Hiroshi Watanabe

At the end of December last year, I published a article comparing the largest BDC – Ares Capital (NASDAQ:ARCC) – with the second largest, FS KKR Capital (FSK). Even though I was optimistic about the two BDCs, I preferred to allocate slightly more in FSK for the following reasons:

- FSK was trading at a discount to NAV, while ARCC had a built-in premium.

- The FSK stock price had been under pressure for some time due to a notable accumulation of non-accruals which management believed were about to change.

- FSK’s yield was several hundred basis points higher than ARCC’s.

Meanwhile, the fact that ARCC had a premium and therefore a lower return was, in my opinion, fully justified by its robust portfolio (made up of diversified, high-quality names) and its fortress balance sheet.

It was just that From a tactical perspective, it made more sense to invest a little more in FSK to capture potential recovery returns that would materialize as interest rates fell (minimizing non-accumulation risk) and that the portfolio would improve.

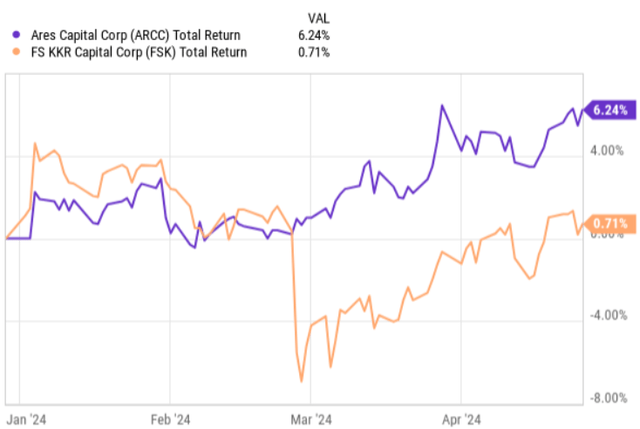

However, on an annual basis, ARCC clearly outperformed FSK, mainly due to FSK’s below-average earnings report. In the chart, we can actually notice that until results day, FSK was performing better than ARCC.

That being said, for about two months I issued a follow-up article on FSK, explaining that BDC’s prospects are still there (and since then, FSK has generated around 7% alpha), now seems like a good time to provide some additional insight into ARCC and how I see ARCC performing in the future.

Before I do that, let me highlight the most important structural elements, which have emerged since my ARCC article was published in December 2023:

- Consensus on the number of interest rate cuts in 2024 has fallen from 6 to just 2, and the overall scenario for a more sustainable rise has clearly strengthened.

- There are some early signs of a synchronized increase in non-accumulations in the BDC space.

- M&A and capital markets activity has yet to pick up, and as interest rate volatility has increased, it appears highly unlikely that 2024 will be favorable for overall deal activity.

- The BDC Index – VanEck BDC Income ETF (NYSEARCA:BIZD) – has continued to rise, recording around 6% total returns on a year-to-date basis.

So, what these aforementioned dynamics say is that BDCs have become a little more expensive, mainly due to the reinforcement of a higher and longer scenario, although the risk of accumulation of non-accumulation has also increased and there are no strong tailwinds supporting the growth of assets under management.

Here we must understand that the increase in non-accruals is only logical, because in 2023 we experienced extremely minimal levels of corporate bankruptcy and companies, which began to refinance their previously fixed rate debts Issued when interest rates were low, have increasingly faced challenges in their ability to meet rising interest charges.

Likewise, the fact that M&A and capital markets are shallow creates a more difficult environment for BDCs to not only grow, but also maintain their existing assets under management. For BDCs, it is essential to find new business in order to at least offset the organic returns of their investments. Alternatively, if the total assets figure declines, the basis from which BDC can capture gaps between investment returns and the cost of capital also becomes smaller, putting downward pressure on revenue generation. Underlying NII.

In my opinion, the risks associated with higher non-accruals and slower portfolio growth (or even portfolio shrinkage) are very low for ARCC, making BDC a great investment compared to to other BDCs.

Here are more details on why this is the case.

Thesis

When it comes to portfolio quality and defense integration into the portfolio, ARCC is one of the best in the game. It all starts with diversification. There are three key diversification levers to consider that really set ARCC apart from the average BDC:

- ARCC is well diversified at the asset allocation level, where it is not only limited to the credit sector but also has branches in private equity, real assets and secondaries which together constitute around 40% of the conventional size of the credit/BDC.

- At the industry level, the economy is also very diverse and, more importantly, in economic pockets that are inherently less sensitive to fluctuations in the economy. For example, ARCC holds less than 2-3% of its portfolio in industries in which leveraged loan transactions typically dominate (e.g., hospitality and gaming, oil and gas, and transportation).

- At the company level, ARCC has one of the lowest concentrations of companies in the BDC sector. As of Q4 2023, ARCC’s average position size in a single company was 0.2%, with the largest investment consuming only about 2% of the portfolio.

Furthermore, in the defensive context of ARCC, investors must appreciate the conservative underwriting strategy applied by Management (in addition to the diversification aspect).

THE comment by Kort Schnabel – co-chair – at the 45th Annual Raymond James Institutional Investor Conference, sums up the story well:

We look for leading companies in terms of market share, companies that hold dominant market shares, and barriers to that market share. Nice defensible moats around their market share. High free cash flow generation. We take into account many sensitivities on these companies when we underwrite in different rate environments and economic environments, ensuring that the cash flow will be there to service our loan.

The results of this strategy can be well observed in the data of the most recent results report. Although the non-accrual situation has become a challenge for more and more BDCs, ARCC continues to benefit from its conservative underwriting standards.

For example, non-accruals at cost ended the year at 1.3%, which is lower than the 1.7% at the end of 2022. This figure is also lower than ARCC’s 15-year historical average of 3% in non-accumulations. Namely, this confirms that ARCC could easily be considered a BDC, which is more defensive than the average BDC.

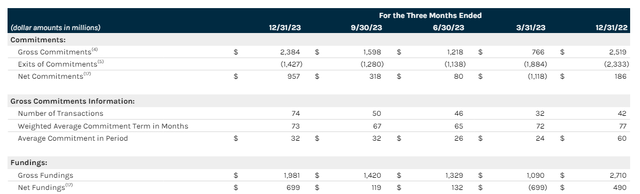

Additionally, if we look at ARCC’s performance in terms of net funding, we can see that even though it is the largest BDC (which implies that a significant portion of capital is paid from organically each quarter), management has actually seen growth. in net financing for three consecutive quarters already.

Presentation of ARCC T4-23 results

All this has happened while the M&A and capital markets have remained rather inactive.

The main reason this has been possible for ARCC is the combination of its size and diversification.

Regarding size, ARCC has become so large that it can now participate and compete with traditional banks in very large transactions. Once again, at the 45th Annual Raymond James Institutional Investor Conference, Kort Schnabel made a great contribution on this aspect:

It also allows us, by the way, that when things slow down a little bit in the M&A environment, as we’ve seen over the last 18 months or so, we can then inject capital into that existing portfolio. This creates ballast in our original system. We’ve already talked about scale. Perhaps not much more to mention here. I guess the ability to engage in large transactions allows us to have market power over documentation terms and pricing, right? We defend over $500 million, sometimes up to a billion dollars per transaction. This gives us a lot of market power and gives us access to capital markets.

The aforementioned diversification angle arising from the different sectors in which ARCC operates also proves useful in providing a more stable demand for ARCC’s capital.

The essential

Amid increasing risk of corporate distress and continued inactivity in M&A and capital markets, ARCC has become a more attractive investment, particularly compared to most other BDCs.

The current premium of ~7% on the underlying NAV seems fully justified and does not harm the attractiveness of ARCC. If we evaluate the ARCC core, we will notice that it has the necessary characteristics to safely withstand the prevailing/mentioned headwinds mentioned in the BDC sector.

Considering the above reasons and the juicy 9.2% dividend, I remain bullish on Ares Capital.