Justin Paget/DigitalVision via Getty Images

Holmen (OTCPK:HLMMF) (OTCPK: HLMNY) (OTCPK: HLHLY) continues to benefit from stamp shortages while the main exporters, Belarus and Russia, remain excluded from the market (discussed in the last cover). The forest businesses therefore benefit. Otherwise, capacity expansions are coming to generate scale in the power generation sector. Operational improvements have done something for the wood products sector, but recovery will be needed in the construction sector. In the cardboard and paper sector, we have passed a period of downtime which is now leading to additional profit gains, but overall end market demand remains weak. The EV/EBITDA multiple is above 10x, which in this environment means that expectations are still quite high and that a turnaround in industrially challenged businesses and increased capacity are likely already priced in.

Distribution of winnings

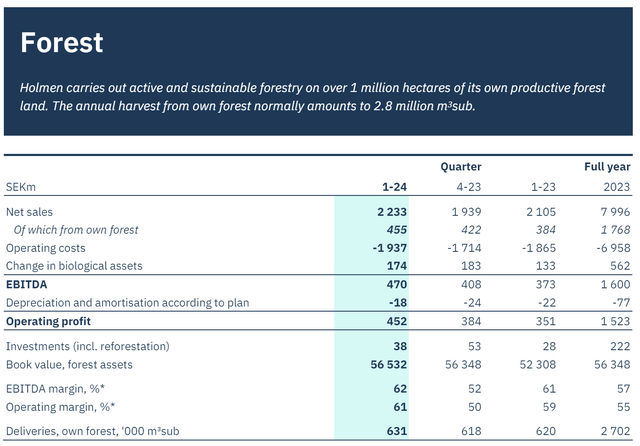

Importation of Belarusian and Russian stamps is not permitted. the European bloc, so there was a big shortage in the Baltic and Nordic markets. SO, prices stamp continue to increase. Even though there are many forests to be felled sustainably, the problem is operational: no one is prepared to meet the demand gap. EBITDA increases in this segment year-on-year.

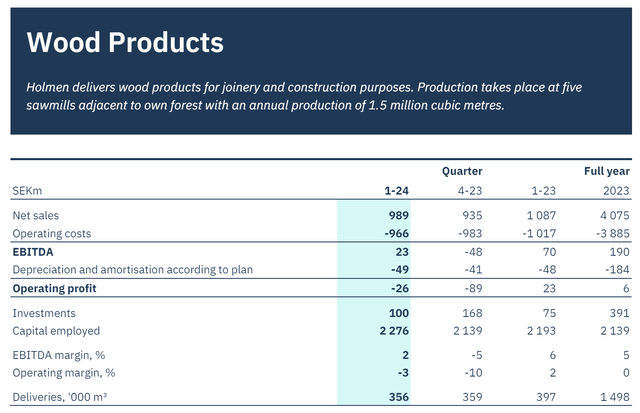

The wood products sector is closely linked to local real estate markets and construction activity. Until recently, property prices were under strong pressure in Sweden. Inflation remains quite highbut the general weakness of the Swedish economy is cause rate cuts. Inflation rates are experiencing significant monthly declines. Rate cuts are more a reflection of weakness in housing markets, which impact household wealth, than a catalyst to reverse housing market trends. The Swedish real estate market had already experienced a certain peak before the war in Ukraine. Overall, this dynamic that European markets have more room to cut rates than the United States reflects ongoing pressures on European economies, which have suffered more and benefited less from the realignment of supply chains. supply.

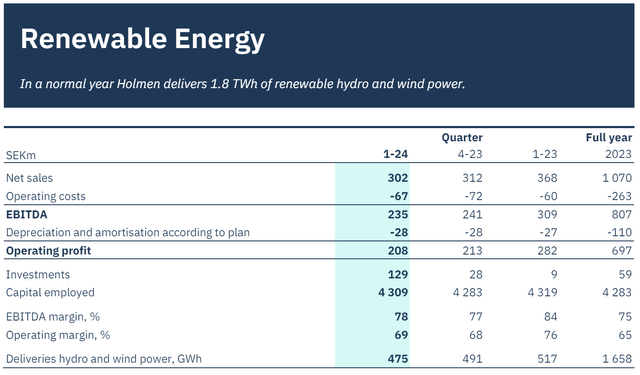

Holmen is also active in the renewable energy generation sector, including hydropower and wind power. They also have nuclear capability. The big expansions are coming at the Blisterliden wind farm, which is expected to increase overall production by around 20%. Electricity prices have of course fallen since the disruption caused by the war in Ukraine last year. But the increase in production should see a notable improvement, especially as electricity price it seems that some have hit rock bottom, but not all markets.

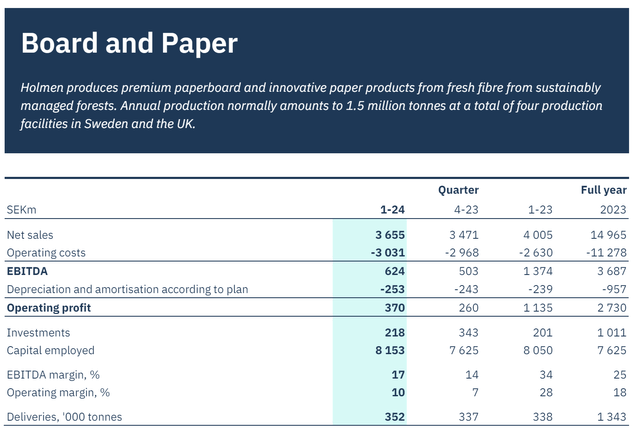

Pulp and paper has now benefited from a resumption of production, where it has carried out planned shutdowns and maintenance work, and a general reopening, with some paper grades seeing some recovery, particularly paper from desk. Gradually, paper has experienced some declines, but at least the destocking of cardboard boxes is complete, which allows prices to recover. Demand remains low, but it is no longer decreasing. Prices are falling because energy inputs are declining, but margins continue to decline. Some permanent capacity reductions have started, which will cause paper prices to fall. But the situation is not particularly good for European producers. There could be further margin declines, as we are still far from long-term levels, which were significantly lower due to long-term low energy prices. Energy prices are now higher, so current price levels are likely closer to the bottom. The problem is demand, which could continue to fall if recessionary pressures increase.

Cardboard and paper (Q1 Press)

Conclusion

A decent composition is SCA (OTCPK: GALE). We think we can be conservative and annualize the current numbers. We don’t have high hopes for the economy and expect incremental improvements to be limited in most businesses. We want to add the effects of a 20% increase in production in the renewable energy sector, but that won’t come online until 2026. On a relative basis, if you annualize Holmen’s numbers, you get something something quite similar to the multiples passed to SCA, so there really isn’t a case of relative value at around 14x EV/EBITDA. The problem is this: we don’t like anything above 10x EV/EBITDA, especially if there are no clear positives. The forestry sector is doing well, but other segments are still under significant pressure. An access card.

Editor’s Note: This article discusses one or more securities that are not traded on a major U.S. exchange. Please be aware of the risks associated with these actions.