The cryptocurrency market has taken an interesting turn in recent days, with the price of Bitcoin experiencing a intense downward pressureOn Thursday, July 4, the leading cryptocurrency broke through the $60,000 mark, falling to as low as $57,000.

BTC price continued to decline on Friday, with the market leader dropping below $54,000 at one point. This disappointing price drop was linked to a variety of events, including government selloffs and potential selloffs following the Mt. Gox payout announcement.

Government Bitcoin Sales Overstated, CryptoQuant CEO Says

In a new article on Platform X, CryptoQuant CEO and Founder Ki Young Ju gave his thoughts on recent reports that country governments are disposing of seized BTC assets. German Government has executed various transactions involving significant amounts of Bitcoin over the past few weeks.

The FUD (fear, uncertainty, and doubt) resulting from the recent selloff is considered to be one of the main drivers of the current downward pressure on Bitcoin’s price. However, CryptoQuant’s CEO believes that the impact of the Government sells seized BTC assets are overvalued.

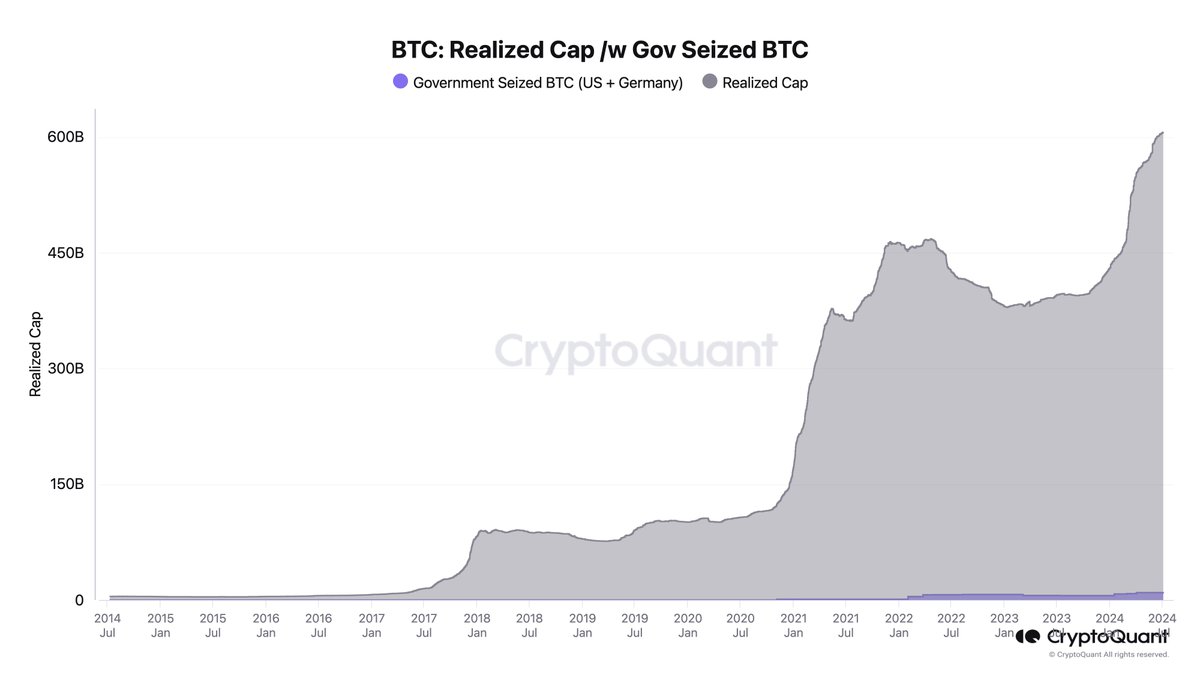

This assessment is based on Bitcoin’s peak in about a year. According to data from CryptoQuant, $224 billion has been invested in the market since 2023, but only $9 billion (less than 5%) comes from BTC seized by governments. It should be noted, however, that this data only takes into account Bitcoin seized by the US and German governments.

Source: Ki Young Ju/X

Young Ju noted in his post that the realized cap here represents the total capital that has flowed into the market since 2023. The “realized” cap differs from the more traditional “market” cap in that it is based on the price of each coin when it last moved.

In another publish on XThe founder reiterated his confidence in the long-term promise of the first cryptocurrency, saying that Bitcoin’s bull run is not over yet. According to the blockchain company’s CEO, the bull run will likely continue until early next year.

Additionally, Young Ju was able to identify the potential top of the Bitcoin cycle using the realized cap metric. The CryptoQuant founder expects the leading cryptocurrency to peak during this cycle around the $112,000 price level.

BTC Price Overview

THE Bitcoin price The stock surpassed $56,000 late Friday, July 5, and is trading at $56,400 at the time of writing. However, the market leader is still down nearly 6% over the past seven days.

BTC price at $56,401 on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView