Industrial production continues to increase, while February’s monthly GDP has erased January’s decline.

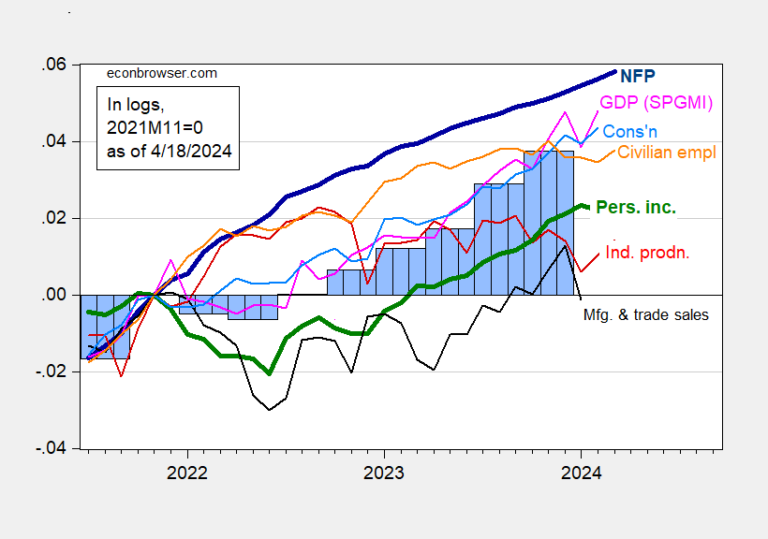

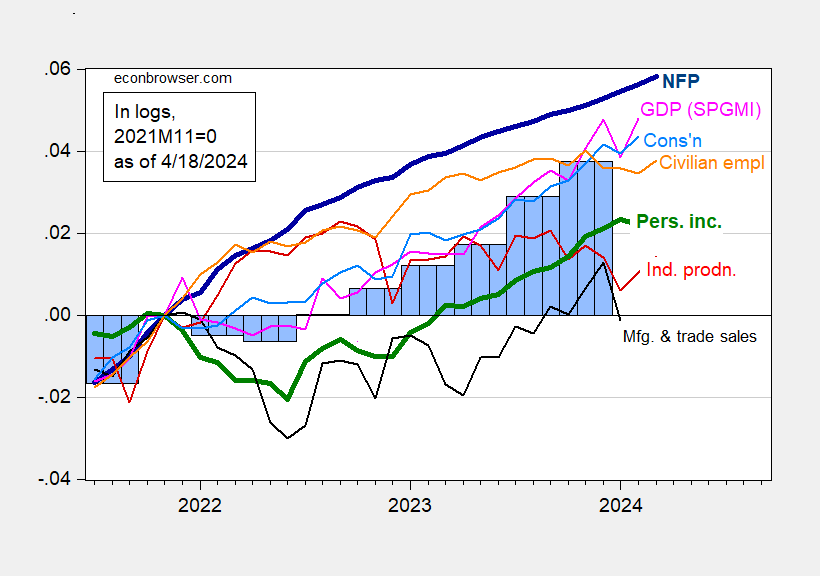

Figure 1: CES non-agricultural salaried employment (bold blue), civilian employment (orange), industrial production (red), personal income excluding current transfers in $Ch.2017 (bold green), manufacturing and commercial sales in $Ch.2017 (black) , consumption in $Ch.2017 (light blue) and monthly GDP in $Ch.2017 (pink), GDP, 3rd version (blue bars), all logarithmic normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2023Q4 3rd version, S&P Global Market Overview (née Macroeconomic Advisors, IHS Markit) (4/1/version 2024) and calculations by the author.

Note that GDPNow as of 4/16 is 2.9% q/q AR, while the Lewis-Mertens-Stock/NY Fed Weekly Economic Indicator stands at 2.01% for the week ending 4/13 . THE Baumiester, Leiva-Leon, Sims Weekly Economic Conditions Index (WECI) is -0.39%, which – if trend growth is 2% – implies growth of 1.61%.