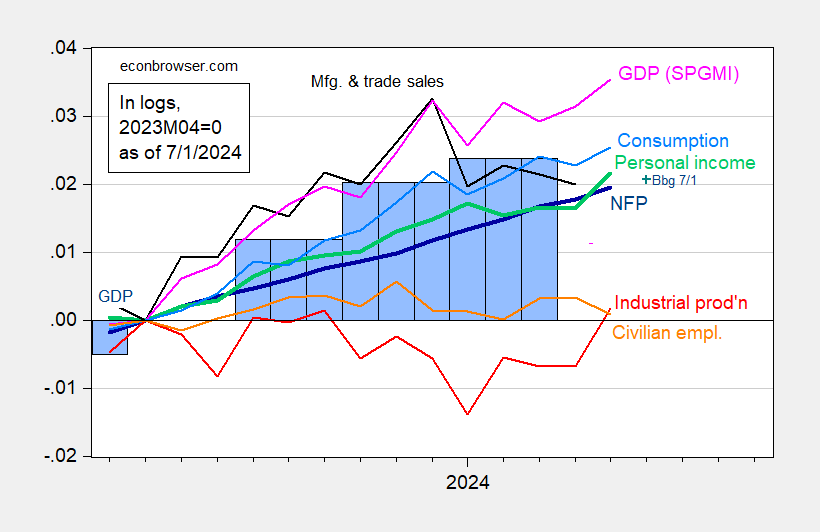

Figure 1: CES Nonfarm Employment (NFP) (bold blue), civilian employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue) and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log-normalized to 2023M04=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q1 Third Release, S&P Global Markets Insights (née Macroeconomic Advisers, IHS Markit) (7/1/(version 2024) and author’s calculations.

All indicators for which we have data, except civilian employment, are up in May.

On the other hand, the current Q1 GDP is now 1.7% (SAAR), down from 2.2% previously. The SPGMI tracking is 1.9%.

When combined with deceleration in measures of underlying inflationAnd inflation expectations for the coming yearIt seems to me that the Fed has so far managed a soft landing (although it should be noted that economic activity indicators will be revised in the future).