Developer

Investment thesis

The Brandes US Value ETF (BATS:BUSA) is an actively managed large-cap value fund with $150 million in assets under management and an expense ratio of 0.60%. Operating under the principles of Benjamin Graham and David Dodd, an investment committee of Brandes Investment Partners selects stocks based on their estimated intrinsic value, derived from metrics such as a company’s price-to-earnings ratio and price-to-book ratio. This strategy is well-known among value investors, but my fundamental analysis reveals diversification, quality, and sentiment issues that offset BUSA’s value advantage. Therefore, I recommend that readers avoid BUSA until it is better established.

Presentation of BUSA

Strategy Discussion

BUSA is led by four industry veterans with a combined 106 years of experience, including 97 years at Brandes. They are:

These individuals form the Global Large Cap Investment Committee. Together, they are responsible for selecting stocks, which reduces key people risk and increases the chances of consistent strategy execution. Brandes Investment Partners website also notes that the company is independent and employee-owned, free from any outside influence.

BUSA doesn’t track an index. Instead, managers select stocks based on their prices relative to their estimated intrinsic values, derived using ratios such as price-to-earnings, price-to-book, price-to-cash flow, debt-to-equity, and dividend-to-price. Additionally, the website notes that value stocks tend to be out of favor, and the strategy requires patience. In other words, the picks often have little price momentum, and this isn’t an ETF where you can expect frequent trading. While it’s still early, BUSA saw just a 1% turnover rate for the three months ending Dec. 31, 2023, according to its financial results report. semestrial report.

Performance analysis

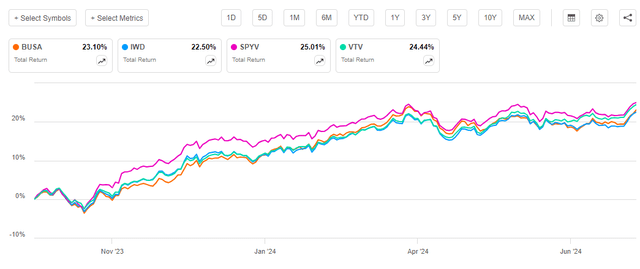

Since inception, BUSA has gained 23.10% versus 22.50% for the iShares Russell 1000 Value ETF (JIF), its stated benchmark index. As shown below, the SPDR S&P 500 Value ETF (Spying) and the Vanguard Value ETF (VTV) generated slightly better returns, at 25.01% and 24.44% respectively.

There’s not much to say, but for the first six months of 2024, BUSA has returned 8.02%, which ranks 40th out of 108 in the large-cap ETF category. That’s better than average, but the best performers in this category are the dividend-focused ones, and BUSA certainly doesn’t present itself as an income fund. Its picks yield 2.08%, as do IWD, SPYV, and VTV, but its 0.60% expense ratio means shareholders would only earn about 1.48% at current prices.

In addition to the passive ETFs listed above, I will compare BUSA with the Fidelity Enhanced Large Cap Value ETF (FELV). On November 20, 2023, Fidelity converted its enhanced mutual fund lineup to active management and, with a lower expense ratio of 0.18%, FELV and its predecessor have generated strong returns since May 2007, outperforming IWD by approximately 27%.

BUSA Analysis

Sector exposures and top ten participations

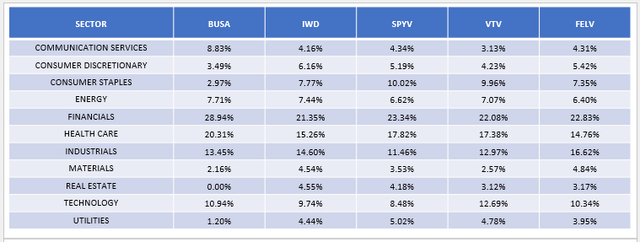

The following table highlights the differences in sector exposure between BUSA, IWD, SPYV, VTV, and FELV. BUSA’s prospectus noted potentially high allocations to the financials and healthcare sectors, and these sectors represent 49.25% of the portfolio. The industrials and technology sectors follow at 13.45% and 10.94%, and the ETF has minimal or no exposure to consumer discretionary, consumer staples, materials, real estate, and utilities.

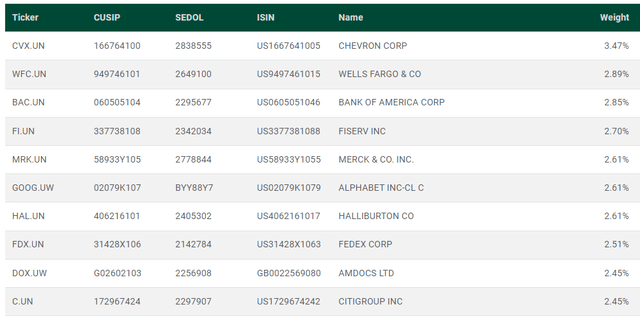

The other four ETFs are more balanced, with at least 2.50% allocated to each sector. That should lead to more consistent, but not necessarily better, returns. Clearly, the BUSA investment committee considers financial sector stocks to be the most undervalued, and they may be right. On Monday, Steven Cress, Seeking Alpha’s head of quantitative strategies, named Wells Fargo Company (WFC) as A first choice in a possible Trump 2.0 administrationciting the potential for “less stringent capital and liquidity rules”“. Wells Fargo is BUSA’s second largest holding, and the diversified banks subsector is the largest, accounting for 10.26% of the fund.

BUSA Fundamentals by Subsector

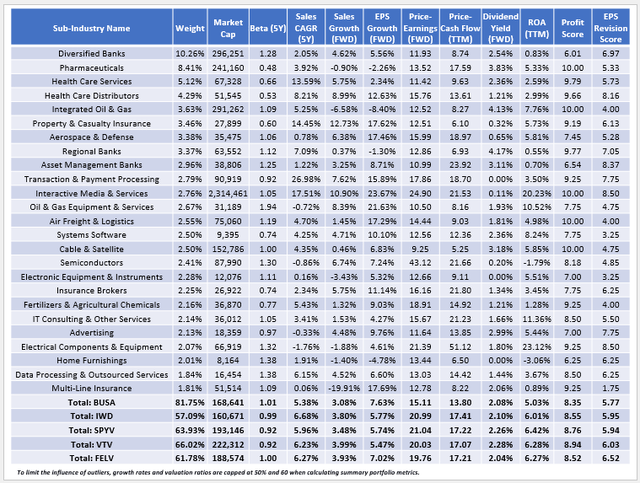

The following table highlights selected fundamental indicators for BUSA’s top 25 sub-sectors, totaling 81.75%. With a five-year beta of 1.01, it is higher than these peers and the category average of 0.96, but it falls short of what “pure” value ETFs offer. BUSA’s weighted average market cap of $169 billion is also in the same range as these peers, making them reasonable comparators and suggesting that BUSA is attempting to compete directly as a core holding.

Here are three additional observations:

1. BUSA’s growth rates appear competitive. Shares of healthcare distributors, property and casualty insurance companies, and aerospace and defense companies are contributing positively to the fund’s estimated 7.63% year-to-date earnings per share growth rate and helping offset weakness in the pharmaceutical and integrated oil and gas sectors. Diversified banks also offer greater earnings growth potential than regional banks, a configuration that has contributed to returns. On a weighted average basis, BUSA’s diversified banks have gained 22.45% year-to-date, compared with 10.08% for regional banks.

FELV also has strong sales and earnings growth rates, but it is better diversified, with only 61.78% of assets in its top 25 sub-sectors. Diversification is an area where BUSA struggles if its goal is to poach investors from traditional funds like IWD, SPYV, and VTV. The risk that certain sectors like financials and healthcare underperform and that managers fail to adapt to changing market conditions, as suggested by the fund’s research philosophy and portfolio turnover rate, may still exist.

2. While BUSA’s diversification poses additional risk, the ETF delivers on its promise of holding stocks at low valuations. BUSA trades at 15.11x forward earnings using the simple weighted average method and 13.57x using the harmonic weighted average method, both of which rank in the top decile of all the large-cap value ETFs I track. However, a lot has to do with structure, as financial stocks typically have low valuations. Using Seeking Alpha’s sector-adjusted factor scores, I came up with a value score of 4.21/10, which is only slightly above average. That’s still better than the four peers listed above, which have scores between 3.38/10 and 3.63/10, but BUSA’s value advantage is smaller from this perspective.

3. BUSA has a Sector-Adjusted Profit Score of 8.35/10, which ranks just 91st out of 109 in the large-cap category. This score is disappointing, as high-quality stocks tend to outperform over the long term. Furthermore, I worry that the investment committee has too much of a contrarian mindset, as evidenced by its weak EPS Revision Score of 5.77/10. This score, which measures changes in consensus earnings estimates, indicates weak analyst sentiment, which can be a significant headwind even if the underlying businesses are strong.

Investment recommendation

BUSA doesn’t offer a good enough mix of diversification, growth, value, quality, and sentiment to justify its 0.60% expense ratio in my opinion. I expect the ETF to be overweight financials for the foreseeable future, which could work under a Trump 2.0 administration. However, I also don’t expect the investment committee to react quickly if market conditions change, which is the main appeal of an active strategy. Granted, it’s still early to say for sure that will be the case, but for today’s readers, the prudent thing to do is to reserve judgment until we get more information. In the meantime, FELV is a better diversified pick with at least as attractive a factor mix and a much lower expense ratio, and it’s my pick over BUSA.