On-chain data shows that Bitcoin trading flows have remained weak recently, a sign that whales have lost interest in selling.

Bitcoin flows for Binance and OKX have remained weak recently

As CryptoQuant Founder and CEO Ki Young Ju pointed out in a job on X, BTC deposits for cryptocurrency exchanges Binance and OKX have been low recently.

The on-chain indicator that interests us here is the “foreign exchange influx”, which keeps track of the total amount of Bitcoin transferred to wallets attached to centralized exchanges.

When the value of this metric is high, it means that investors are currently depositing a large number of tokens on these platforms. Since one of the main reasons holders transfer to exchanges is for selling purposes, this type of trend can have bearish implications for the asset.

On the other hand, the fact that the indicator is low implies that these platforms are not currently seeing as many deposits. Depending on the trend of the opposite measure, namely the exchange outflow, such a value can be either bullish or neutral for the price of the cryptocurrency.

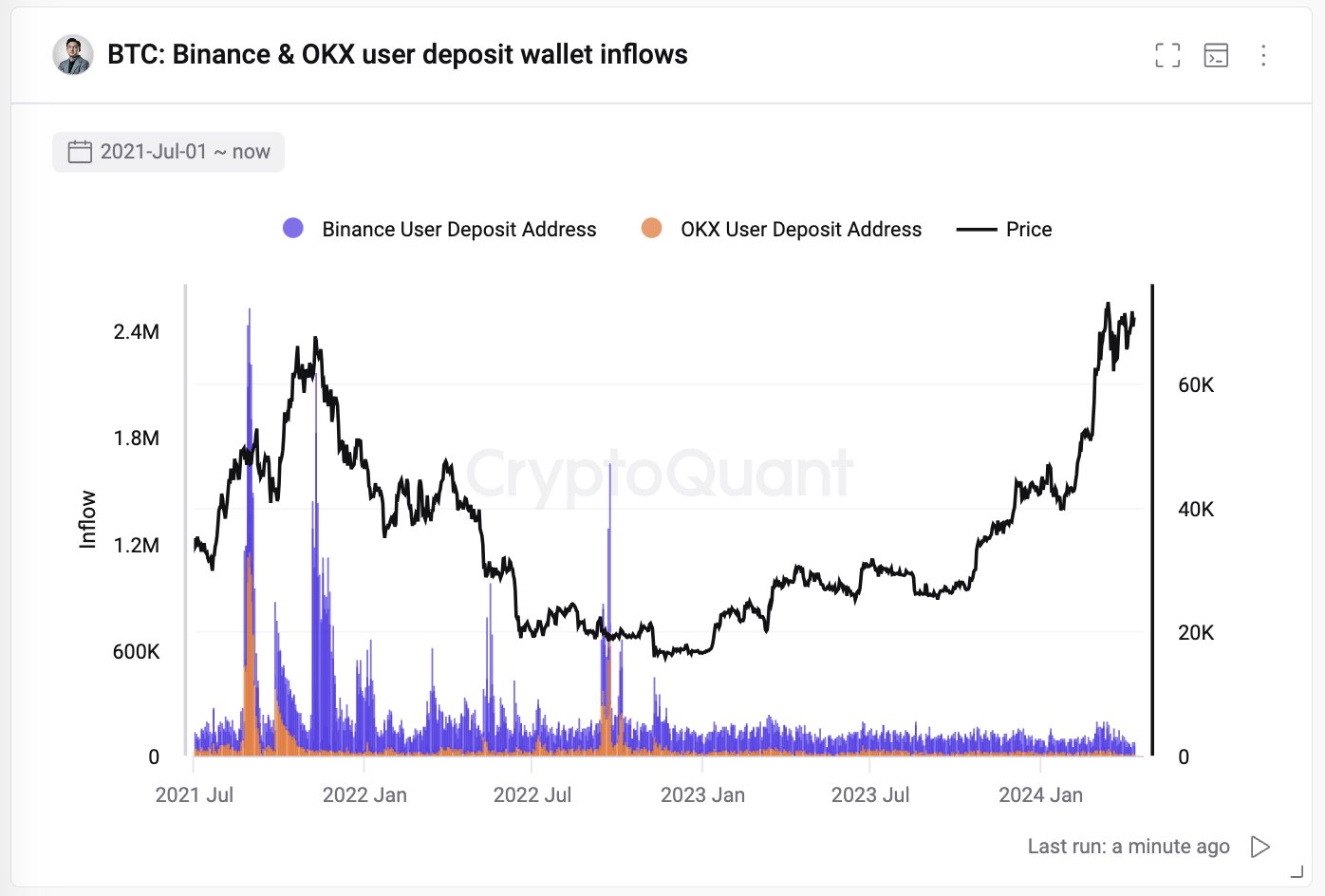

Now here is a chart that shows the Bitcoin exchange inflow trend for Binance and OKX over the past few years:

The value of the metric appears to have been low in recent days | Source: @ki_young_ju on X

Binance is the largest exchange in the world by trading volume, while OKX is usually number two behind it by the same extent. While these two platforms certainly do not represent the entire cryptocurrency market, user behavior on them would still provide an estimate of the broader trend.

As the chart shows, exchange flows for Binance and OKX have been at relatively low levels for some time now. When BTC observed its rally to a new all-time high (ATH) earlier in the year, deposits saw a slight upward trend, but recently inflows have returned to low values.

This suggests that the selling appetite, particularly from whales, simply hasn’t been there for the cryptocurrency. Even the ATH break was only able to encourage a few major users of the platforms to turn to sales.

The behavior contrasts with, for example, the second half of Running of the bulls 2021, which is visible on the graph. The then rebound had not only seen exceptional spikes in inflows, but baseline inflows had also been generally higher than recent levels.

Interestingly, the rally’s two major peaks also coincided quite nicely with extremely large capital inflows, so based on this trend, the current rally may not yet be close to a summit.

However, it remains to be seen whether this same trend will continue during this cycle, given the new emergence of spot exchange-traded funds (ETFs).

ETFs have provided an alternative way to gain exposure to the asset, meaning that cryptocurrency trading may no longer have the same relevance in the market.

BTC Price

At the time of writing, Bitcoin is floating around $70,400, up more than 5% over the past seven days.

Looks like the price of the coin has mostly moved sideways recently | Source: BTCUSD on TradingView

Featured image by Thomas Lipke on Unsplash.com, CryptoQuant.com, chart from TradingView.com