Drive Bruce Hall The desires of any discussion on the impact of trade policies include presentations of the progress of the manufacturing sector, over as long a period as possible. Here, without further ado, is what I was able to quickly gather.

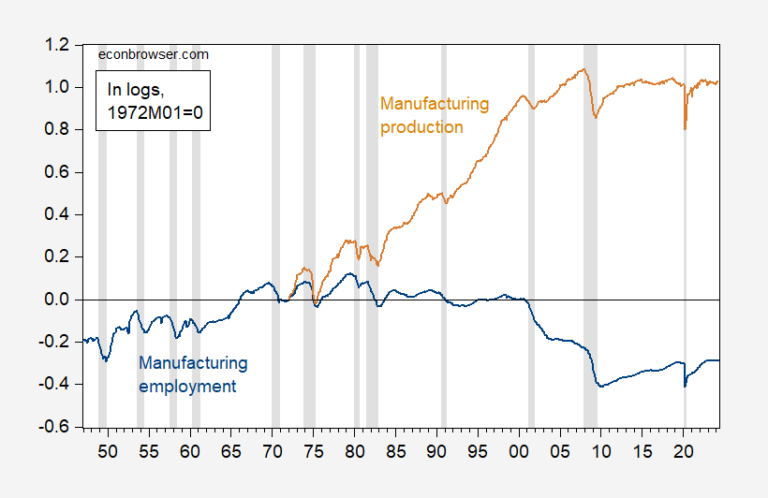

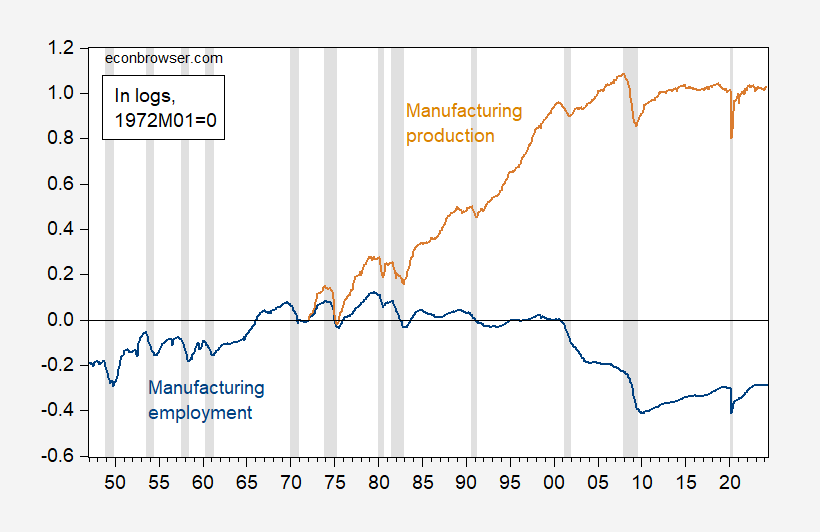

Figure 1: Manufacturing employment (blue) and manufacturing production (tan), both seasonally adjusted, in log, 1972M01=0. The NBER has defined the peak to trough dates of the recession in gray. Source: BLS, Federal Reserve via FRED, NBER and author’s calculations.

and for a shorter duration:

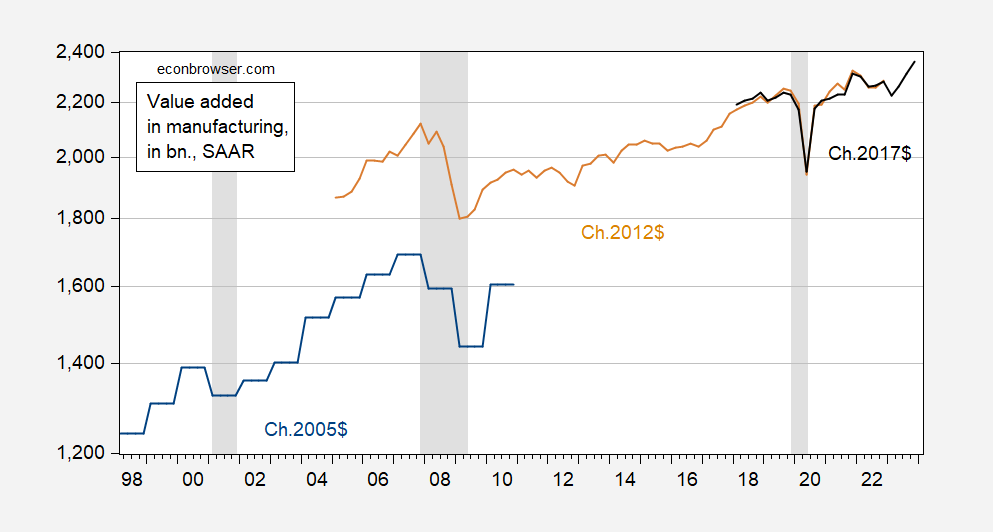

Figure 2: Added value in billions. Ch.2005$ (blue), in billions.Ch.2012$ (tan), in billions. Ch.2017$ (missing), all SAAR. The NBER has defined the peak to trough dates of the recession in gray. Source: BEA via FRED, NBER and author’s calculations.

While total manufacturing employment is just above pre-trade war levels and (gross) manufacturing output is about equal, real value added is much higher. And the added value is much higher than it was when China joined the WTO.

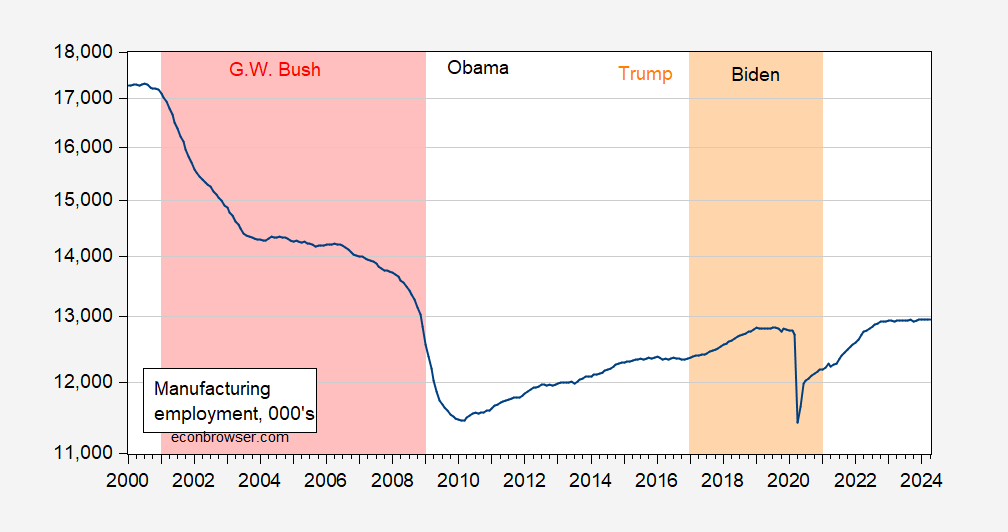

Addendum: When did significant job reductions take place:

Figure 3: Employment in the manufacturing sector, in thousands, sa (blue). Source: BLS via FRED.