On-chain data shows that the Bitcoin mining hashrate recently saw an 11% decrease as miner profitability fell to a 3-year low.

Bitcoin miners haven’t been under this much stress in 3 years

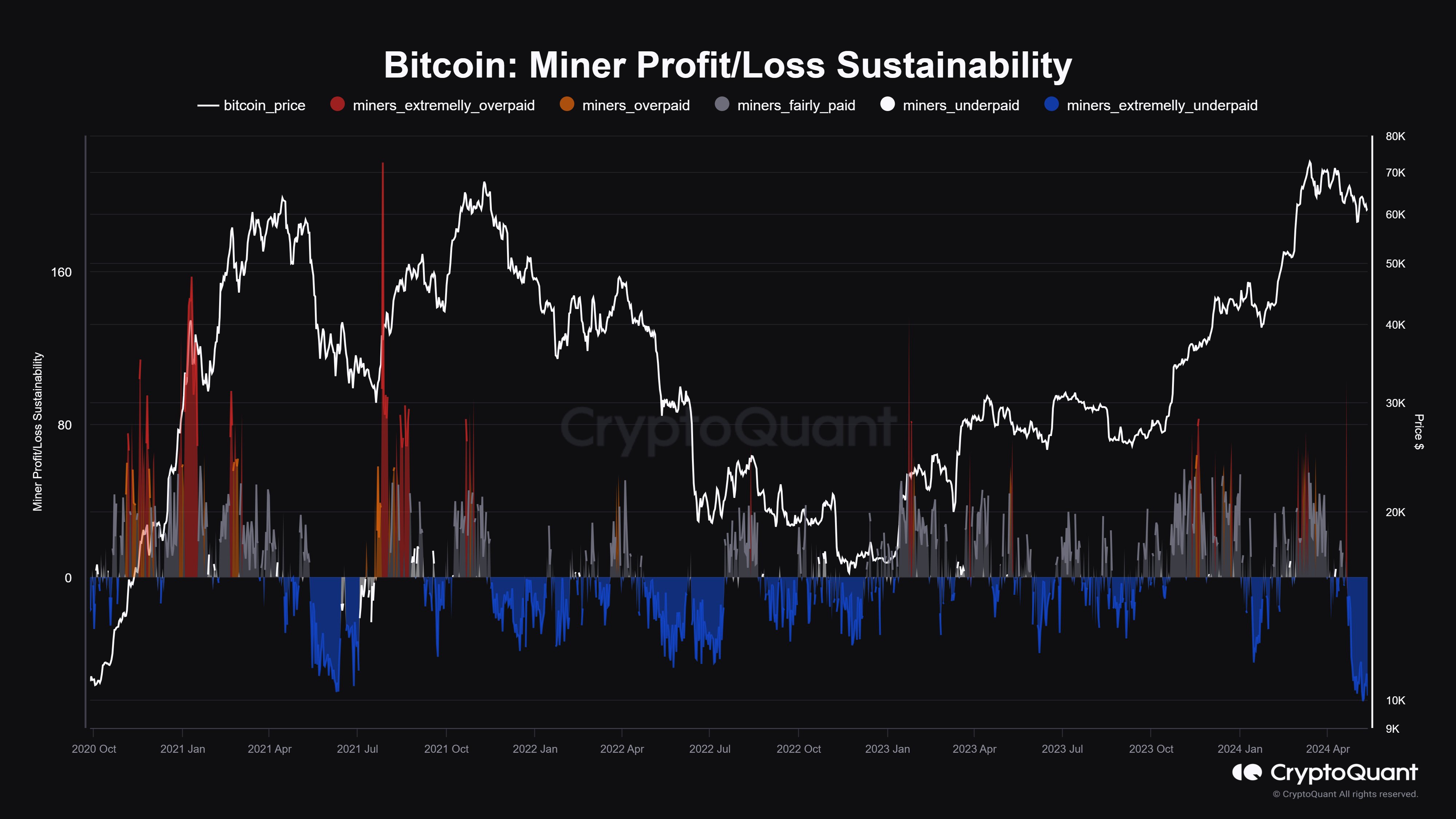

As CryptoQuant Community Manager Maartunn pointed out in a job on X, Bitcoin miners are currently significantly underpaid. The relevant metric here is “Miner Profit/Loss Sustainability”, which essentially tells us whether the minors’ income are right or not right now.

Here is the chart shared by the analyst that shows the trend of this BTC metric over the past few years:

The value of the metric seems to have been quite negative in recent weeks | Source: @JA_Maartun on X

From the chart, it is visible that the profit/loss sustainability of Bitcoin miners had been at positive levels earlier when the rally to the new all-time high occurred.

Miners earn revenue from two sources: the block rewards they receive for solving blocks on the network and the transaction fees they receive as compensation for processing individual transfers.

During rallies, transfer fees may increase due to high network activity and block rewards become more valuable due to the rising BTC price. As such, it is not surprising that the profitability of these on-chain validators reached notable levels during the previous rally.

However, recently the value of the indicator has plunged deep into negative territory, implying that miners have become extremely underpaid. Bitcoin has been on a downtrend during this period, but the lower spot value is not the only reason miners’ finances are now under pressure.

The much awaited Reduce by half what happened last month would be the much bigger factor at play here. During this event, BTC block rewards were permanently cut in half, so it’s easy to see how this would affect the mining economy.

Interestingly, the halving day itself saw quite high revenues for miners, with the sustainability of miners’ profits/losses heading into overpaid territory, as shown by the single spike in the chart. This was the result of the Runes arriving on the network.

This new protocol, which allows users to create fungible tokens on the Bitcoin network, saw immediate popularity and the resulting transaction activity caused blockchain fees to skyrocket. However, the hype could not last for too long and transaction fees returned to lower levels again.

The halved rewards combined with relatively low fees are why miners’ profitability has been hit so hard. “This risks creating considerable tension, especially for the least efficient miners,” notes Maartunn.

It appears that some of the struggling miners have already started to withdraw, like Bitcoin hash ratea measure of the computing power connected to the network by miners, has seen an 11% decline in its 7-day average chart since the all-time high set alongside the halving.

Looks like the value of the metric has been declining recently | Source: Blockchain.com

Miners can now only hope that the price of BTC will see enough of an increase to offset the drop in revenue caused by the halving, or that perhaps transaction fees will see another boom.

BTC Price

Bitcoin saw further recovery falter as the asset’s price fell to $61,700 after returning above $63,000 yesterday.

The price of the coin has continued to consolidate over the last few days | Source: BTCUSD on TradingView

Featured image by Erling Løken Andersen on Unsplash.com, Blockchain.com, chart from TradingView.com