Drive Bruce Room writing :

What’s interesting is that since the PCE consistently performs 2 points below the CPI.

This seemed to me a surprising stylized fact, contradicting what I knew thanks to the various analyzes I had carried out. I wrote that the difference was about 0.45 ppt between 1986 and 2019. Mr. Hall then cited a The morning star report notes:

at its peak in summer 2022, CPI inflation was almost 2 percentage points higher than PCE inflation (9.0% versus 7.1%).

Well, I certainly can’t deny that it is. However, we must then question the following statement:

What’s interesting is that since the PCE consistently performs 2 points below the CPI.

I don’t think one month of inflation differential at 1.87 ppt constitutes “consistency”.

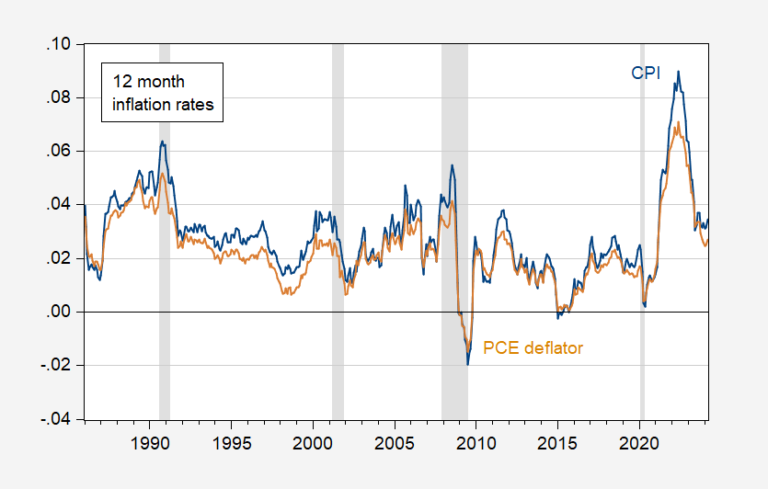

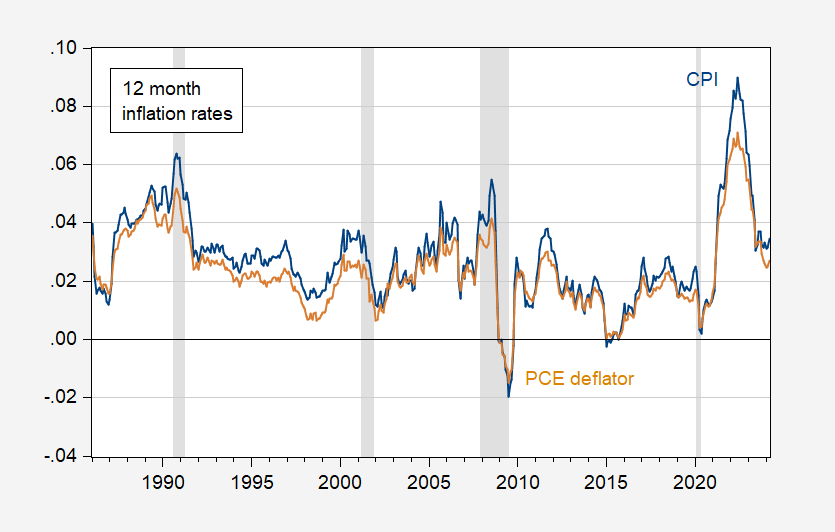

To confirm, here are the 12-month inflation rates, 1986-2024 (from the Great Moderation):

Figure 1: 12-month CPI inflation rate (blue), PCE deflator (tan). The NBER has defined the peak to trough dates of the recession in gray. Source: BEA, BLS via FRED, NBER and author’s calculations.

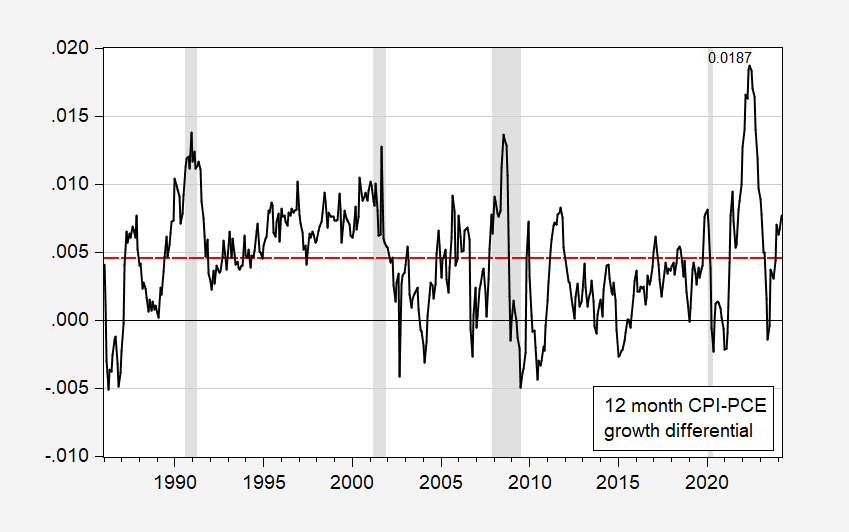

It doesn’t seem like “consistent” is the right adjective for me. Moreover, the difference is 1.87 ppt maximum (one month). It is 1.83 the following month.

What does the differential look like over time? This is shown in Figure 2, with a red dotted line at the differential (average) value for 1986-2024M03. The red dotted line is obtained using a regression of the CPI inflation rate minus the PCE deflator inflation rate.

Figure 2: 12-month differential CPI-PCE deflator (black). Red dashed line at the mean value for 19986-2024M03. The NBER has defined the peak to trough dates of the recession in gray. Source: BLS, BEA, NBER and author’s calculations.

Now, is it true that the CPI is a “better” measure of the costs of consumer goods and services? Yes, probably for the costs that consumers face, as opposed to the cost of goods and services consumed by households (keeping in mind that for some things, e.g. health care, the consumer does not bear all of the costs costs). On the other hand, we know that the CPI is quasi-Laspeyres (while the PCE deflator is chain-weighted). This base weighting problem is somewhat minimized as the CPI has moved toward annual changes in certain weights, making it closer to the chain-weighted CPI.

Anyway, this to summarize is slightly dated but mostly applicable (except for the frequency of CPI weighting changes).