tadamichi

What is driving this stock market collapse that is not supported by extraordinarily strong fiscal flows and goes against usual seasonal patterns?

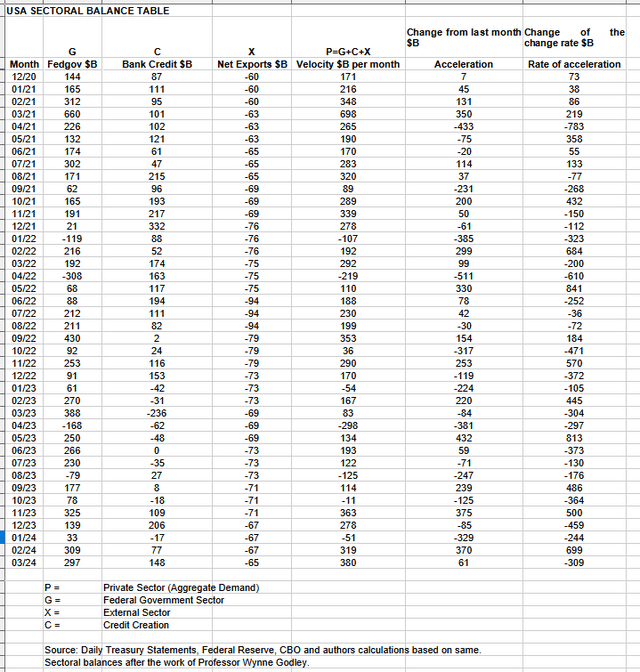

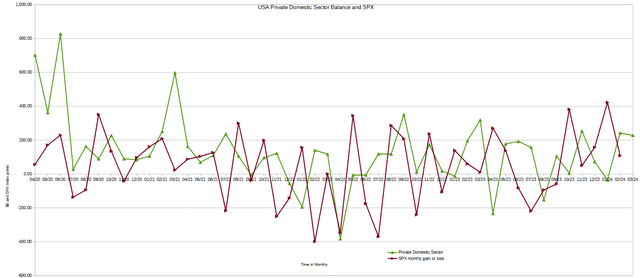

The table below shows US sectoral balances up to the last month. The information is prepared from the U.S. National Accounts.

U.S. Treasury and author calculations

In March 2024, the private sector recorded a surplus of $380 billion, a very positive outcome for asset markets as private sector financial balances increased and led to growth in overall demand for goods. , services and investment assets.

From the table, we can see that the $380 billion surplus in private sector funds came from a $297 billion cash injection by the federal government (and this includes the new capital injection channel). the Fed about $8 billion from interest on reserves that went directly into reserves). the banking sector), minus the -$65 billion that flowed from the domestic private sector into foreign bank accounts at the Fed (the foreign sector X) in exchange for imported goods and services. Bank credit creation added $148 billion, more than double last month’s rate.

The numbers for the last six months or so are nothing special compared to the 2020 COVID-related emergency spending shown at the start of the table and where a strong stock market rally took place. Fiscal flows alone cannot explain the sudden and lasting collapse of the American stock market.

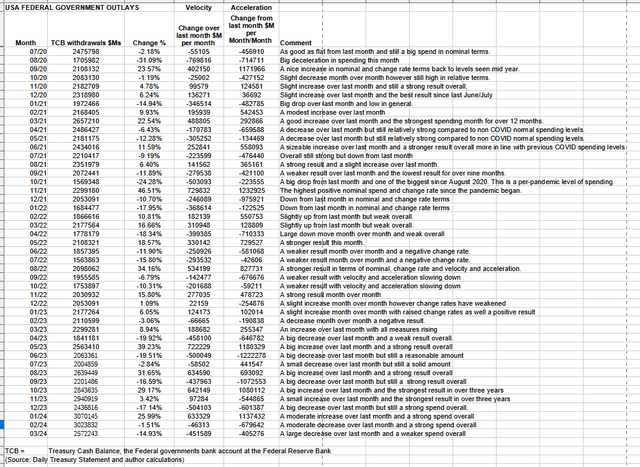

The chart below shows how much money the federal government withdrew from its bank account at the Federal Reserve. When the government spends money, it gives more money to the private sector and helps the stock market rise.

U.S. Treasury and author calculations

The table shows that total spending was down almost half a trillion from the previous month and on the order of $2.5 billion. This month, federal taxes, fees, charges and obligations allowed $297 billion of that spending to remain in the private sector and form the federal deficit that matches the private sector surplus dollar for dollar. When the current account deficit is deducted from this result, the domestic private sector balance amounts to $228 billion. In terms of purchasing power, it gets even better when you add the $148 billion in bank credit creation.

While this is a strong result, it is not strong enough to explain the stock market’s strength over the past six months.

The chart below shows how the rise and fall of the US private-domestic balance tends to dominate the SPX.

U.S. Treasury and Author Calculations and SPX

Last month, the advance of the balance of the domestic private sector over the (SPX) predicted that the (SPX) would end March higher than it started and that actually happened.

This month, the chart projects the same outcome for April given continued strength in domestic private sector fiscal flows. So far this has been the case and it is likely to continue.

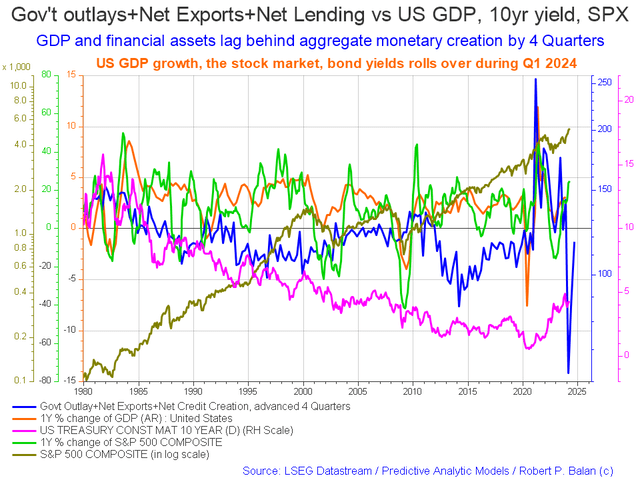

The chart below shows how the information in the U.S. sectoral balances table changes over time, taking into account possible lags in the impact of these changes. It’s like a tool that helps us see from afar what’s happening in the market.

The blue line represents money spent by the government and credit created by banks, minus the checking account balance. It can predict economic changes up to four quarters in advance.

The change from last month is that the SPX rose, as did GDP and bond yields. The main blue line continues to rise.

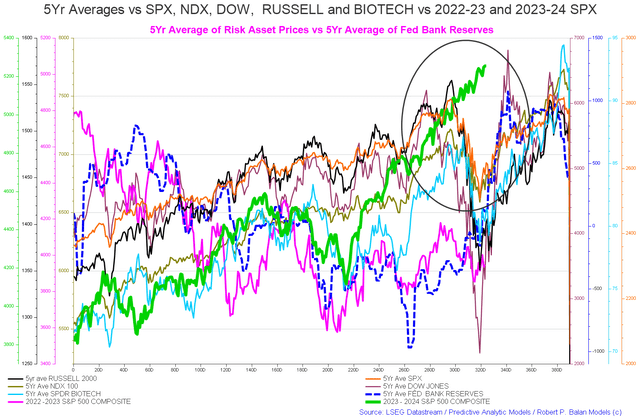

The chart below shows the five-year average of seasonal stock market trends for the SPX (SPX), Nasdaq (NDX), Dow (DIA), Russell 2000 (RTY) and biotechnology market indices. The black oval shows where we are currently.

This chart clearly shows how the green line has ignored the expected seasonal pattern defined by the orange line. The orange line represents the five-year average of the SPX. True to form, the SPX should have plunged at the end of the first quarter of 2024 and allowed for a dip buying opportunity. There should have been at least two opportunities to buy seasonal drops this year, but they didn’t happen, and we’re starting to wonder why.

Four factors come to mind:

1. Treasury interest income from higher interest rates.

2. Global budgetary expenditures of world governments.

3. The next peak of the real estate cycle.

4. Interest on reserve balances paid to banks by the Federal Reserve Banks increases with interest rates.

These factors will be discussed in more detail below.

1. Treasury interest income:

One major thing that has changed a lot over the last 18 months or so is the Fed’s stance and interest rate policy.

What is different from other years is that we now have high interest rates, and it may be just the increase in Treasury revenues that benefits wealthy beneficiaries who then buy paper assets in a manner targeted, outside the scale of normal asset purchase models.

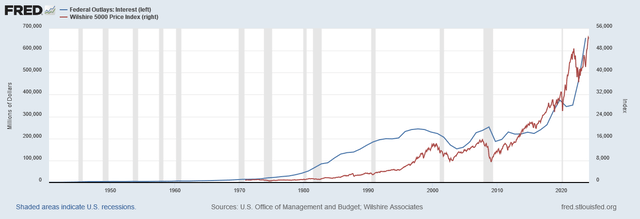

The chart below shows a very long-term and broad growth relationship between federal interest spending and the stock market.

It appears that federal interest spending is ahead of the stock market by several quarters and that as the stock of Treasury bonds has increased, the effect has accelerated and the curve has become steeper over time . The curve is now almost vertical.

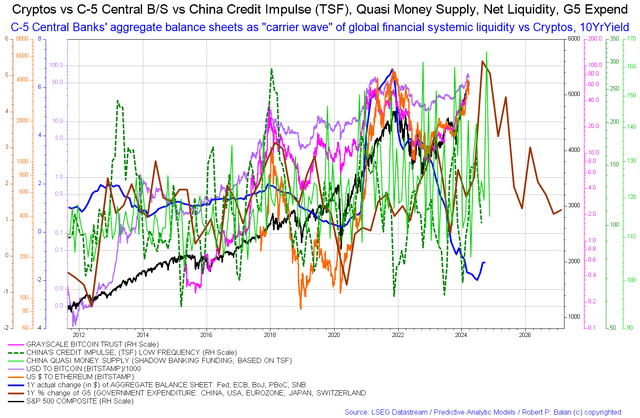

2. The confluence and increase in the lagged effect of G5 budgetary flows.

G5 flows represent the sum of spending by the world’s five largest economies. The C5 are the balance sheets of the five largest central banks in the world.

Mr. Robert P Balan of Predictive Analytical Models Investment Department

Together, the G5 and C5 tax flows impact what is known in fluid dynamics as a carrier wave upon which all other tax flows and market effects rely.

The chart above shows that the wave of brown holders increases sharply until 2024, which will tend to stimulate the asset markets.

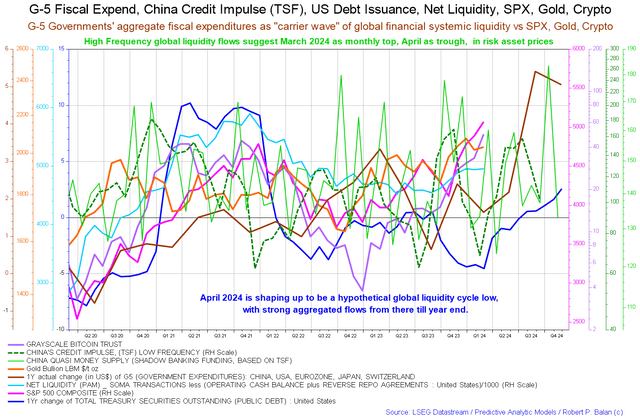

The brown line on the graph above shows this carrier wave. The following chart shows this in a more granular format but doesn’t go as deep as the chart above.

Mr. Robert P Balan of Predictive Analytical Models Investment Department

A shorter-term view of this same information shows how the brown line goes down in the first quarter of this year, then rises again starting in the second quarter.

These charts are not very precise, and it could be that the macroeconomic rise resulting from the G5 flow arrived earlier than expected and would explain the unusual dynamism of the markets. It also highlights the fact that things are likely to get better rather than worse as the year progresses.

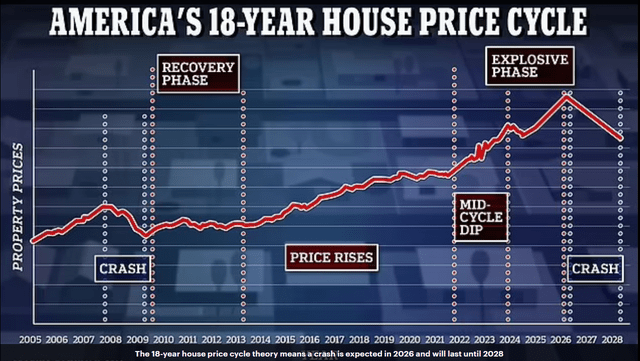

3. The economic rent effect of the final winners’ curse phase of the real estate cycle.

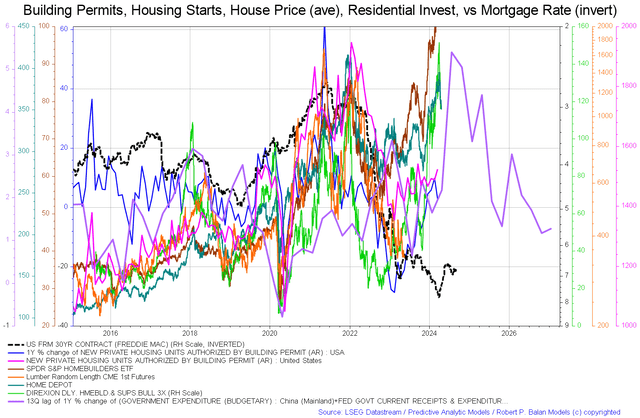

The chart above shows the course of the real estate cycle and how it is now entering its final, most explosive and speculative stage. Rising house prices are creating a targeted wealth effect among homeowners and are the high point of price increases since the recovery began in 2009. 15 years of land price growth peaking, being monetized, then entering asset markets.

Land prices rise and peak to the point where there is a wealth effect that starts with the asset value of normal people’s homes. Some of them would then get a home equity loan that would allow wealth born out of nowhere to be monetized and spent on paper assets, thereby causing a targeted collapse of the stock market. There you see how rising land prices stimulate credit creation and therefore overall demand, even for normal people and not just for the upscale parts of the city, and this money finds its way to the stock market in a targeted manner .

It is important to check the real estate market regularly as it is closely linked to the overall economy and is expected to peak in 2026.

The chart shows some aspects of the real estate market. In this case we have the price of lumber (orange line which tends to increase in a boom) which seems to have bottomed out and is close to a local low, but which is still not increasing. not. Now every month down is the homebuilder ETF, Home Depot. Construction starts and permits nevertheless increased. The rate on 30-year Freddie Mac contracts has fallen (which is normally good for housing and may explain why permits and approvals have increased at the same time as more people have taken out a slightly cheaper loan and chosen to build or buy). The purple line for government spending rises for most of the remainder of 2024 before dropping and rising through 2025. This line is the same fiscal carrier wave that sets the overall trend for all other waves that follow in its wake, and is illustrated in point two above. .

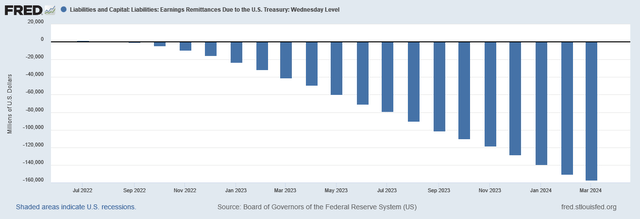

4. Interest on reserve balances at the Fed

Another important factor is the interest on reserve balance income which goes directly to banks due to high interest rates, and which is linked to the first factor listed above. This is shown in the table below

Banks tend to invest their disposable income in income-generating paper assets, such as stocks and bonds, at a rate of about $10 billion per month.

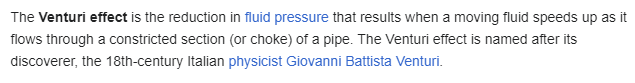

The 4-way financial Venturi effect.

The four factors described above support the thought experiment that the current and continuing collapse of stock markets in the face of only average fiscal flows is due to a financial Venturi effect.

Wikipedia

Interest income from the Treasury, IORB, and monetized wealth from the real estate cycle are sources of income of which the beneficiary is already largely wealthy. Seeking yield and a high level of discretionary spending, the recipient seeks to invest this money in paper assets and thus creates a stock market rally out of scale compared to the real strength of current fiscal flows.

The background effect of the overall increase in the lagged impact of G5 budgetary flows underlies and reinforces this Venturi effect.