According to the latest on-chain observation, losses realized by Bitcoin traders have reached a level that has proven critical for the movement of the part several times in recent years. This raises the question: is the price of Bitcoin hitting bottom?

Traders’ Realized Losses Are Below -12 Again — What Happened Last Time?

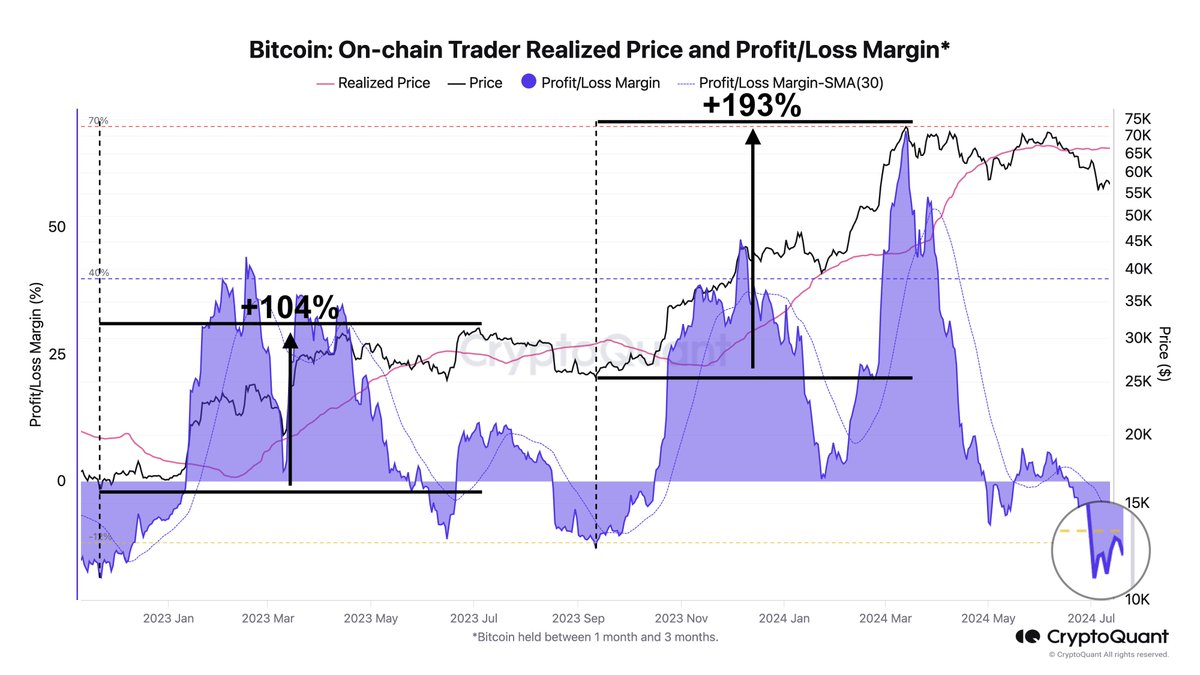

In a recent article on the X platform, prominent crypto analyst Ali Martinez sharp Bitcoin traders have noticed that the amount of losses suffered by Bitcoin traders has increased in recent weeks. This on-chain revelation is based on CryptoQuant’s profit/loss margin metric, which aggregates the profits and losses of all Bitcoin trades.

Profit/loss margin essentially measures the overall profitability of investors in a particular cryptocurrency (Bitcoin, in this scenario). When the value of the metric is positive, it implies that more BTC is being sold at a profit. A negative profit/loss margin, on the other hand, indicates that more Bitcoin is being sold at a loss.

According to data from CryptoQuant, the profit/loss margin is currently below -12, meaning that traders are currently making more losses than gains in the market. Historically, this the level is more significantconsidering that the metric has been below the -12 mark in previous cycles.

Interestingly, recent periods where the profit/loss margin has fallen below -12 have been followed by periods of significant price increases. As the chart shows and as Martinez pointed out, the last two times the metric has fallen below this level have seen price increases of 104% and 193% respectively.

Source: Ali_charts/X

If this historical pattern is to be believed, it is likely that the Bitcoin price will see significant bullish activity in the near future. Furthermore, the observation of significant losses in the market may suggest that bottom of a bearish cycle and the beginning of a more positive phase.

Will Bitcoin Price Rise? Here Are the Important Levels to Watch

If the historical model is confirmed and the Bitcoin Price SurgesThere are a few price areas to watch. According to Martinez, the leading cryptocurrency has major resistance levels around the $61,340 and $64,620 areas.

This revelation is based on the cost basis of Bitcoin investors and the distribution of BTC supply across different price ranges. The size of the dots in the chart below reflects the strength of resistance and support and the amount of BTC purchased in each price zone.

Key resistance levels for #Bitcoin The levels to watch are $61,340 and $64,620. The crucial support level to watch is $57,670! pic.twitter.com/YrBPkJmWzn

— Ali (@ali_charts) July 13, 2024

At the time of writing, the price of Bitcoin is hovering around $59,467, reflecting a 2.7% increase in the last 24 hours. According to data from CoinGecko, the flagship cryptocurrency has increased by 2% over the past week.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from Pexels, chart from TradingView