What you should know:

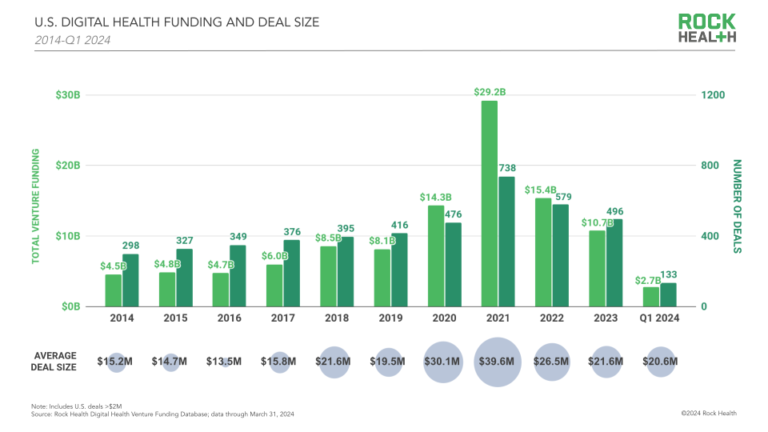

– Q1 2024 Digital health U.S. funding reached $2.7 billion across 133 deals, with an average deal size of $20.6 million, according to Rock Health First Quarter 2024 Digital Health Financing Report.

– The report reveals that the digital health financing landscape underwent a significant shift in the first quarter of 2024, marking a transition from a period of rapid growth to a more measured environment focused on long-term sustainability. This signals a shift toward smaller check sizes, indicating a more cautious approach by investors and a focus on companies demonstrating concrete value before securing larger investments.

Creative financing and label-free tours

The trend toward creative financing measures seen in 2023 continues in 2024. Unlabeled financing rounds, which provide companies with capital without a specific funding stage designation, remain popular, accounting for 48% of deals in the first quarter. Additionally, companies are exploring alternative financing options such as credit facilities with potential conversion to equity, such as DecisionRx’s $100 million deal with Carlyle.

Significant investments in AI

Artificial Intelligence (AI) continues to be a hotbed of investment, with 40% of Q1 funding ($1.1 billion) going to AI-based companies. This increase is fueled by successful fundraising led by companies like Abridge (Series C – $150 million) and Zephyr AI (Series A – $111 million). The growth of AI in healthcare applications such as clinical decision support and precision medicine is attracting significant investor interest.

Focus on real-world results

A crucial change in 2024 is an increased emphasis on demonstrable results. Investors are demanding evidence that digital health solutions deliver measurable improvements in patient care. This trend highlights the need for standardized methods to measure and report results, especially as solutions tackle complex conditions with diverse patient populations. Companies like Codametrix ($40 million) stand out for their commitment to evidence-based research.

Public Market Shakeup, Delisting, and Reset Expectations

The pool of publicly traded digital health companies is shrinking. The first quarter of 2024 saw three delistings, following nine in 2022. This brings the total to 43, a significant drop from 2021’s peak of 54. The public digital health market is undergoing a significant transformation. Delistings from companies like Science 37 and Better Therapeutics have reduced the publicly traded cohort from its 2021 peak.

This change recalibrates expectations for startups aiming for an IPO exit. Companies like Veradigm delisting from Nasdaq while simultaneously acquiring another company illustrate the changing landscape. Delistings also impact private company valuations. The performance of public markets influences investors’ expectations for future returns, leading to a potential decline in startup valuations. Publicly traded companies with strong financial performance, such as margin management and revenue visibility, set a new benchmark for success.

Navigating the new normal

- Preparing for public outings: Companies aiming for an IPO or public exit must adapt. Realistic expectations regarding exit strategies and valuations are crucial. Some may even explore dual-track processes, considering both IPO and M&A options.

- Moving from growth to sustainability: Financial planning and forecasting must become more conservative, similar to that of publicly traded companies. This shift from growth-focused projections to market-aligned guidance prepares companies for long-term success, regardless of their exit strategy (IPO or private sale).

The road ahead: adapt and innovate

The digital health industry is entering a new era characterized by increased oversight, a focus on outcomes and the need for sustainable business models. This challenging environment also presents opportunities for businesses able to adapt and innovate. Building a culture of data-driven decision-making, prioritizing outcome measurement, and exploring alternative funding options will be crucial to success.

“Innovating in healthcare is hard, but it may be your gap”

– Halle Tecco, startup founder and investor, founder of Rock Health