On-chain data shows that Bitcoin and Dogecoin have managed to rise to the top of the rankings in terms of holder profitability. This is what the ranking looks like.

Bitcoin and Dogecoin are among the coins with the highest investor profitability ratio

In a new job on X, market intelligence platform IntoTheBlock explained how holder profitability compares between some of the best layer 1 networks in the area.

Here, holder profitability refers to the total percentage of investors or addresses on a given cryptocurrency network that are currently making net unrealized gains.

This metric works by looking through the transaction history of each address on the blockchain to find the average price at which it acquired its coins. If this average cost basis for any holder is less than the current spot price of the asset, then the investor is assumed to be holding profits.

The indicator summarizes all of these addresses and determines what percentage of the total they represent. Naturally, investors whose base price is higher than the current price are counted as losses, and those whose two are equal are considered to be just breaking even.

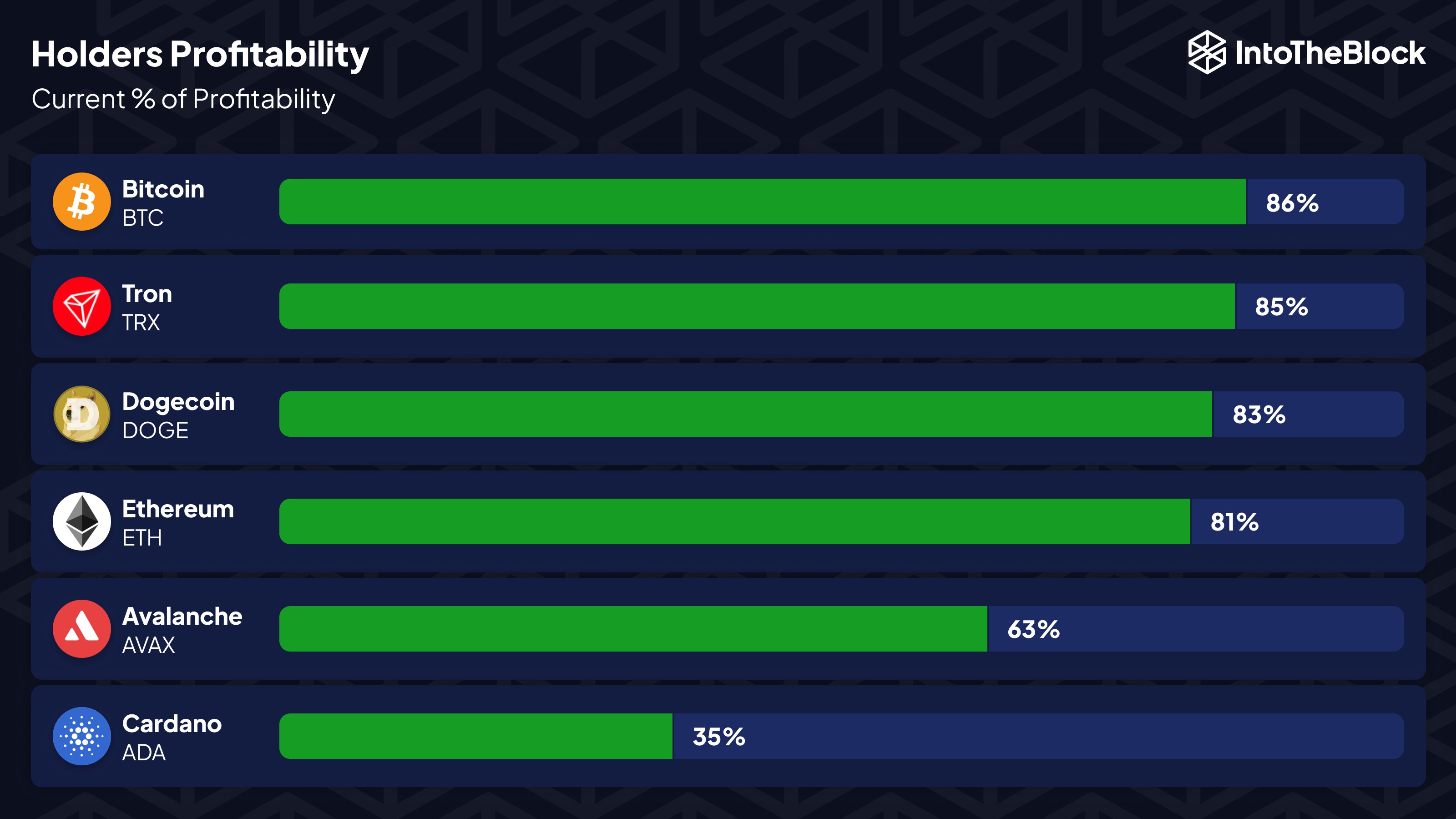

Now here’s what holder profitability looks like on six major coins: Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), Cardano (ADA), Avalanche (AVAX), and Tron (TRX).

The ranking of these top assets based on their respective holder profitability | Source: IntoTheBlock on X

As the chart shows, Bitcoin is currently the leading cryptocurrency in terms of holder profitability, with 86% of its addresses in the green. Tron is second with 85%, while Dogecoin is third with 83%.

These assets beat Ethereum in this measure, despite the asset being the second largest on the network in terms of market capitalization. However, with a profitability of 81%, ETH is not far behind.

The situation looks much worse for Avalanche and Cardano investors, with the latter network being particularly dire. 63% of AVAX investors are currently making profits, so at least most of them are in the green, but the same cannot be said for ADA, since only 35% of holders are floating above the ‘water.

Generally, profit investors are more likely to participate in the sale at any time, so the risk of massive sales can increase as the holder’s profitability increases.

Coins like Bitcoin and Dogecoin have high profitability, but it is not uncommon for bull markets. Profitability may remain even more extreme in such periods, so current levels may be cooled slightly.

Just as tops have historically been more likely to form at extreme profitability levels, bottoms can occur when a small percentage of investors are in the green, as profit sellers exhaust themselves at this point.

Building on this, Cardano’s low profitability (and also Avalanche’s, to some extent) may be a positive sign for the price, as it suggests there could be notable potential for a rebound.

BTC Price

Bitcoin retraced the recovery it made earlier in the week and its price has now declined to as low as $63,200.

The price of the asset appears to have plunged over the past day | Source: BTCUSD on TradingView

Featured image by Kanchanara on Unsplash.com, IntoTheBlock.com, chart by TradingView.com