Data shows that Bitcoin whales on cryptocurrency exchanges Bybit and HTX have opened massive long positions at current price levels.

Bitcoin Taker Buy and Sell Ratio Increased Recently for Bybit and HTX

In a new job on The relevance indicator here is the “Lessee’s buy and sell ratio“, which tracks the ratio between Bitcoin buying and selling volumes.

When the value of this metric is greater than 1, it means that the taker’s buy volume or long volume is currently greater than the taker’s put or put volume. Such a trend implies that the derivatives market currently shares a majority bullish sentiment.

On the other hand, an indicator below this threshold may imply the dominance of a bearish mentality in the sector, as short volume outweighs long volume.

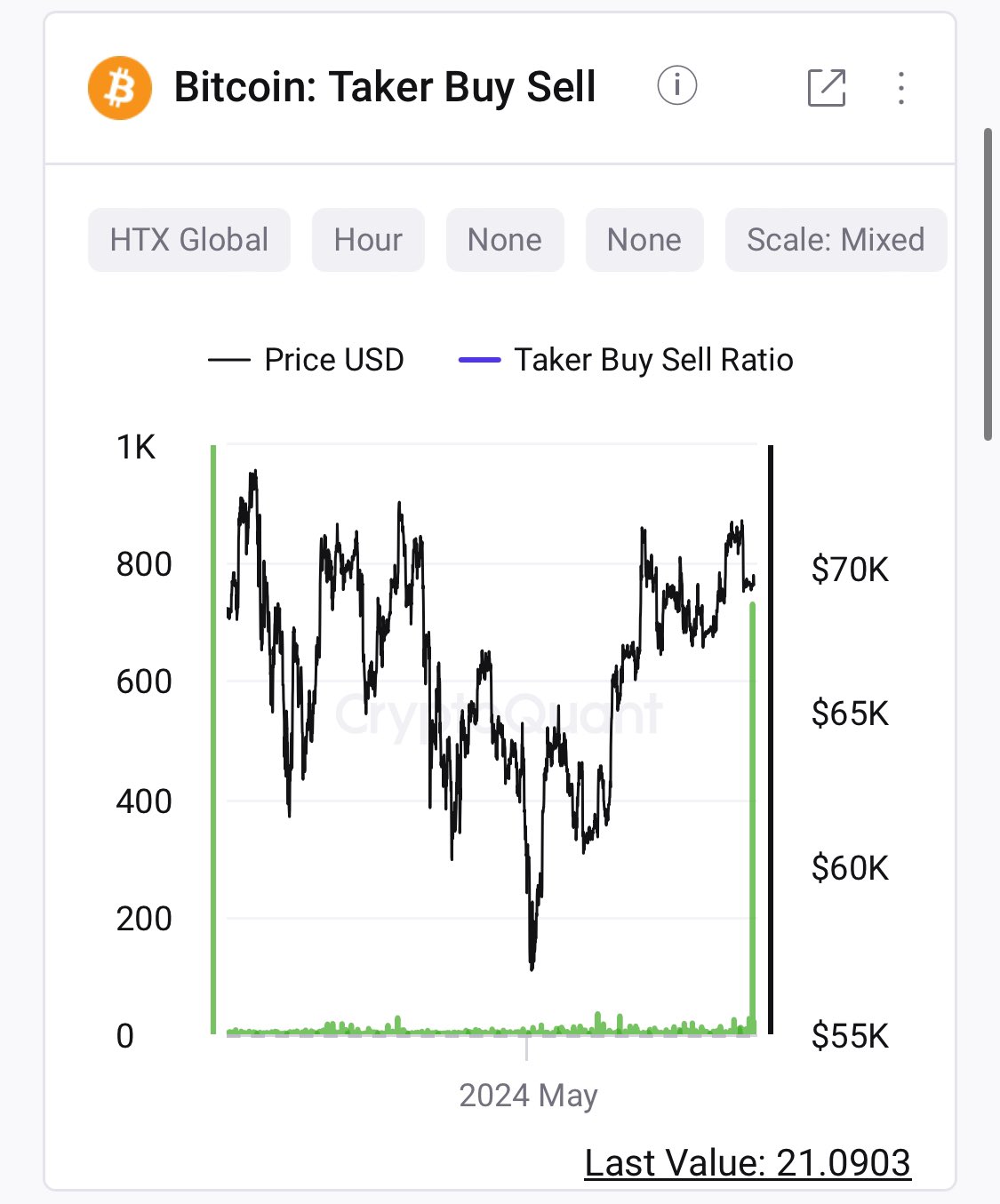

Now here is a chart that shows the recent trend of Bitcoin Taker’s buy and sell ratio specifically for the HTX exchange:

The value of the metric appears to have been quite high in recent days | Source: @ki_young_ju on X

As seen in the chart above, Bitcoin Taker’s buy and sell ratio for HTX has recently reached an extremely high level. This would imply that users of the platform have just opened a large number of long positions.

This sharp increase in the indicator follows BTC falls towards the $69,000 level. Thus, it would seem that the whales on the stock market, I think this drop is worth making big bullish bets.

Another member of the CryptoQuant team, Maartunn, made a quote-repost of Ju’s post on this development at HTX and noted that the Bybit platform has also seen a sharp increase in the Taker Buy Sell ratio at recent lows.

Looks like the metric has also registered a large value for this exchange | Source: @JA_Maartun on X

From the chart, it is clear that although the rise in Bitcoin Taker’s buy-sell ratio for Bybit has also been quite significant in itself, its magnitude is still not as extraordinary as that seen on HTX.

Nonetheless, the metric reaching these highs implies that on-platform orders from whales also trend strongly toward the long side. So, it appears that major entities on at least two exchanges have decided to open big bullish bets at recent price levels.

It now remains to be seen whether these long positions will pay off for these colossal Bitcoin investors.

BTC Price

Bitcoin has been moving sideways since the plunge a few days ago, with its price still trading around $69,420.

The price of the coin hasn't made any notable recovery from the plummet yet | Source: BTCUSD on TradingView

Featured image of Dall-E, CryptoQuant.com, chart from TradingView.com