James Brey

MO now yields 9.55%

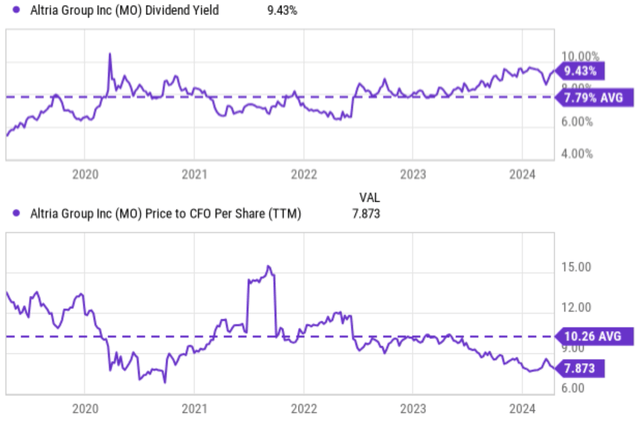

Altria Group (NYSE:MO) is currently significantly undervalued, as the charts below show. The chart shows its dividend yield relative to its historical average and its price-to-cash flow (“CFO”) ratio. compared to its historical average. In terms of dividend yield. Its current yield, as shown in the top panel of the chart, is around 9.43% and 9.55% on a FWD basis as of this writing (BTW, it’s a dividend champ). It is not only well above the historical average (7.79%), but also among the highest levels in a decade. In terms of P/CFO, it trades at just 7.9x, compared to its last 10-year average of 10.2x and also among 10-year lows.

When yield and valuation are so out of balance, our experience has taught us to check whether one of the following two scenarios is likely:

- Dividend distributions are dangerous and a cut is imminent.

- The underlying business is chronically unprofitable and is likely to stagnate permanently.

After considering these questions, we conclude that neither scenario is likely, as we will detail below.

Dividend security

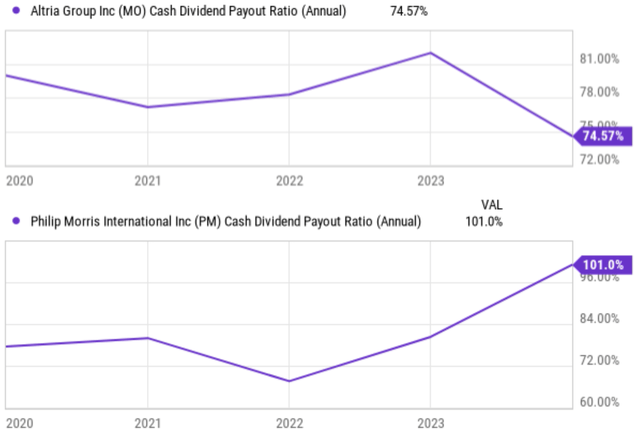

My projection for its cash payout ratio is around 75% for fiscal years 2024 and 2025, among the lowest levels of its historical range, as shown in the chart below. Tobacco stocks can maintain a much higher payout ratio thanks to their excellent profitability (more on that later) and high conversion rate into cash gains. To better contextualize things, an example from Philip Morris (PM) the distribution rate is displayed in the bottom panel.

Another key factor that can impact dividend safety is the financial strength of the company. Distribution ratios do not include this angle. That’s why we always urge dividend investors to look beyond simple payout ratios and take a close look at the balance sheet as well.

For MO, the news is all good in my opinion. Its credit ratings are in the upper-middle end of the investment grade range, with a stable or positive outlook. For example, Fitch Ratings has assigned Altria’s senior unsecured notes a “BBB” rating with a stable outlook, and you can read the full details below. report.

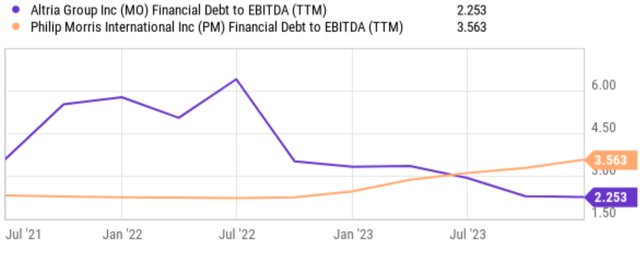

To get a more concrete view of its financial strength, the chart below shows MO’s debt/EBITDA ratio compared to that of PM. As seen, MO’s debt-to-EBITDA ratio has steadily declined from around 6x in July 2021 to only around 2.2x currently. A lower debt-to-EBITDA ratio suggests that a company is less leveraged, has a greater capacity to service its debts and also more flexibility in allocating capital, for example towards dividends and share buybacks – a subject I will return to later. The contrast with PM better highlights MO’s financial situation. The orange line shows that PM’s debt-to-EBITDA ratio has increased over the same period. Currently, PM’s debt-to-EBITDA ratio is around 3.56x, almost 60% higher than MO’s.

Growth prospects

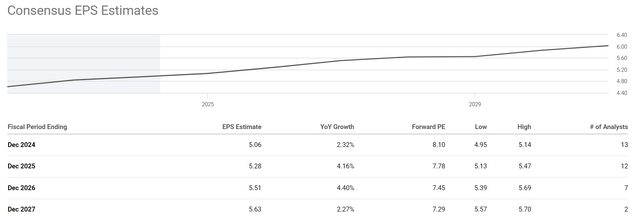

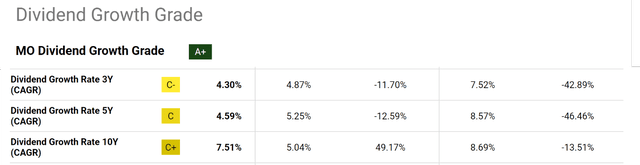

Now let me turn to the question of growth. At its current FWD P/E of 8.1x, my interpretation is that the market expects the stock to stagnate for good. As we have seen, the consensus forecasts an average annual growth rate of around 3% over the next few years, more than enough to keep up with inflation. Such a projection is too conservative, both relative to its historical record and relative to my own estimates. As a dividend champion, its dividend distributions are a reliable indicator of its true economic profits, in my opinion, and those profits. As the second chart below shows, the average dividend growth rate is over 7.5% over the past 10 years and around 4.6% over the past 5 years.

In search of Alpha In search of Alpha

My approach to estimating its long-term growth rate is detailed in our blog post. Here I will directly quote the final result:

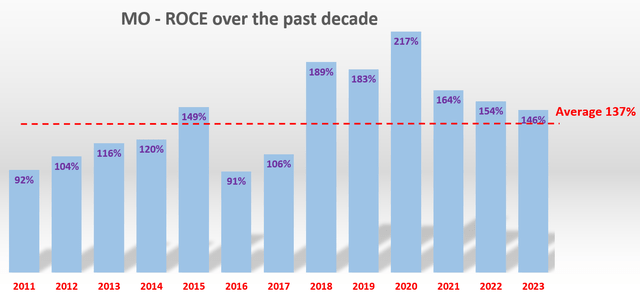

A company’s long-term EPS growth rate is governed by the product of its ROCE (return on capital employed) and its reinvestment rate (“RR”). For MO, its RR is 4% according to my analysis. With an average ROCE of 137% over the past few years (see the following chart below), the long-term EPS growth rate would be around 5.5% (4% RR x 137% ROCE ~ 5.48 % growth).

If you’re used to growth stocks, a 5.5% annual growth rate is certainly nothing to get excited about. But with a P/E in the single digits, a 5.5% annual growth rate could generate tremendous returns over the long term.

And there are indeed some important growth areas in which MO can invest. The main enablers are its oral tobacco and other new products. The Oral Tobacco division has seen strong performance over the past few quarters, with sales up 7% in the December 2023 quarter. To make the news even better, the segment also demonstrated holding power lower prices and promotional investments in recent quarters. Looking ahead, I expect the momentum of the Oral Tobacco Products division to continue. I also think that the company’s subsidiary, the electronic cigarette producer NJOY, has good development potential. Management has recently strengthened NJOY’s global supply chain to support the expected increase in volumes of these e-vaping products – a timely investment in my opinion that will pay dividends for years to come (both figuratively and verbally). literal meaning).

Other risks and final thoughts

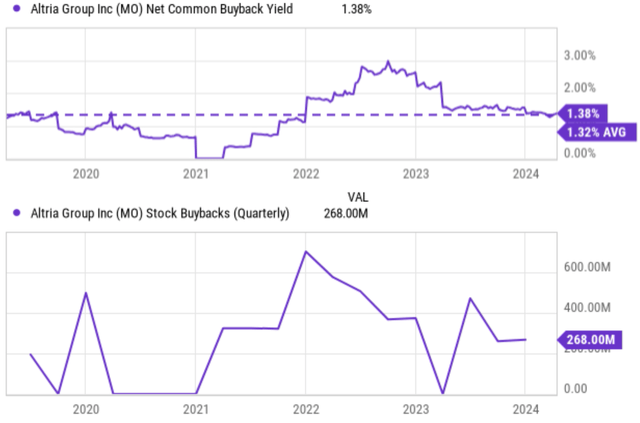

A final upside risk concerns share buybacks. The company has regularly purchased its own shares (see the following chart below). Recently, the board reached an expedited $2.4 billion deal share buyback program. At the same time, the board also announced plans to sell part of its stake in Anheuser-Busch InBev. I expect Altria will also consider using the buyback proceeds for additional share repurchases. I view such an accelerated program as a very efficient use of its capital given the favorable valuation ratios. Such repurchases would further increase EPS growth rates and be highly accretive to total shareholder returns.

In terms of downside risks, MO faces many of the same risks generic to the tobacco sector, such as regulatory risks, decline of smoking products, litigation risks, etc. However, due to the concentration of its products, MO is more dependent on traditional cigarette sales. compared to some peers who are diversifying into nicotine alternative products. Its Smokable Products segment remains by far the largest source of sales and contributed approximately 89% of its sales in 2023. This makes MO more vulnerable to a decline in smoking rates.

In total, MO’s current yield and valuation ratios are among the most attractive levels in a decade. Such extraordinary levels suggest that dividend payouts are unsustainable and/or that the underlying business is likely to become terminally stagnant. With the above analyses, we conclude that neither scenario is likely and therefore consider the stock a good investment opportunity under current conditions.