Lambert here: I can’t have too many graphics!

By Wolf Richter, Wolf Street Editor-in-Chief. Originally published on Wolf Street.

Earlier today we discussed the labor market as a whole. But each sector faces its own labor market. In some sectors, trucking employment has fallen from record highs to all-time highs, while in other sectors the outlook is bleaker, usually due to structural changes. So we’ll look at decade-long employment trends in each major sector, based on current employment data from the Bureau of Labor Statistics.

Industry categories are classified by workplace. Surveys are sent to employer facilities. The main activity of this installation determines the industrial category. For example, an employee at an Amazon fulfillment center would fall under the “transportation and warehousing” category. It’s not the company that matters, but the work done at that specific location.

And we use three-month moving averages (3MMA) to iron out the drama of monthly scribbles.

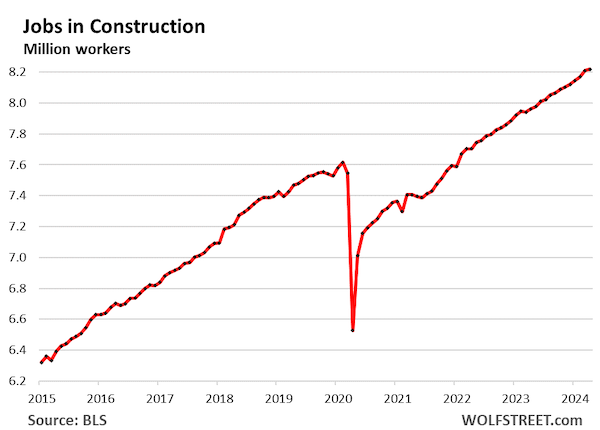

Construction (all types, from individual housing to highways).

- Total employment: 8.22 million, new historic record

- 3MMA growth: +24,000

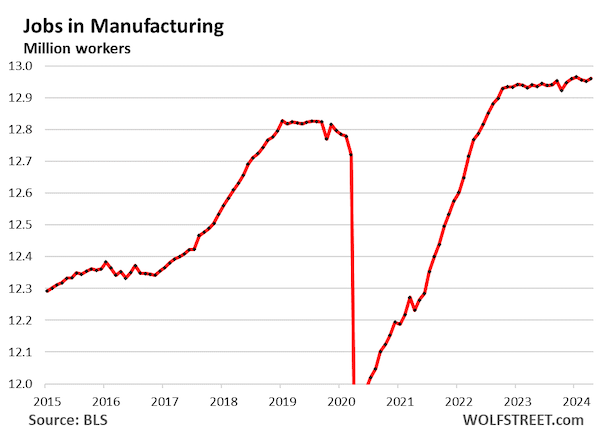

Manufacturing: After a sharp surge in the pandemic, employment remained stable for more than a year, but with a slight upward trend, interrupted by a decline during the auto industry strikes in October. The last five months have all been in a very tight range, around 12.96 million, the highest since before the Great Recession. The manufacturing industry continued to automate, requiring fewer but more skilled workers, including engineers.

- Total employment: 12.96 million

- 3MMA: -2,000

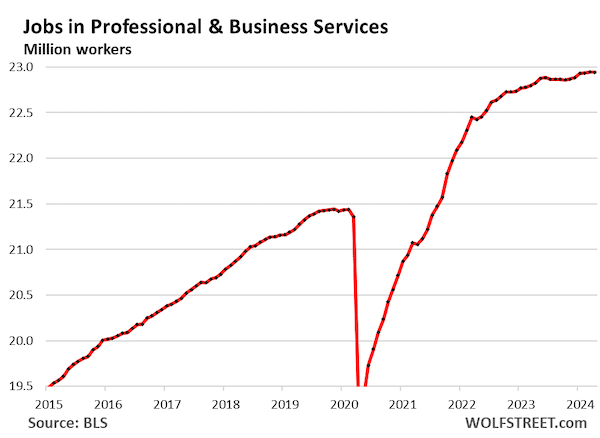

Professional and business services. One of the largest industries in terms of employment, it includes facilities whose employees work primarily in professional, scientific, and technical services; Management of Companies and Enterprises; Administrative and support services, as well as waste management and sanitation. It includes the facilities of some technology and social media companies.

The heterogeneous employment growth resulting from the pandemic has certainly slowed, but continues at a moderate pace with extremely high employment levels:

- Total employment: 22.94 million (record)

- 3MMA growth: +4,000

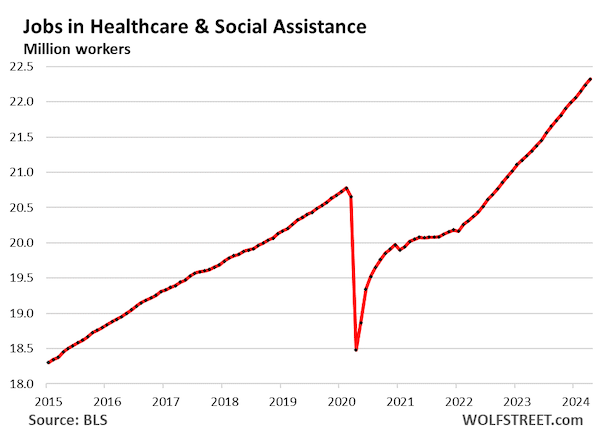

Health care and social assistance:

- Total employment: 22.32 million, new high

- 3MMA: +88,000

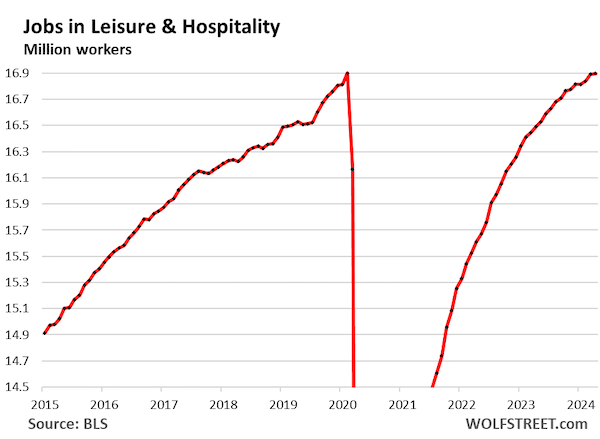

Leisure and hospitality – restaurants, accommodation, resorts, etc.

- Total employment: 16.9 million, back to pre-pandemic high.

- 3MMA growth: +28,000

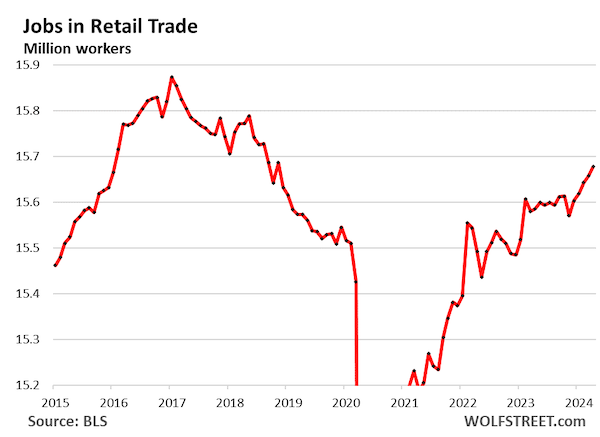

Retail business includes workers in physical retail stores, such as shopping malls, car dealerships, grocery stores, gas stations, etc., and other retail locations such as markets. This does not include technology-related jobs in e-commerce operations, drivers and warehouse workers.

Much of this sector has been under severe pressure from e-commerce operations and dozens of major retailers have been liquidated by bankruptcy courts in recent years, with a total loss of jobs, as we have documented in our report. Brick-and-Mortar Meltdown Series. The retailers that are doing well are those that sell groceries, car dealerships, gas stations and others that aren’t under the full pressure of e-commerce.

- Total employment: 15.7 million

- 3MMA growth: +20,000

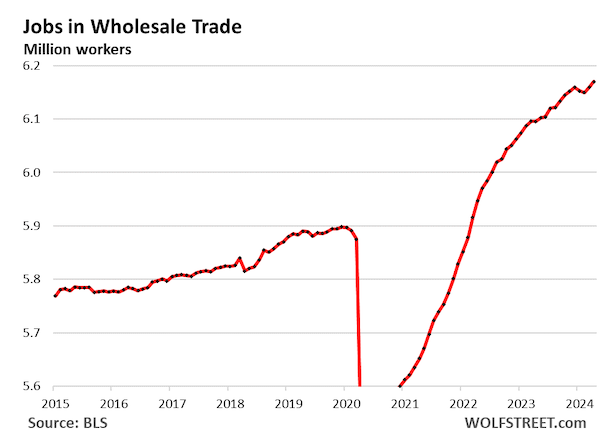

Wholesale:

- Total employment: 6.17 million, new historic record

- 3MMA: +6,000

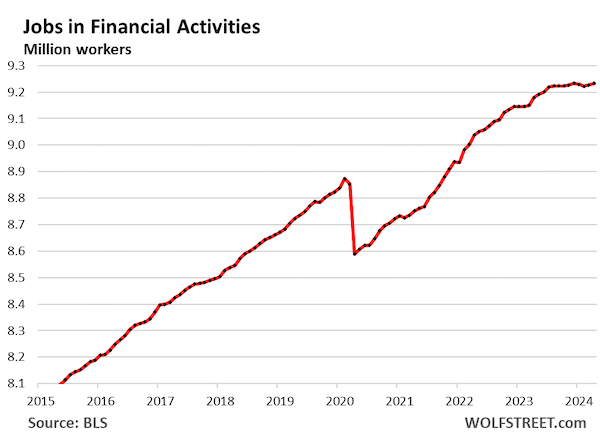

Financial activities (finance and insurance as well as rental, leasing, purchase, sale and real estate management). Employment has stabilized at very high levels as the mortgage sector was decimated after the refinancing boom collapsed amid rising mortgage rates in 2021.

- Total employment: 9.23 million

- 3-MMA Growth: 1,000

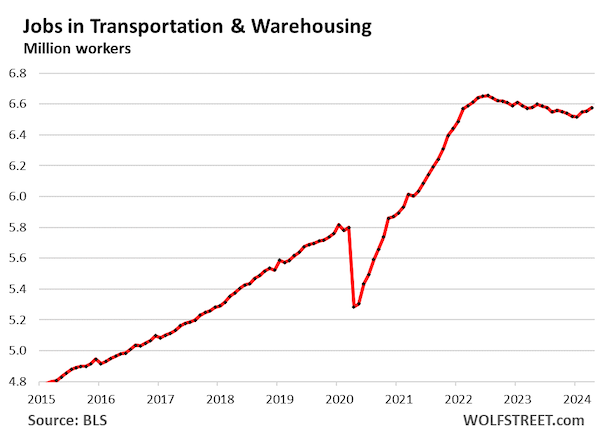

Transportation and storage: Employment surged with the pandemic boom in durable goods, and when that faded as consumers shifted to spending on services, employment began to decline. But in recent months, the situation has started to increase again:

- Total employment: 6.58 million

- 3MMA growth: +20,000

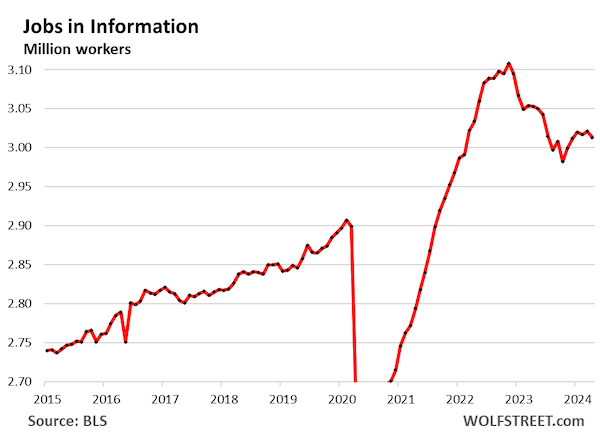

“Information” includes facilities where people work primarily on web search portals, data processing and transmission, information services, software publishing, film and sound recording, broadcasting, including on Internet, and telecommunications. This includes some tech and social media company job sites. You can see the effects of layoffs.

- Total employment: 3.01 million

- 3MMA growth: -2,000

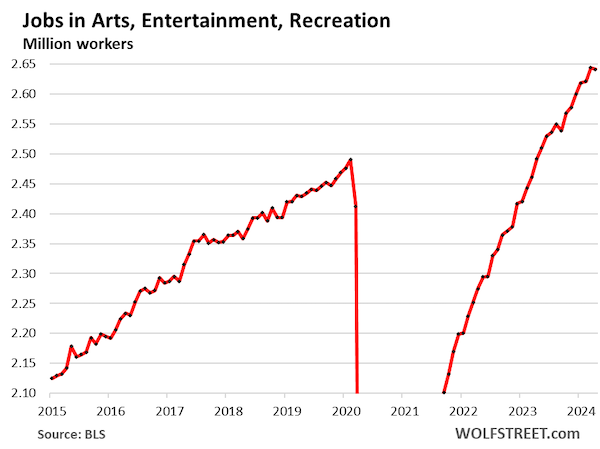

Arts, entertainment and recreation includes spectator sports, performing arts, entertainment, gaming, recreation, museums, historic sites and others:

- Total employment: 2.64 million

- 3MMA growth: +8,000

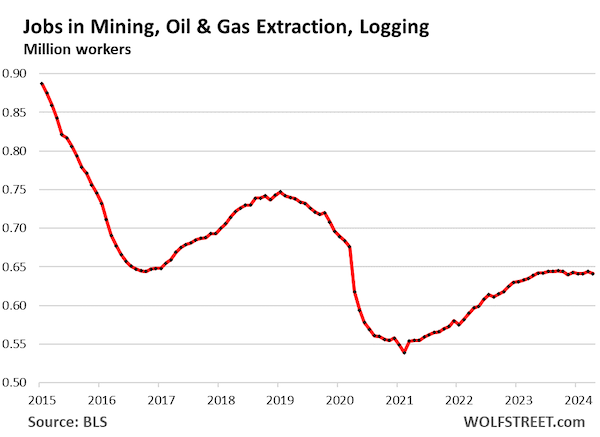

Mining, oil and gas extraction, logging: Major technological advances have impacted employment in this industry, from autonomous mining trucks to equipment and technologies used in hydraulic fracturing and logging.

And over these years, the United States has become the world’s largest producer of oil and natural gas.

- Total employment: 641,000

- 3MMA growth: unchanged

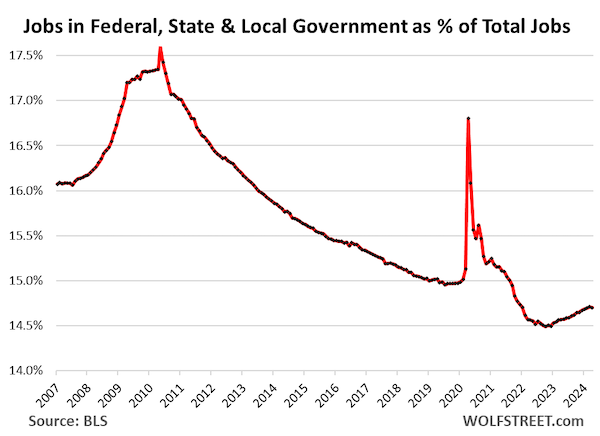

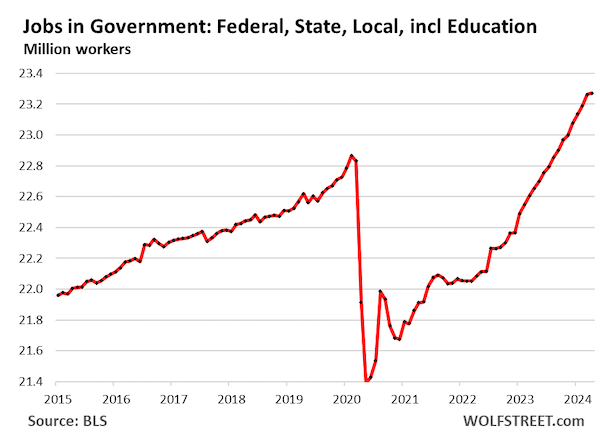

Federal, state and local government jobs. About 12.8% of all civilian government employees work for the federal government. About 87.2 percent of them work for state and local governments, many in public education, from elementary schools to universities.

As the economy and labor market have grown over the past 15 years, public employment has also grown, but at a slower rate than overall employment, and thus the percentage of civil servants relative to overall workers fell to a multi-decade low of 14.5%. end of 2022. Since then, this percentage has risen to 14.7%

So here is the total civilian employment at all levels of government:

- Total employment: 23.27 million

- 3MMA growth: +45,000.

And this is total government employment as a percentage of total nonfarm employment. The biggest spikes occur during the census taken every 10 years, which in 2020 fell on the pandemic, when overall employment had plunged, and thus the percentage of public employment relative to total non-agricultural employment increased more than normal: