Joseph Clark

After years of poor performance, UK stocks are now trading near their lowest relative valuations in modern history. However, despite local economic weakness, many of Britain’s leading companies are multinationals and derive the majority of their revenue from overseas sales, presenting an opportunity. for active investors to exploit the strong global growth potential of these discounted British multinationals.

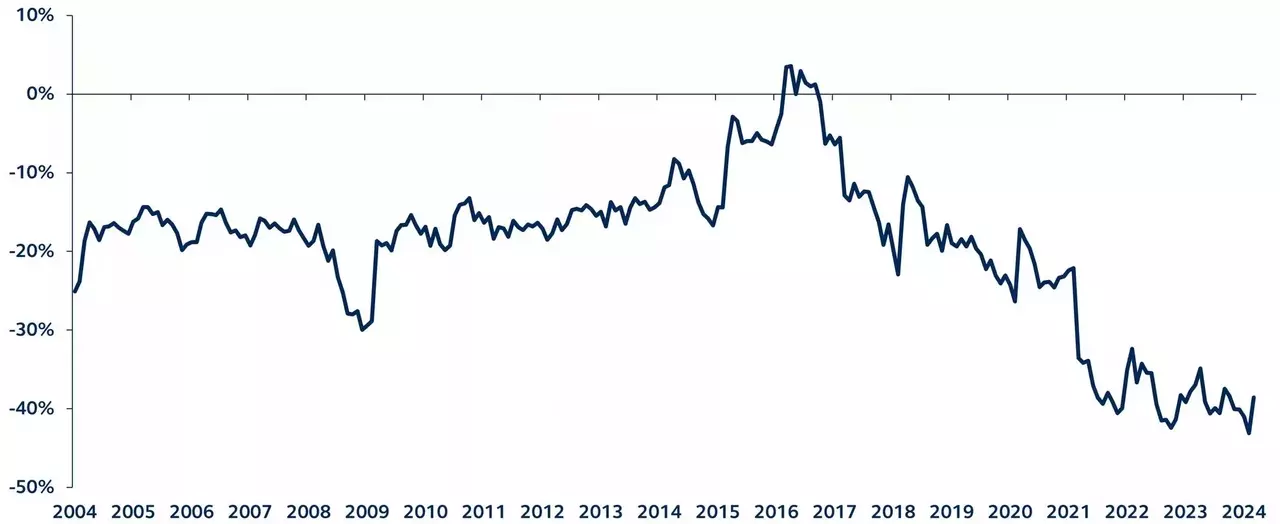

UK Price/Profit vs. World

MSCI UK PE Index divided by MSCI World PE Index, 2004-present

Source: Factset, MSCI, Principal Asset Management. Data as of December 31, 2023.

Over the past 20 years, the share of UK stocks in the global stock market has fallen by more than two-thirds, now standing at less than 4%. The 2016 Brexit referendum only worsened the UK’s stock market situation, and since then returns for the market as a whole have been significantly lower than those of its global peers.

With a weakened currency, a complex pension framework and stamp taxes on transactions frustrating local and foreign investors and further discouraging equity exposure, the difficult environment has even prompted some UK companies to relist their shares to the UNITED STATES.

However, despite this cautious macroeconomic backdrop, the UK remains home to many of the world’s most competitive multinational companies with significant operations outside the UK. In fact, among the 100 largest UK listed companies, more than 70% of their total revenue comes from overseas sales.

Amid indiscriminate capital outflows, particularly from passive funds, there are multinational leaders in the UK who can provide access to strong global growth opportunities.

It’s important to note that these companies are trading at historic valuation discounts, presenting a potential opportunity for investors. In addition, weak exchange rates have made many of these companies more competitive in export prices, thereby increasing their attractiveness.

For investors, active management could be key to navigating and taking advantage of these unique opportunities. The current landscape provides an opportunity to unlock value among strong multinational companies, making it an ideal time to consider certain UK stocks within international/global equity portfolios.

Editor’s note: The summary bullet points in this article were chosen by the Seeking Alpha editors.