Bodnarchuk

Based in Canada K92 Mining Inc. (OTCQX:KNTNF) owns and operates the “Kainantu” gold mine in the Asia-Pacific country of Papua New Guinea. The appeal here is an impressive operating track record, including six consecutive years of production growth in what is recognized as an inexpensive, high-quality asset.

The company is on track to complete a major expansion project that is expected to more than double gold production by next year. Indeed, the setup is particularly compelling given that the price of gold is at an all-time high and is a powerful earnings-favorite. We anticipate a big year for the company and expect more upside for K92 Mining shares.

K92 Mining Financial Data Summary

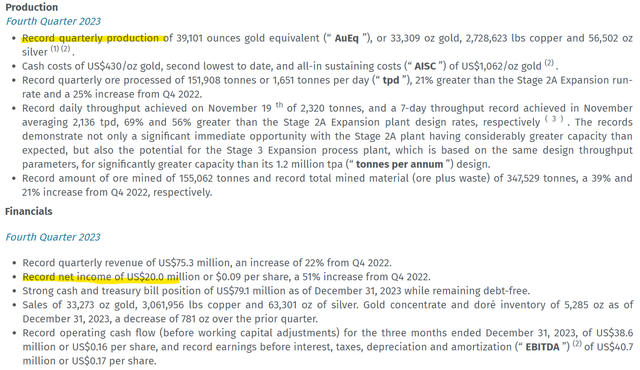

K92 reported his 4th quarter results early April, marked by record quarterly production reaching 39.1,000 gold equivalent ounces (AuEq), up 10% year-on-year, reflecting an increase in plant production “stage 2 ” of the group in-service from May 2023. A 15% higher average realized sales price contributed to total revenue of $75.3 million, up 22% year-on-year.

Cash costs of $430/oz gold decreased 17% year-over-year as part of easing operating costs which were reduced in 2022 by increased fuel and transportation expenses. This momentum helped push net income to $20.0 million, representing an impressive 50% increase from the fourth quarter of 2022.

In 2024, the latest update shows a first quarter production figure of 27.4k AuEQ ounces, up 28% year-on-year. K92 reaffirms its full-year AuEQ production guidance of between 120,000 and 140,000 ounces, a solid 11% year-over-year increase at the midpoint.

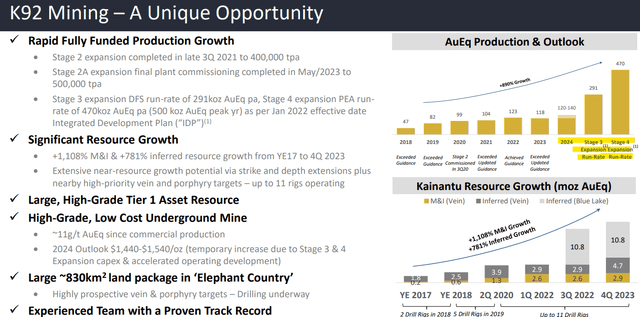

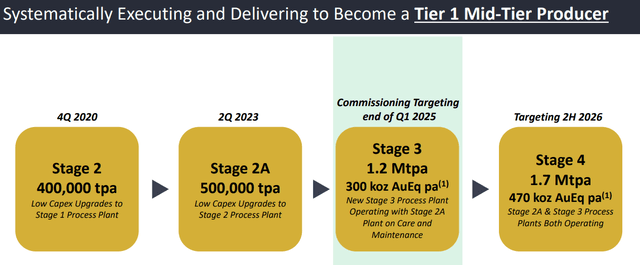

Attention has turned to the “Stage 3” expansion, a new self-contained plant capable of processing 1.2 million tonnes per year. The project should be put into service by the first quarter of 2025 paving the way for an annual production rate of 291,000 AuEq, 124% higher than the 2024 forecast.

Although a high level of CAPEX this year could limit profits in the short term, profitability is expected to increase from 2025 and beyond.

This expansion is expected to be funded by underlying cash flow and strong balance sheetwhich ended the year with $79.1 million in cash against effectively zero debt.

The “Stage 4” expansion project is also on the horizon. In this case, the company plans to reach a total annual AuEQ production capacity of 470,000 by the second half of 2026.

The outlook here is for production growth of almost 300% over the next few years, transforming K92 Mining into a “global mid-tier 1 producer.” Operating costs are also expected to be significantly reduced over the period, taking advantage of greater economies of scale and higher revenues.

What’s next for K92 mining?

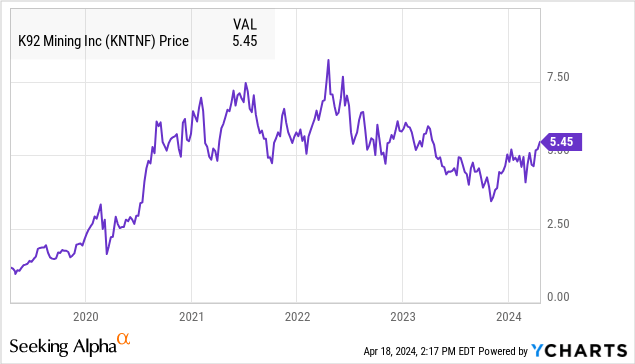

Overall, K92 Mining has a very impressive setup, with the numbers speaking for themselves. It’s fair to say that the company has one of the highest production growth forecasts among its global mining peers, but it also appears that some of the positive aspects of its story are already priced into its valuation.

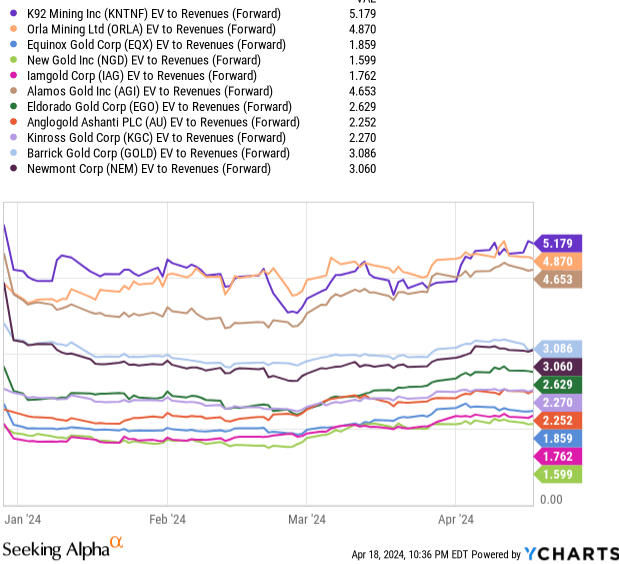

K92 trades at approximately 5x prior year sales, representing a premium to a group of comparable gold mining names. The key here is to recognize that 2024 is somewhat of a transition year towards stronger results through 2026.

If we assume revenues will at least double by 2025 given the expected increase in production, a year-over-year sales multiple closer to 2.5 times would be close to the industry average among names like Newmont Corp. (NEM) or Barrick Gold Corp.GOLD)

yGraphics

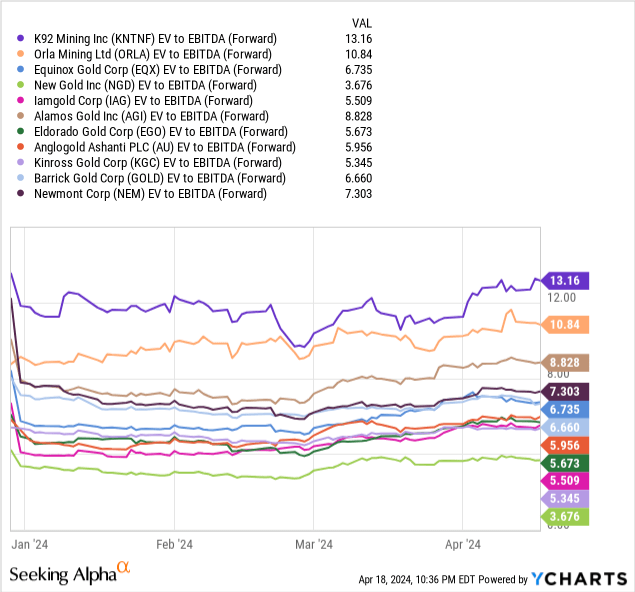

This dynamic is also evident through the forward EV/EBITDA ratio where K92 trades at around 13 times 2024 consensus EBITDA, a level almost double the industry average where stocks like AngloGold Ashanti plc (AU) or Equinox Gold Corp.EQX) trade at a multiple closer to 6x.

The argument we make is that this valuation premium may widen given the company’s growth prospects. The optimistic scenario here is that K92 will meet or exceed its targets and execute its expansion plans, thereby allowing the operation to reach its valuation.

Keep in mind that all of these estimates assume a constant or stable gold price. A scenario in which precious metal prices rise would make stocks even more attractive.

Final Thoughts

We view K92 Mining as a Buy, looking at stocks that are currently trading above $5.50 and nearing a 52-week high after a period of volatility last year. We call for KNTNF’s rally to continue, with 2022 highs above $8.00 per share on the table as an upside target.

Overall, the company is a suitable option for exposure to the upward momentum in the price of gold and the precious metals sector as a whole.

In terms of risks, there are a few important points to consider. Firstly, K92 Mining’s operating jurisdiction in Papua New Guinea is considered a higher risk jurisdiction in terms of the legal system and political stability. Historically, this hasn’t been a problem for the company, but it could increase volatility.

We can also mention the weakness of any mining company whose operations are concentrated on a single asset. This contrasts with large global mining players who have greater diversification. For K92, the risk is that a Force Majeure type event in Kainantu could paralyze the entire company.

Finally, a scenario where the price of gold (XAUUSD:CUR) a prolonged downward correction would likely put pressure on the stock and force a reassessment of earnings potential.

Editor’s Note: This article discusses one or more securities that are not traded on a major U.S. exchange. Please be aware of the risks associated with these actions.