CatLane

Introduction

It’s been over a year since I covered Acme United (NYSE:UCA)so an update is in order since the company has improved quite a bit since my “hold” rating, particularly margins, which I believe have been the drivers of price appreciation. because revenue growth was low. In the article I argued that there are no buy signals for the company yet, but given the following quarters with improvements across the board, the company has exceeded my expectations and has changed my mind, therefore, I am upgrading the company to a purchase. The company has great potential in distributing its products in the NA region, and further margin improvements are on the table.

Briefly about performance

Of the T1 ’24which ended on March 31st In 2024, the company had approximately $2.4 million in cash and equivalents, up from $23.3 million. in long-term debt. For a company the size of ACU, this is a perfectly decent amount of debt, but is it concerning? After all, the amount of debt has decreased significantly compared to the same period last year, when the outstanding debt was around $40 million. It is therefore less worrying than at the time. Additionally, the company’s debts in terms of interest charges are manageable. The company’s interest coverage ratio is over 5x, which is well above what analysts consider healthy, which is 2x. Thus, with a reduction in debt, combined with a decent coverage ratio, the company does not run any risk of insolvency. Now let’s look at how other important metrics progressed throughout ’23.

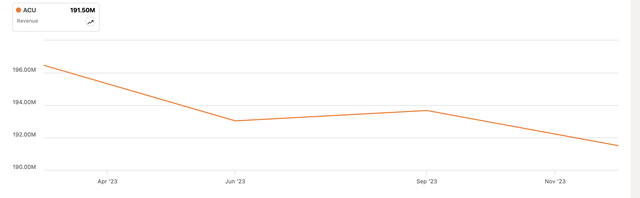

Starting with revenues, we can see that year-over-year, revenues declined by around 1.3%, which is not great in my opinion, given the difficult macroeconomic environment we have experienced throughout of 23, and it’s not better so far in 24. either.

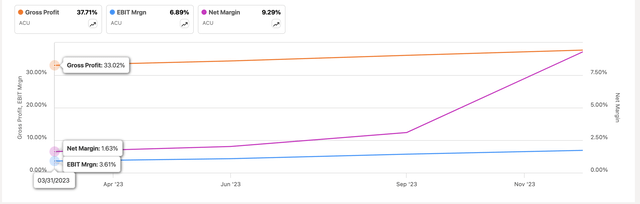

In terms of profitability and efficiency, it looks like 2023 was a decent efficiency year for the company. Margins have generally improved, which is commendable given the macroeconomic challenges. Management has been successful in finding inefficiencies and eliminating them to improve the company’s operations during the most difficult times, and that is admirable.

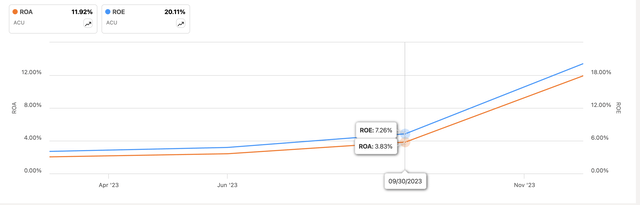

Not surprisingly, the company’s ROA and ROE also saw a considerable increase due to the company’s improved financial results. However, I expect this figure to fall as the company’s financial results were inflated due to the gain on the sale of its business segment, namely its hunting and fishing business, which was sold for around $20 million. So, over the next two quarters, I expect ROA and ROE to decline significantly, to be more in line with Q3 ’23.

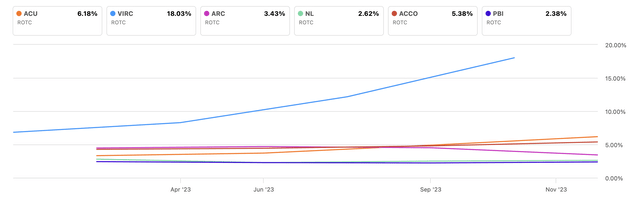

In terms of competitive advantage, the company claims to compete with 3M (MMM)Fiskars (OTCPK:FKRAF), Honeywell (Honesty), and Cintas (ETC), however, all of these competitors are out of the company’s league in terms of size, so I’ll compare its ROTC to the choice made by Seeking Alpha by default. Here we see that ACU is somewhere in the middle in terms of competitive advantage, and well below the first place, which is Virco (VIRC). This tells me the company could do better, but low ROTC is not uncommon at similar sized companies. As I mentioned before, these competitors won’t be perfect for the company, but they will provide an idea of how it compares to companies of similar size.

Overall, we can see that the company has achieved good results in 2023. Even though the company’s revenue has not changed much, I often say that if the company can improve its efficiency and its profitability thanks to the increase in its margins, it will see its value appreciate, even if the growth in turnover is non-existent.

Comments on recent gains

As I write this article, the company released its first quarter results, and there is something the market did not like as the company is currently down over 8%. So, let’s look at the numbers.

Revenue for the quarter was $45 million, a decrease of 1.7% year-over-year. Diluted EPS was $0.39 per share, an increase of 39% year-over-year. The company improved its profitability while improving its operations, thanks to reduced shipping costs and general and administrative expenses. The decrease in revenue was due to the inclusion of the company’s discontinued fishing and hunting products, Camillus and Cuda, which were sold to GSM Holdings on November 23. Excluding these products, the company recorded a slight increase in its turnover of approximately 1% in the United States and 7% in Europe. Gross margins increased significantly year over year, by more than 300 basis points. So it seems the report wasn’t bad in my opinion, so why the liquidation? To be honest, it’s hard to say. After listening to the call for results, I found nothing alarming and management was very happy with the company’s upcoming quarters. So the sale could well be just a simple profit taking, and given that the company is very small and has seen good growth in a year, coupled with a bad day in the markets in general (April 19th ’24), I don’t think the sale was due to anything management said on the call.

Outlook feedback

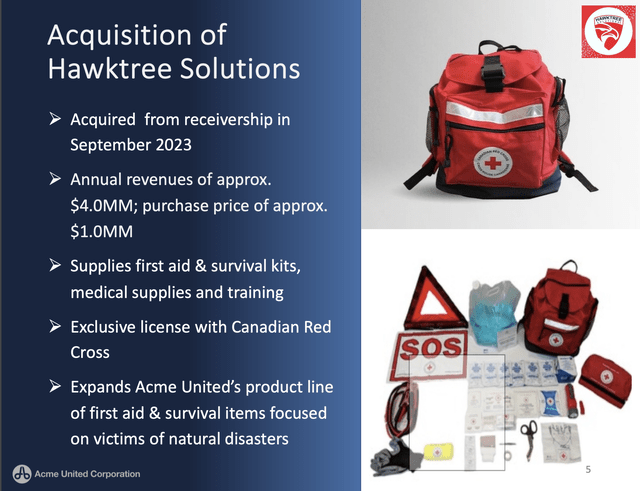

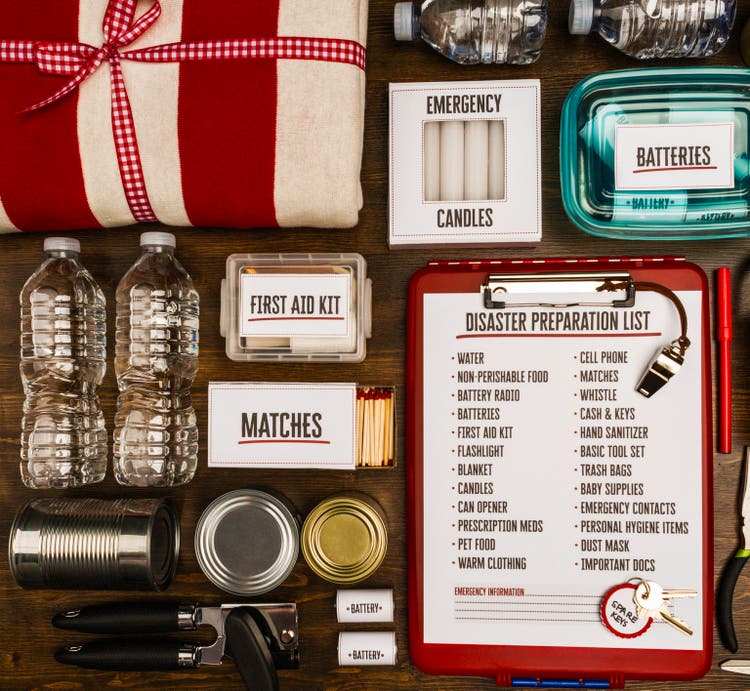

The company recently acquired a first aid company, Hawktree Solutions, in an auction for just $1 million, and the company will already implement it by acquiring an exclusive licensing agreement with the Cross- Canadian red.

Additionally, the company has expanded the presence of most of its product line by entering into agreements with numerous partners in the United States. The company has just started shipping its first aid kits to a major pharmacy in the United States, expanded its presence with a major hardware chain in the United States and Canada and also started shipping its Spill Magic products to a large mass market retailer in the United States. WE.

Other products include Wescott, which ships to another leading mass market retailer, as well as artisan products. Additionally, DMT Sharpeners has now established a new consumer retailer. So it looks like there will be a lot of growth over the next few quarters, which doesn’t seem to be very well received if you look at the price action on the day of the earnings release, which is confusing.

The company is also committed to further improving its margins, and I believe management is more than capable of achieving this in the future.

Assessment

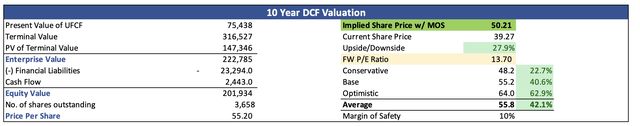

It’s been over a year since I’ve done a DCF model for the company, and I think I was a little too conservative back then, so an update is in order, given how positive management is about the future of the company. However, I’m going to stay on the conservative side, to give myself some margin of safety.

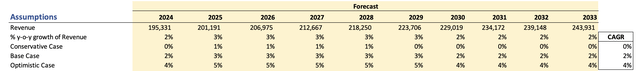

For revenue, no estimates are available from analysts and management doesn’t provide these numbers either, so I’ll have to make some educated guesses for modeling purposes. Now that the fishing and hunting industry is no longer a hindrance and will not depress the company’s revenue, I model rather conservative revenue growth over the next decade, which corresponds to long-term US inflation. aim. In the past, the company has managed to achieve much higher sales, but as I said, I will remain conservative and would like to be surprised by an increase. In addition to my base case, I will also model a more conservative case and a more optimistic case to give me a range of possible outcomes. Below are these estimates and their respective CAGRs.

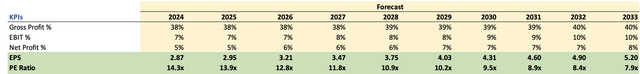

As for margins, I hope that management continues its remarkable efforts to make the company much more profitable and efficient, which will increase its margins over time. However, I will only model a tiny improvement here as well, to ensure its safety. Below are these estimates.

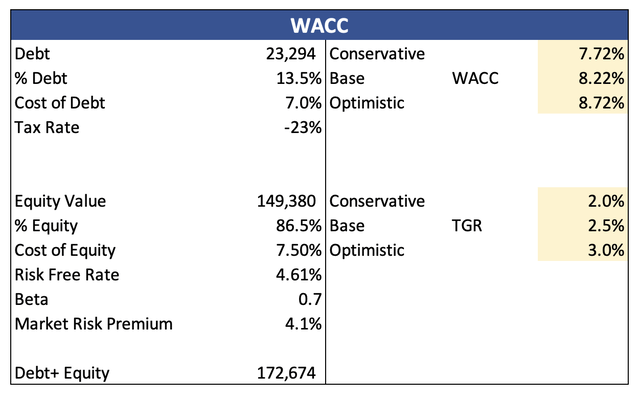

For the DCF model, I was going to go with the company’s WACC of around 7%, however, I decided to add another 1%, which should be an extra margin of safety and give me more headroom error in the calculations above. . Prevention is better than cure and conservatism is what I tend to err on the side of with these assumptions. See WACC calculations below.

Additionally, I’ve settled on a final growth rate of 2.5%, which is close to the U.S. inflation target, and I’d like the company to at least get there as well. To completely drive it home, I add an additional 10% discount to the final intrinsic value calculation for this extra safety cushion. That said, ACU’s intrinsic value is around $50 per share, meaning the company is trading at a decent price relative to its fair value.

Risks

The greatest risks come from the uncertainty of the economies in the United States, Canada and Europe. Inflation still not under control, with the arrival of the most recent CPI data hotter than expected, putting a damper on hopes of seeing the FED lower its interest rates very soon. Negative sentiment will cause most, if not all, companies to fall, especially small caps like ACU.

I emphasized management’s fantastic efforts to improve the company’s profitability, even as revenues decline/stagnate. However, if, due to more difficult macroeconomic conditions, transportation prices rise again and management drops the ball on reducing costs internally. , margins could suffer again, and without revenue growth and improving profitability, my bullish thesis changes.

As the company is a small cap, expect a lot of volatility over the long term, especially during big events like quarterly results. However, if the long thesis is intact, such massive downward swings should be viewed as an opportunity to start a position or add to an existing one.

Closing comments

It seems to me that the company is on track to become more profitable and that its revenue growth should return within a year or two, now that the underperforming segment is gone, allowing management to focus on products that will deliver results.

I view this drop in share price on earnings day as a good entry point for anyone looking at the company and wondering whether to join. Therefore, I am increasing my rating to Buy, as it appears the company has improved significantly since I last covered it. There is decent upside potential, but be cautious due to economic uncertainty.