James O’Neil

Introduction

Public services have been out of favor for some time now. In a recent articleI looked at another utility with a growing renewable energy portfolio and explained why I believed Northland Power (NPI:CA) was a compelling buy in the space. Today I’m going to look at a small company, Avista (NYSE:AVA), and point out why I’m optimistic about the name. While the long-term thesis on renewables is the same, Avista in particular has seen growth in its margins and ROE, and the rate base over time should generate additional earnings per share growth. With a strong balance sheet and a secure dividend, Avista presents an attractive investment in the utilities sector.

Company presentation

Avista is above all a regulated public service who holds a stake in a regulated public service operations in the Pacific Northwest where it distributes electricity and transmission to eastern Washington and northern Idaho. In addition to this, it also distributes natural gas in Oregon and has power generation facilities in Washington, Idaho, Oregon and Montana. Avista also provides electricity to a small number of customers in Montana. Finally, thanks to its subsidiary companyAlaska Energy and Resources Company, Avista provides retail electric service in the City and Borough of Juneau.

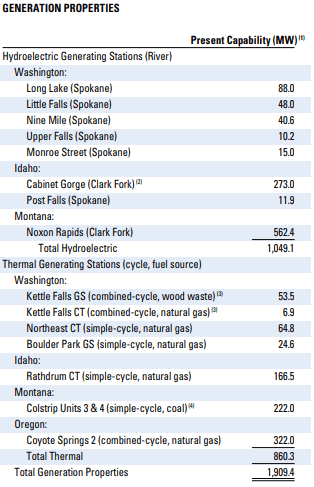

One reason to love Avista is its renewable energy business. Of its total operations, 48% are hydroelectric, 9% wind and 2% biomass. But the company also owns 33% natural gas and 8% coal, which allows for some diversification. As for his generation properties, Avista has a current capacity of 1,049 MW in hydroelectric capacity and 860 MW in thermal capacity.

Annual report 2023

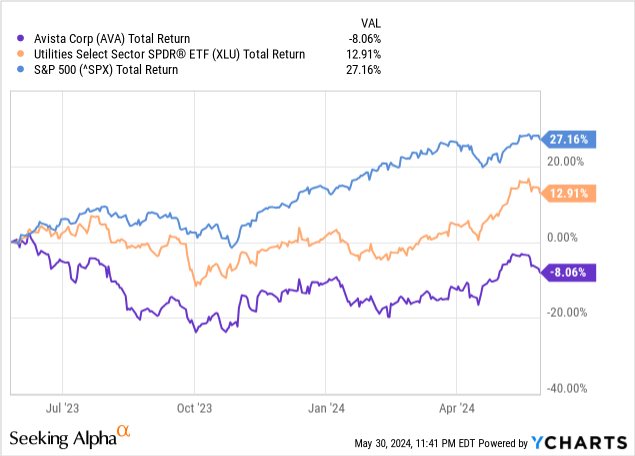

Avista shares have underperformed over the past year, delivering a total return of -8.1%, compared to the S&P500’s return of +27.2%. With a dividend yield of 5.3%, the drop was cushioned by dividend distributions to shareholders. Additionally, Avista’s negative total return over the past twelve months also lags that of the Utilities Index ETF (XLU) at +12.9%.

So why this underperformance? Avista, like most utilities, has been under pressure lately as rising interest rates intended to combat inflation weigh on utility companies. Two effects fuel this trend.

First, utilities are typically leveraged businesses, choosing to take on debt given the low return on assets generated by their facilities. They are able to leverage because demand for electricity transmission and distribution tends to be very stable and predictable, with little variability in cash flows from year to year. When interest rates rise, the cost of debt when refinancing means that their interest costs increase, even though they often generate the same income, so the increase in expenses compared to stable income has a net negative impact on them.

Second, when rates rise, from an investor’s perspective it often becomes more attractive to buy safer fixed income investments rather than buying utilities, which are generally considered riskier (stocks) . In this context, as rates have increased, investors have been sale utilities.

Financial data and outlook

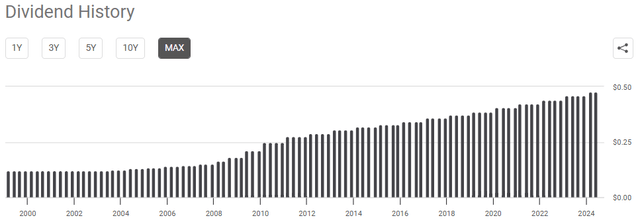

One of the reasons I like Avista (and something I think is underappreciated by investors when it comes to the company) is its history of consistent performance. dividend growth over time. Over the past 21 years, the company has paid an increasing monthly dividend to its shareholders; a fairly rare track record in the public services sector. With a growing dividend, one would have expected the company to pay out almost all of its EPS as a dividend. However, the distribution ratio is at 76%, the dividend therefore seems well covered. This should provide some insulation to the dividend as well as comfort to investors knowing that the company could likely continue to increase its dividend even if EPS remained flat for a few years.

Dividend History (Searching for Alpha)

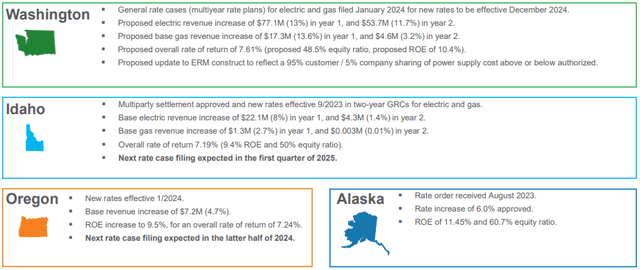

But in my opinion, I don’t think the EPS will remain stable. In fact, Avista made it very clear why this wouldn’t be the case. Considering around half a billion in capex per year, rate base growth is expected to continue growing at 5% through 2026. With strong ROEs allowed across its four geographies (10.4% in Washington, 9.4% in Idaho, 9.5% in Oregon and 11.5% in Alaska), particularly in Alaska, the regulatory environment is surprisingly favorable with multi-year rate plans that isolate flows of the company’s cash flow.

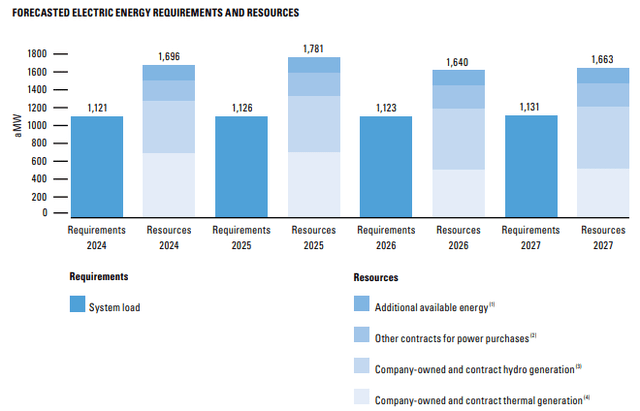

We can also see that the company has been proactive in keeping its resources ahead of need to meet demand, regardless of operating conditions. The average hourly load was 1,115 aMW in 2023, 1,142 aMW in 2022 and 1,113 aMW in 2021.

With a market capitalization of $2.84 billion, long-term debt of $2.60 billion, and cash of $12 million, Avista’s implied enterprise value is approximately $5.42 billion. of dollars. Debt to enterprise value of 48%, which is comparable to other peers. Trailing twelve month EBITDA was $550 million, representing a total debt-to-EBITDA ratio of 4.7x, down from a peak of 6.3x two years ago (source: S&P Capital IQ ). As leverage continues to fall alongside continued earnings growth through 2026, leverage is expected to decline somewhat, barring further growth investments.

On the call for results, management said it was able to take advantage of $83.7 million in tax-exempt bond financing at 3.875%, or about 140 basis points below the taxable market. These cost savings should also support EPS growth. Additionally, management is also not planning any further debt issuances during the year, just an equity issuance of approximately $70 million later in the year to fund investments.

Evaluation and conclusion

Looking at the 4 sell side evaluations on Avista, there are 3 “hold” ratings and a single “buy” rating. The average price target is $40.00, implying an upside of approximately 10.6%, not including the 5.3% dividend yield. With a total return potential of 15.8% upside over the next year, even though the majority hold ratings, analysts see upside potential with Avista.

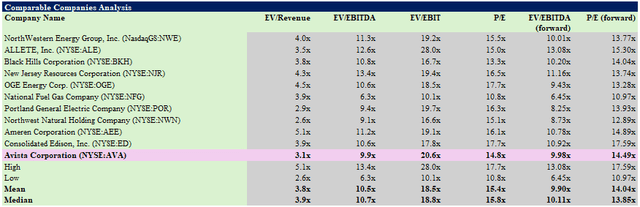

Avista trades at 9.9x EV/EBITDA and 14.8x P/E (or 14.5x forward earnings) (source: S&P Capital IQ). Relative to peer companies, it trades at a one-turn premium to EBITDA and earnings, so the company is roughly in line with the peer group.

Author, based on data from S&P Capital IQ

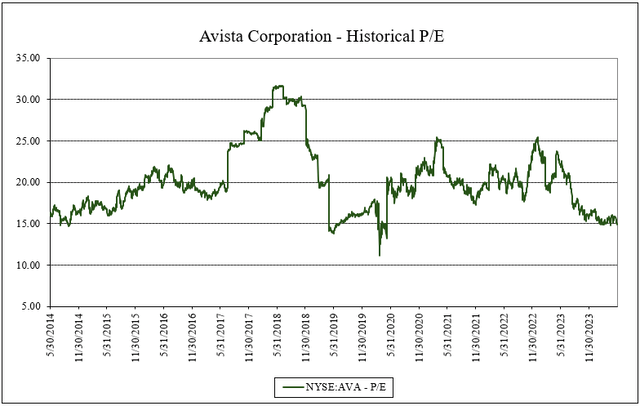

However, when comparing the company to its historical P/E, the company is trading at a discount of over 5 turns to its ten-year historical average P/E of 20.1x P/E. In my opinion, this is likely due to the interest rate environment, which has knocked down its peers.

Author, based on data from S&P Capital IQ

But if history is any indication, this is historically a great time to buy into this range, as Avista has rarely been this cheap. In my opinion, the current valuation offers investors the opportunity to acquire discounted stocks. With a growing rate base, a growing renewables portfolio, strong financials, and a balance sheet that provides flexibility to the company, I believe Avista offers a combination of growth and revenue. There is still weakness in the sector, and it may not go away for some time until sentiment changes. However, I believe that as the company continues to execute its growth plans and capitalize on its diversified energy portfolio, shareholders could benefit from both capital appreciation and income generation, especially considering the history of constant dividend increases. I am optimistic about Avista’s prospects and will increase my stock.