Vesnaandjic/E+ via Getty Images

Argenx’s performance and outlook in the face of market challenges

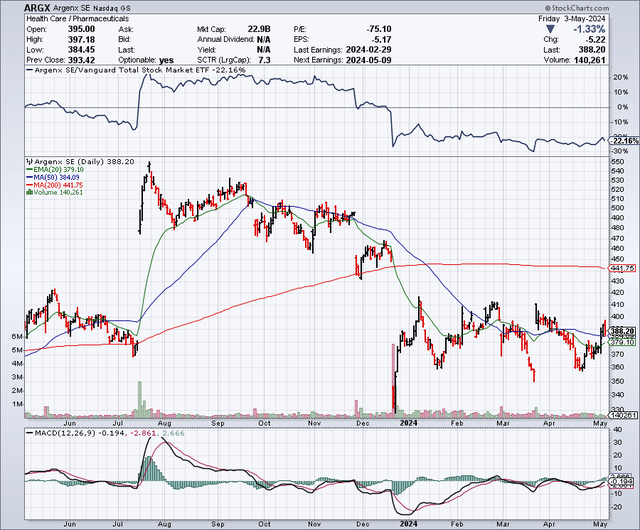

d’Argenx (NASDAQ:ARGX) the stock is down 22% since my last review in October. At the time, I noticed growing revenue opportunities for the company’s main asset, Vyvgart. argenx, a biotechnology developer based in Amsterdam, is a leader in the anti-FcRn market, which is expected to reach more than $10 billion. In the most recent quarter (Q4), argenx reported $374 million in global product net revenue (Vyvgart and Vyvgart Hytrulo) and $417 million in total operating income. argenx is still posting heavy operating losses ($138.6 million) due to high R&D expenses ($306 million) and general and administrative expenses ($208.8 million). Recall that the company is advancing Vyvgart intravenously and subcutaneously in several autoimmune diseases. Additionally, argenx pipeline includes ARGX-119 (targeting MuSK), empasiprubart (targeting C2), ARGX-118 and a few others. As I mentioned in previous contributions, argenx is face some competition in the clinic. Immunovants (IMVT) anti-FcRn antibody, IMVT-1402, shows promise as differentiated subcutaneous administration at home. This asset is expected to move to phase 2 in some autoimmune diseases later this year. Some other competitors include Johnson & Johnson (JNJ) nipocalimab, which comes demonstrated Phase 2 efficacy in Sjögren’s disease. UCB’s Rystiggo is already approved for the treatment of generalized myasthenia gravis (gMG). So far, MG is the “silver” indication in the anti-FcRn market. argenx linked its 2023 revenue of $1.2 billion to gMG. Additionally, argenx note that the switch to Vyvgart Hytrulo, a subcutaneous formulation, is underway.

While Vyvgart still accounts for the majority of prescriptions, we are seeing greater traction with Hytrulo, likely supported by access dynamics, favorable payer policies that reflect Vyvgart, and a dedicated J-Code in place. We are committed to further innovation in the patient experience by advancing the development of our pre-filled syringe or PFS this year.

For the future, argenx is expected will release its first quarter results on May 9. Analysts estimate revenue of $400 million with EPS of -$0.75. The estimated EPS would be a slight improvement, suggesting a potential stabilization of their finances. As of Dec. 31, the company reported $3.2 billion in “cash, cash equivalents and current financial assets.” Assuming similar net losses for the coming quarters ($138.6 million), that gives argenx at least five years of cash flow. Even if this period is quite extended, investors are probably hoping for a cap on their net losses. The company may have avoided this when it projected using “up to $500 million in net liquidity in 2024.”

Additionally, investors should keep an eye on the ongoing developments associated with Vyvgart. In February, the company announced that the FDA accepted its Supplemental Biologics License Application (sBLA) for Vyvgart Hytrulo for the treatment of chronic inflammatory demyelinating polyneuropathy (CIDP). A decision is expected next month, with a launch expected later this year. The company discussed the “overlap” between the MG and CIDP markets, which should help it overcome some of the challenges associated with bringing a new product to market for this indication (e.g., established treatments). CIDP is not as large a market as MG, but it is still considerable. The global CIDP market is projected is expected to eclipse $3 billion in 2031. As Vyvgart Hytrulo is considered to be the first of its kind for CIDP due to its differentiated mechanism of action and implementation, it is expected to take a considerable share of this market. Subsequently, regulatory approval and a successful market launch could boost agrenx’s valuation.

Finally, several data readouts are planned in 2024. Vyvgart’s data on Sjögren’s syndrome, post-COVID-19 postural orthostatic tachycardia syndrome (PC-POTS), and myositis are just a few. Any success in these indications could actually generate value for shareholders.

Market Sentiment

argenx has a market capitalization of $22.9 billion. According to data from Seeking Alpha, consensus analysts estimate revenue of $1.8 billion in 2024 and $2.45 billion in 2025. Argenx stock has underperformed over the past periods, notably in the last six months, with a decline of 22% while the SP500 returned 17.65. %.

Short-term interest is relatively low, 2.26% of the float. There is no recent internal activity of note. Establishments increased their positions by 5.3 million shares and decreased by 3.9 million shares. Major holders include Fmr, Artisan Partners and Avoro Capital Advisors.

Overall, I would rate Argenx’s market sentiment as ‘mixed’.

Risk-reward analysis and investment recommendation

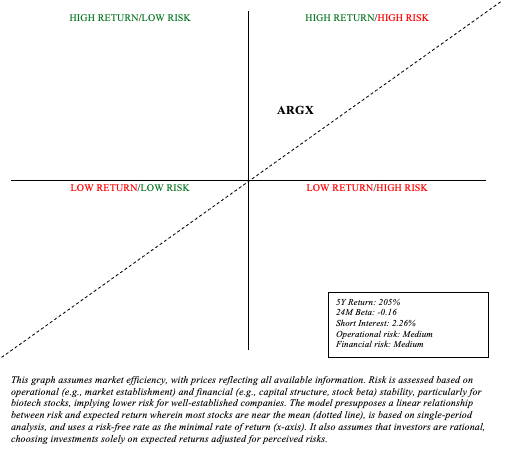

When assessing risk and reward, most biotech stocks will fall into quadrant 1 (high reward/high risk). I’m particularly interested in biotech stocks that I believe lie above the sloping line representing the linear relationship between risk and expected return.

Visual representation of the author

Due to Vyvgart’s robust launch and argenx’s leadership in the autoimmune disease space, I think argenx is a worthwhile investment. Certainly, argenx remains a young drug developer. There are therefore considerable financial and operational risks to take into account. However, the expanded cash position and strong balance sheet (virtually no debt) mitigate the impact of the heavy R&D and SG&A spending that is required to maintain leadership during these early innings. Certainly, there are existing and potential threats looming in the anti-FcRn market, but I don’t think argenx is going away anytime soon. The market is large enough for a few players and argenx is clearly striving to remain a leader. The maximum annual income of argenx is expected to eclipse $7 billion in 2031. Because argenx is marketing a biologic, this gives them several more years of exclusivity compared to a simple small molecule drug. Therefore, an appropriate multiple (in valuing Argenx shares) would be at least 4. Argenx’s current company value of $20 billion could result in undervaluation in light of these hypotheses. Subsequently, I am comfortable with maintaining my rating at “buy“, also noting that recent weakness in stocks could provide greater opportunities for returns.

There are certain limitations and risks associated with my “buy” recommendation. This is a recommendation best suited to a barbell portfolio (allocation with 90% of funds in secure assets like Treasuries and broad-market ETFs, supplemented by targeted investments of 10% in equities at high alpha). In a regular portfolio, I would be conservative with the allocation. argenx’s leadership in its market could be considerably challenged in the years to come. Additionally, data on autoimmune indications outside of MG and CIDP may be disappointing. As always, investors are encouraged to maintain a diversified and robust portfolio to mitigate some of these idiosyncratic risks.