Drive Bruce Room denigrates the use of the PCE deflator to deflate… NIPA’s PCE (Personal Consumption Expenditures). OK, it’s true that the PCE deflator uses business prices rather than consumer prices. Mr. Hall suggests using the CPI. But it has different weights. (It doesn’t make sense to apply a price index with CPI weights to an aggregate with PCE weights – read price index theory if this is confusing). What to do? What to do?

Well, check FRED. OK, read a small amount of literature and find out that there is something called market-based PCE (chained price index) that uses consumer facing prices (CPI), but at the same time uses PCE weights. What do we get then (compare with using the PCE deflator in this job) ?

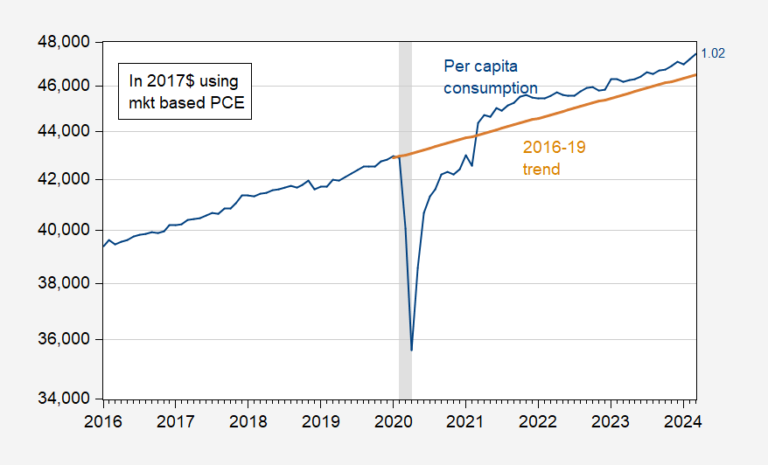

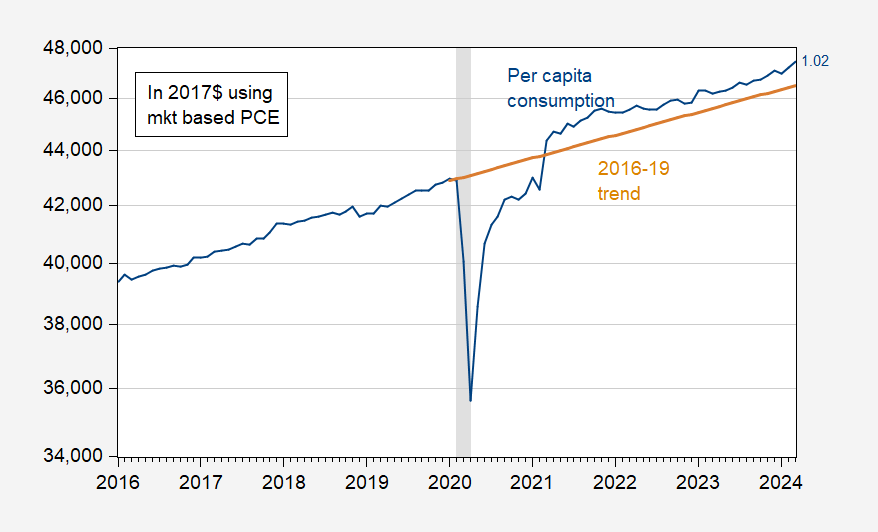

Figure 1: Per capita consumption in Ch.2017 dollars using PCE market-based weights, calculated using consumption divided by population (blue) and 2016-19 (stochastic) trend (tan). The NBER has defined the peak to trough dates of the recession in gray. Source: BEA, Census via FRED, NBER and author’s calculations.

Well, there you go! Consumption per capita in March was 2.0% above the (stochastic) trend of 2016-2019 (compared to 1.2% according to the figure reported by the BEA using the conventional PCE deflator).

After years of blogging and reading comments, I now understand that – despite the great ease of access to databases and the widespread explanations of how indices are constructed – there is a very strong correlation between claims not substantiated comments by commentators and ignorance of the data. If only people could invent something that would systematically compile a basic body of knowledge on such things…maybe call it a manual! And maybe if people read such things before commenting, we would actually have progressed in the world.