Monty Rakusen/DigitalVision via Getty Images

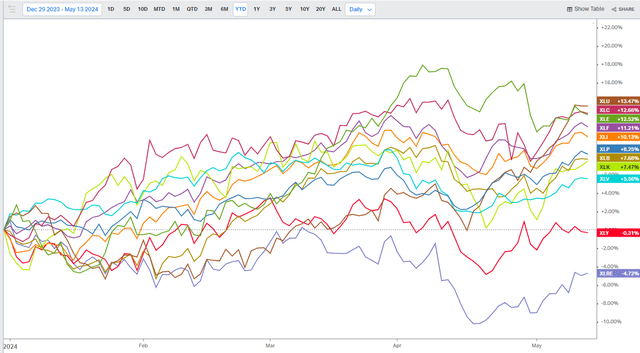

So far this year, these are two markets in the oil and gas sector. While WTI has recently oscillated between the upper $70s and lower $80s, Henry Hub natural gas has rallied, crossing the psychologically important $2 mark. All the while broad-based stock market gains in 2024 have been marked by some relative strength in energy sector stocks. This comes as the energy sector posts a very high free cash flow yield and a still attractive price-to-earnings ratio, not to mention massive share buybacks from major players in the niche.

I to reiterate a buy rating on Devon Energy (NYSE:DVN). Following an EPS beat reported earlier this month and with a increased production prospectsDVN’s momentum has weakened in the short term, but the chart looks better in the long term.

The energy sector is among the top S&Ps 500 zones in 2024

According to Bank of America Global Research, DVN is an independent energy company that explores, develops and produces oil, natural gas and natural gas liquids in the United States. It is a large-cap diversified American exploration and production company. The Company’s asset base is distributed throughout continental North America and includes exposure to the Delaware, STACK, Eagle Ford, Powder River Basin and Bakken regions. At the end of 2023, net production was approximately 658,000 boe/d, of which oil and natural gas liquids accounted for approximately three-quarters of production, with the remainder being natural gas, according to Morningstar .

Back at the beginning of May, Devon reported a decent set of quarterly results. T1 non-GAAP EPS of $1.16 beat Wall Street consensus forecasts by a nickel, while revenue of $3.6 billion, down 6% from last year’s levels, was roughly in line. The stock was little changed in the session following the earnings announcement, but that was better than the trend of very bad reactions to earnings reports. Implied volatility has now fallen to just 21%, according to data from Option Research & Technology Services (ORATS).

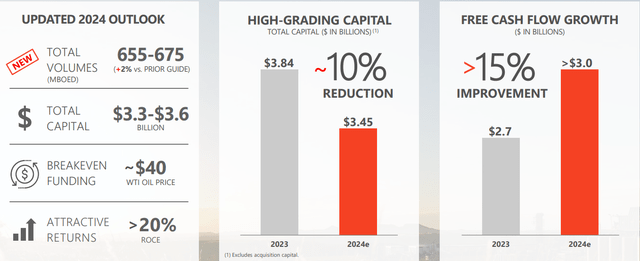

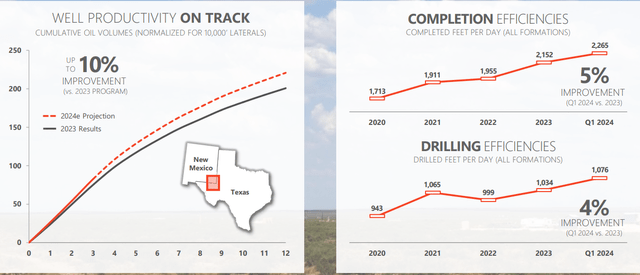

But digging into the first quarter release, there was some optimism. The management team raised its production guidance for fiscal 2024 by 2%, to a range of 655,000 to 675,000 boe/d without requiring additional investments. The upbeat outlook follows healthy production in the Delaware Basin, which accounts for around two-thirds of Devon’s output and, according to Morningstar, is among the cheapest sources of oil in the country. And with improved drilling efficiency and well productivity, higher production can be achieved without requiring additional financing. This leaves room for other shareholder-friendly activities.

Production outlook in 2024

Delaware Basin – Advancing Operational Efficiency

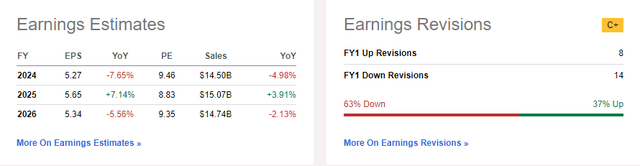

On assessmentcurrent Seeking Alpha consensus forecasts predict a Fall of PSE this year, but then a recovery of comparable magnitude over the past year. Earnings per share are then expected to fall to just $5.34 by 2026. There have also been several EPS downgrades over the past 90 days, which is not an encouraging sign.

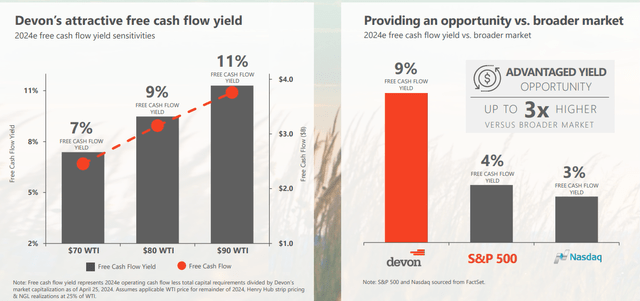

Nonetheless, DVN has a trailing 12-month free cash flow yield of almost 9%, while its dividend yield is 1.7%. The company says it is targeting a 70% cash return to shareholders in 2024 and is prioritizing its $3.0 billion share repurchase program. As for the balance sheet, Devon’s management team says it is focused on paying down debt and increasing cash balances.

EPS seen in $5-$6 range through 2026

Significant generation of free cash flow

If we assume a normalized EPS of $5.50 and apply the stock’s 5-year average of 10.8, then shares should be trading near $59. While this is a lower valuation than the company’s last valuation at the end of 2023, it still leaves plenty of room for upside.

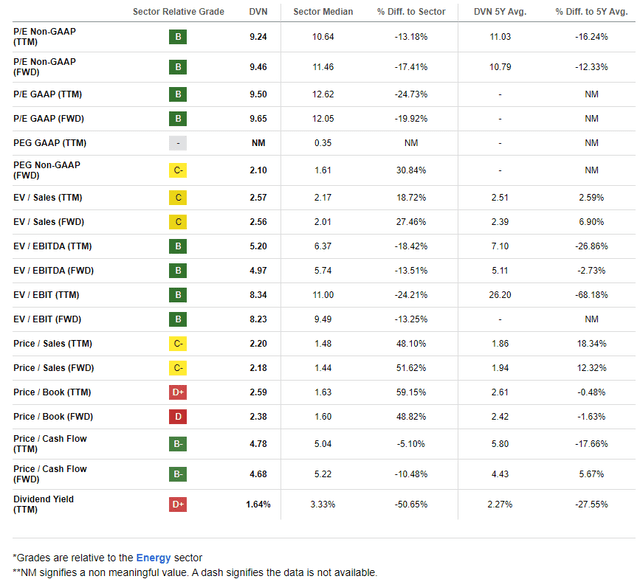

DVN: still a compelling value story

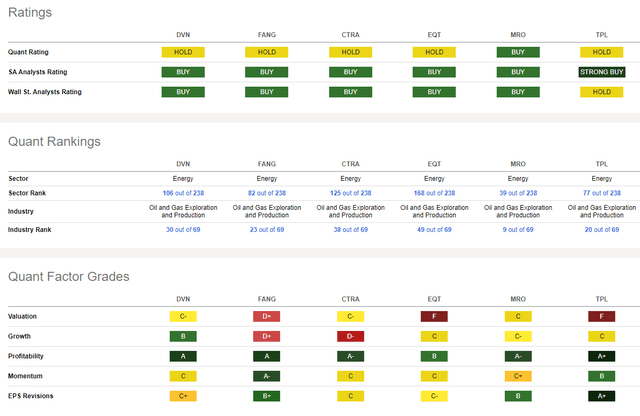

Compared to its peers, Devon has a low valuation rating, but its growth trajectory is healthy. What else, profitability trends are very strong. But after two lackluster years of price action, DVN is by no means a moose stock, even after the notable rally from $40 to $55 between February and early April.

Competition analysis

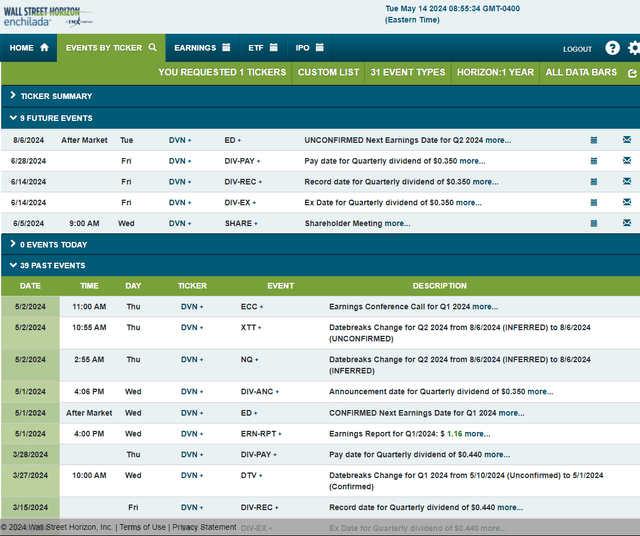

Looking ahead, corporate events data provided by Wall Street Horizon shows an unconfirmed Q2 2024 earnings date of Tuesday, August 6 AMC. Before then, the company will hold its annual shareholder meeting on Wednesday, June 5, which could also lead to some volatility in stock prices. DVN trades ex $0.35 dividend on June 14.

Corporate Event Risk Calendar

The technical take

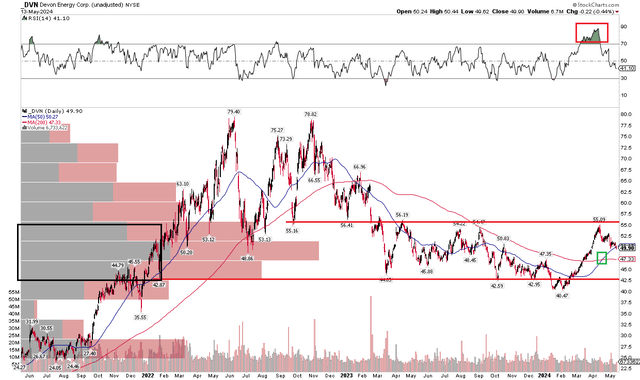

With a mixed fundamental situation, marked by uncertain earnings prospects but accretive moves for shareholders, DVN’s chart has seen some improvement. Note in the chart below that a false bullish breakout took place below the $42 mark. The stock then reached resistance in the mid-50s as the RSI momentum oscillator expanded into extreme overbought conditions.

Also take a look at the short-term 50-day moving average and the long-term 200-day moving average. A bullish golden cross pattern occurred, in which the 50dma moved above the 200dma. Additionally, the 200JMA has moved from a negative slope to a flat slope, suggesting that the bears have lost some control over the main trend. Nonetheless, $55 remains important resistance and a key test for the bulls.

Overall, the chart has trended towards a range after an extended downtrend from the June 2022 all-time high.

DVN: false bullish breakout leads to resistance test, flat 200dMA

The essential

I reiterate a buy rating on Devon Energy. I view the shares as undervalued, but with mixed earnings expectations. However, DVN’s momentum has generally improved, perhaps creating a bullish base and higher prices going forward.