At a recent blogger conference, I was asked to cite the most important article published in my field (macroeconomics) in the last ten years. I didn’t find any.

In a sense, this reflects the fact that the field has evolved from 20th-century macroeconomic research, which I am most familiar with. My ignorance perhaps says more about me than it does about the macro realm. In desperation, I suggested that Paul Krugman’s 1998 Brookings article (It’s back . . . ) is the most recent one that I remember having a decisive impact on the way we think about macroeconomics. A few years ago I wrote an article explaining how the important “Princeton School” of monetary economics was heavily influenced by this article.

Many brilliant economists continue to do very sophisticated research on money and macroeconomics. And yet I rarely see new articles that seem interesting to me, at least in the same way that many articles from the second half of the 20th century seemed interesting when they were first published. And it’s not just in macroeconomics. Casual art enthusiasts like me know of hundreds of famous paintings from the 1880-1924 period, but very few famous paintings from the 1980-2024 period. For what ?

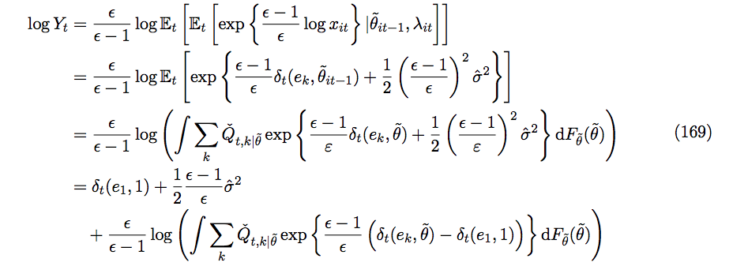

Tyler Cowen recently linked to an NBER working paper by Joel P. Flynn and Karthik Sastryxwhich examines how optimistic and pessimistic narratives might contribute to the business cycle. Technically, this 134-page paper is far above anything I have ever done, presenting literally hundreds of mathematical equations, some quite complex. Here is an excerpt from the conclusion:

Calibrating the model to fit the data, we find that the implications of the business cycle stories are quantitatively significant: measured declines in optimism account for about 32% of the peak-to-trough decline in output over of the recession of the early 2000s and 18% during the Great Recession. Finally, we show that the interaction of many simultaneously evolving and highly contagious narratives, some of which are individually subject to hysteresis, can nevertheless underlie stable fluctuations in emergent optimism and output. Taken together, our analysis shows that narratives can be an important cause of the business cycle.

Their work relies on a “real business cycle” framework, which I am generally somewhat skeptical of. It’s not that these RBC models don’t tell us important things about the economy, but rather I believe that (at least in the United States) real shocks are primarily important as a determinant of long-term trends , and not economic cycles. (Covid being the obvious exception.)

I’ve only skimmed the article, so I won’t express an opinion on their empirical estimates, but this caught my attention:

Our analysis leaves open at least two important areas for future study. First, we have analyzed the importance of corporate narratives and have abstracted from the study of household narratives. It seems reasonable that similar mechanisms could operate on the household side of the economy, where contagious narratives could influence spending and investment decisions. Furthermore, narratives that evolve simultaneously on the “supply” and “demand” sides of the economy could have mutually reinforcing effects. From this perspective, narratives have the potential to explain even more of the business cycle than our analysis suggests.

I like this observation because I have long believed that the most important impact of (real) supply shocks is how they interact with (nominal) demand shocks. So a real housing/banking shock in 2007 probably lowered the natural rate of interest. The Fed got behind schedule and cut rates too slowly (especially in 2008). This led to lower nominal GDP (less demand), thus worsening the recession.

They conclude with the now almost obligatory call for further research:

Second, there is still much to study about what “makes a story a story” – that is, in the language of our model, what underpins all of the stories and their contagiousness? Further study of these issues would shed further light on policy issues, including both the interaction of classical macroeconomic policies with narratives and the potential effects of “direct narrative management” via communication. Furthermore, probing these deeper origins of narratives could further enrich the study of narrative constellations beyond our analysis, to account for the full range of economic, semantic, and psychological interactions between narratives in a complex world.

Will further research answer these questions? I’m skeptical. I worry that the next couple of bright young macroeconomists will say, “Flynn and Sastryx have already done this, let’s develop a different model.” » There is probably enough truth in almost any plausible macroeconomic model that one can find some empirical support for the theory (at least if one sufficiently “tortures” the data set).

It is possible that my skepticism about modern macroeconomics is simply the reflection of an old man who is no longer up to date with recent developments. I plead guilty. But in the second half of the 20th century, one did not need to read 100-page research papers to understand that macroeconomics was generating many revolutionary ideas. I do not see interesting new ideas explained in non-technical articles aimed at the layperson.

Here’s a way to think about my pessimistic mindset. I’ve been doing macro research for most of my life. Fairly early on, I came to the conclusion that American economic cycles were rather simple. In most cases (not Covid) these were simply monetary policy errors leading to fluctuations in NGDP and high correlation in real GDP in the short term due to wage stickiness.

If you were to explain why paintings from 1880-1924 seem more memorable than those from 1980-2024, you might point out the fact that painters of the early period discovered many interesting new styles, and that there were none just not as much to discover in the second half. Another opinion is that I am wrong, and that future generations will discover even more masterpieces in the art of painting from the period 1980-2024 than from those of 100 years ago. The future will tell.

Thomas Kuhn said that in science we often make progress by developing models, then discovering that there are some “anomalies” that those models don’t explain, and then developing new and improved models to explain those anomalies. Perhaps our best macroeconomic models from the late 20th century explain business cycles quite well (and note that the “Fed error” theory I just gave might explain why). explanation does not imply prediction). Perhaps the remaining anomalies are simply very difficult to explain.

But that doesn’t entirely explain my skepticism about modern macroeconomics. You can argue that we invented too much good macro models in the second half of the 20th century. We have Keynesian models, monetarist models, real business cycle models, Austrian models, MMT models, and many variations within each category. Flynn and Sastryx use an RBC framework in their article. Because my view is that this framework is not very useful for understanding business cycles, from the outside this whole line of analysis seems a little off target. And this skepticism doesn’t just apply to RBC models, in my view. any of them The non-market monetarist model does not meet the essentials. They all seem to be trying to explain something that has already been adequately explained. They do not address the anomalies in the model in which Fed errors lead to NGDP and create cycles due to sticky wages; they usually work with a completely different framework.

That’s why for a grumpy old man like me, the macro no longer seems progressive. We don’t fill in the gaps; we continually try to reinvent the wheel.

Once again, it is quite possible that I am disconnected from reality. All I can say is that I no longer read articles and say to myself, “I always wondered why certain macroeconomic variables (M, Y, P, i, U, etc.) showed this pattern, now it makes more sense. » I don’t see any progress.

But hey, in 1890 people didn’t yet see Van Gogh’s genius, so it’s quite possible I’m forgetting something important.

PS. Here is a painting by Kandinsky from 1925. What was left to say?

PP. Here is one of the 247 mathematical equations in the article: