phototechno

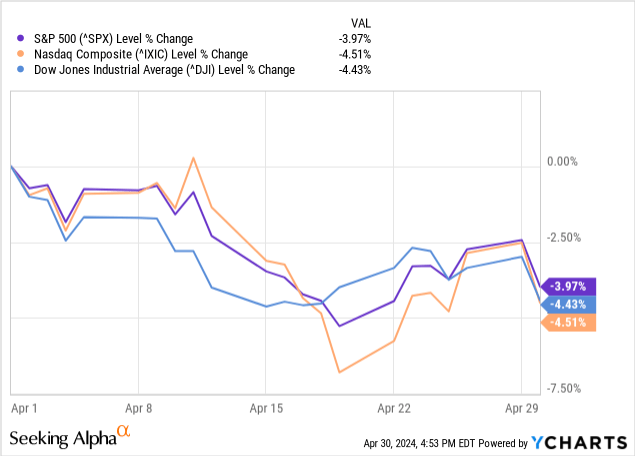

Another month, another round of additions to my closed-end fund portfolio to increase my monthly cash flow. That said, April was a more interesting month as the stock market as a whole finally suffered a slight pullback and overall volatility increased. HAS by one point, the S&P 500 index was down just over 5% during the month. This is the first decline in about six months, dating back to the correction level the market reached last October.

The last trading day of April also saw a sharp decline ahead of the FOMC meeting, which could indicate we’re not in the clear yet.

Y Charts

This ended up being short-lived and we are now running into new all-time highs in the broader indices.

With that, there was seemingly just enough volatility to upset some reductions in the CEF space and make them more attractive. While I still lean toward a higher weighting of cash, this has provided additional opportunities to use that cash over the past month compared to the previous month. In total, I added five different names this month, but all of them previously held positions.

Nuveen AMT-Free Municipal Value Fund (NUW)

I started this month by adding to my NUW post. In addition to purchasing the Western Asset Investment Grade Income Fund (PAI) consistently over the past year, I have purchased NUW due to its attractive valuation, lack of leverage, and higher quality allocations to fixed income.

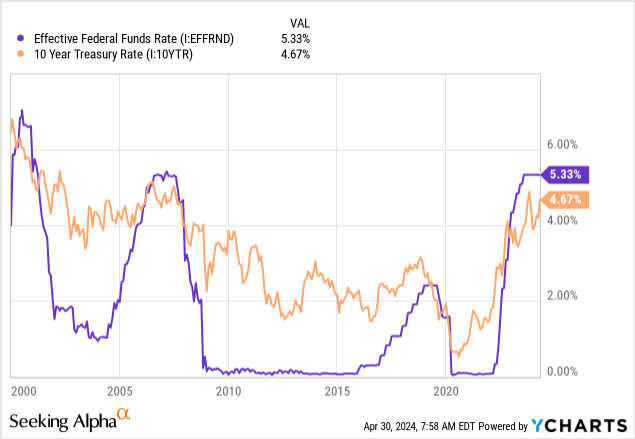

These will be more interest rate sensitive investments, meaning that risk-free returns will actually determine how their prices move. We see a “higher for longer” scenario as inflation remains persistent. At the same time, the Fed is not expected to raise its target rate further in the near term, this is subject to change based on upcoming data. If this can be an indication of how long-term risk-free rates are moving, which they tend to do very generally, but with more volatility, most of the damage should be done.

Y Charts

If that ends up being the case and most of the damage is there, then I’ll be happy to collect relatively safe income and overall de-risk my portfolio with these names. In general, I hold significant exposure to highly leveraged CEFs, primarily invested in below investment grade equities or fixed income securities. The main play in this area is to accept a lower return for less risk, but some potential appreciation in the future if rates fall.

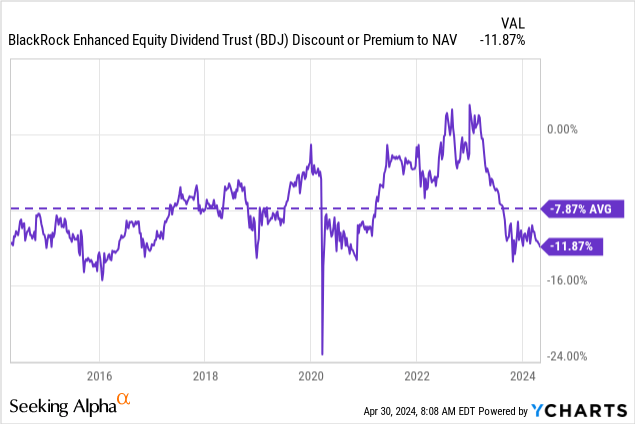

BlackRock Enhanced Equity Dividend Fund (BDJ)

BDJ is a fund that I cover regularly and that I have had made just in March for a very recent update. It is also one of the largest positions in my CEF portfolio. The fund focuses on a value-oriented portfolio as it benchmarks against the Russell 1000 Value Index while also employing a covered call strategy. This is where the other benchmark, the MSCI USA Value Call Overwritten Index, comes in.

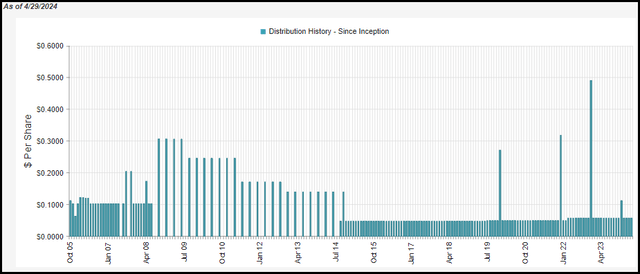

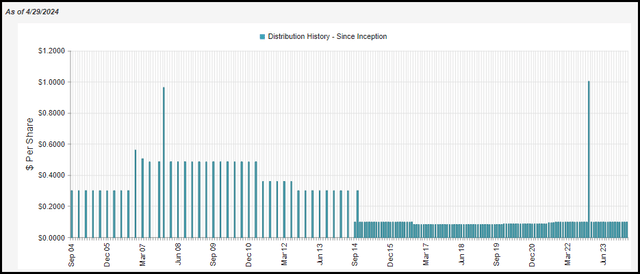

Outside of the global financial crisis, the fund has provided investors with a fairly regular and predictable monthly distribution.

BDJ distribution history (CEFConnect)

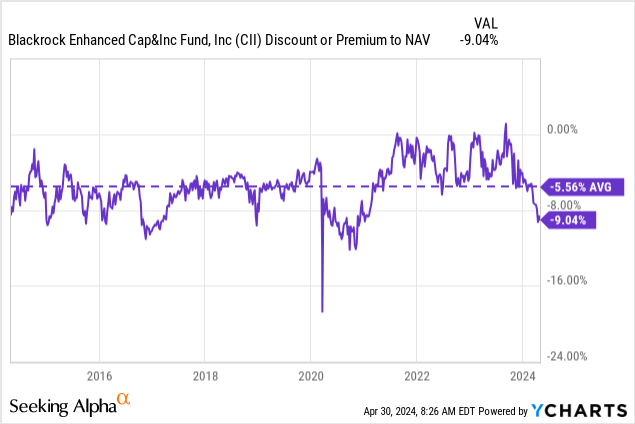

With a current distribution rate of 8.41%, while the fund’s net asset value rate is 7.37%, the significant difference here is due to the fund’s discount. This discount has expanded significantly over the past year. This is precisely why I once again added to my position in BDJ, as it trades at this attractive valuation. It is trading below its long-term average discount of around 8%.

Y Charts

XAI Octagon Alternative and Variable Rate Income Trust (XFLT)

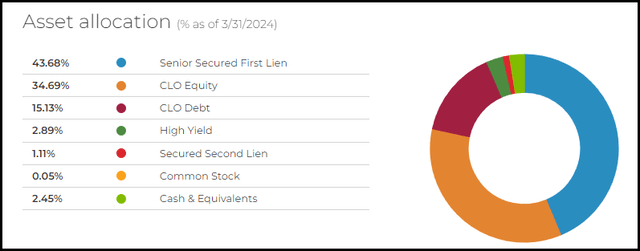

Speaking above, when discussing NUW on investing in significant allocations of CEFs focused on sub-investment grade securities while also using leverage, we find XFLT. The fund invests primarily in senior loans and CLOs, both in equity and debt tranches, with rather negligible exposure to other asset classes.

XFLT portfolio breakdown (XA Investments)

This is a perfect example of higher risk but potentially significantly higher reward. XFLT yields around 14.50% and earns its income from the income generated on its portfolio, as highlighted in a recent update. However, with defaults increasing and leverage around 40%, this could cause problems in the future if the economy turns sour.

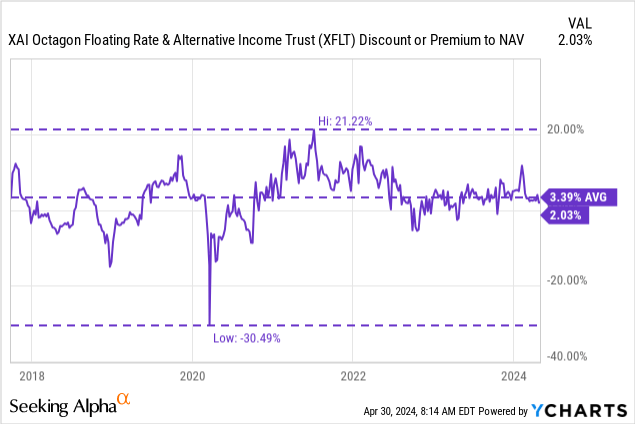

For the moment, navigation has gone rather well and the valuation is not too rich. The fund trades at a premium, but that tends to happen with XFLT, which is likely why shareholders recently voted to allow XFLT to remove its term structure and convert it to a perpetual fund. Based on the average premium over the life of the fund, we are currently at around this level.

Y Charts

BlackRock Health Sciences Trust (BME)

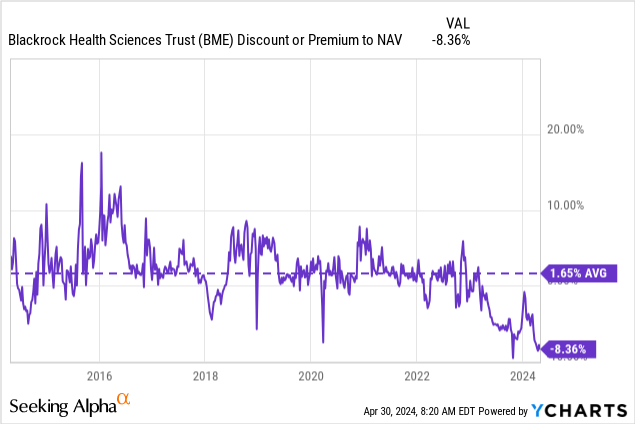

This is a fund whose volatility has apparently caused the valuation of this fund to fall. Historically, the fund very rarely trades at a discount over most of the last decade, but over the past year the fund has experienced significant discounts. Once again, it reaches a significant level, as we have highlighted earlier in the month. The discount has narrowed somewhat since then, but still remains at an attractive valuation, in my opinion.

Over the past decade, BME has generally traded at a premium, on average. This doesn’t mean it’s guaranteed to return to this level, but it does tend to suggest that the decline may be more limited in terms of widening from here on.

Y Charts

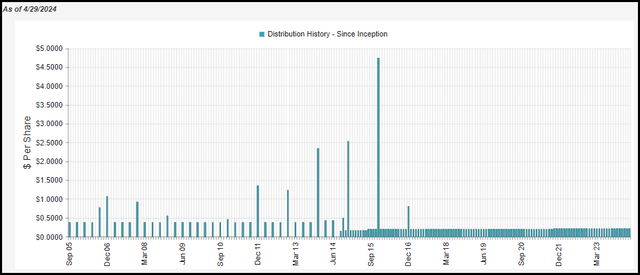

Similar to BDJ and CII (which I discuss next), the fund uses a covered call strategy. In this case, BME, as the name suggests, focuses specifically on healthcare exposure. Given the generally stable nature of the healthcare sector, this has allowed BME to offer a generally stable distribution to investors.

In fact, the fund never reduced its regular distribution to investors, even though it had come to market before the GFC. Only a handful of other CEFs can boast the same feat.

BME distribution history (CEFConnect)

BlackRock Enhanced Capital & Income Fund (CII)

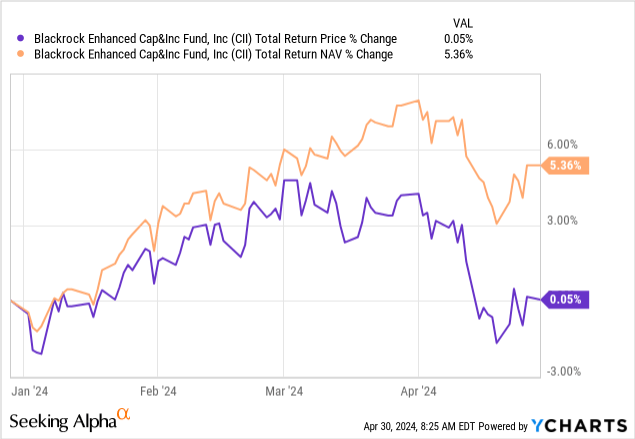

CII is another fund in the BlackRock suite that has also opted for a substantial out-of-character discount based on its historical trading levels. It’s also not that the fund’s portfolio is performing terribly.

Y Charts

Year to date, the fund’s portfolio, as measured by total fund net asset value returns, is up 5.36%. At the same time, total share price returns are stable, hence the fund recently opted for a deeper discount.

Y Charts

CII uses a covered call strategy, which may limit some upside potential in rapidly appreciating markets. However, for the most part, CII is invested in a portfolio that primarily reflects the broader market as a complementary fund to BDJ, but which focuses on the Russell 1000 index. It also offers a higher relative return than that of the market as a whole, thanks to the distribution of capital gains from its underlying portfolio and those generated by covered call options.

History of distribution of CII (CEFConnect)

As the fund is moving towards a significant discount, the distribution rate is 6.41%, but the net asset value rate is 5.83%. This may not be that high compared to some other CEF peers that target distribution levels around 10%, but it does allow for a few things to note.

Either the fund will experience some appreciation or, at the very least, it should stay above its initial net asset value for reasonable periods of time, which some investors like. Indeed, the fund, in my opinion, has a good chance of collecting its dividends for investors. Alternatively, the fund could consider seeing its distribution increase from now on, which could attract more interest from investors and see its discount narrow.

Another factor to consider is that with a lower relative yield than some other equity CEFs, it is in a position where it has a greater margin of safety in the event of a downside. Even if a market correction occurs, this could lead to the fund maintaining its distribution for a longer period or avoiding cuts altogether while others might cut them because they are already at the higher end of the distribution. range of distribution rates.