This is Yves. We linked to the underlying New York Times op-ed by Gabriel Zucman in Links Today, but this article is important in that it summarizes Zucman’s article and takes it off the New York Times paywall . Zucman is a relatively young academic, following in the footsteps of inequality monitoring specialists. Emmanuel Saez and Thomas Piketty who warned early and loudly of worsening income and wealth inequality. Zucman made an important contribution years ago with his book “The Hidden Wealth of Nations,” which documented the enormous sums of money scattered in tax havens by billionaires and aspiring rich.

By Jake Johnson. Originally published on Common dreams

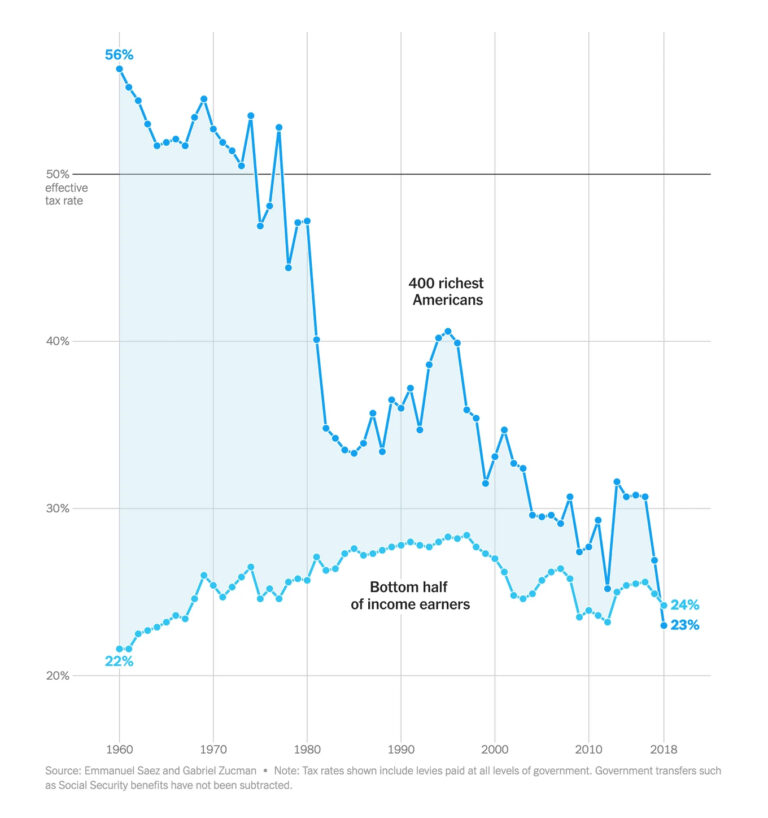

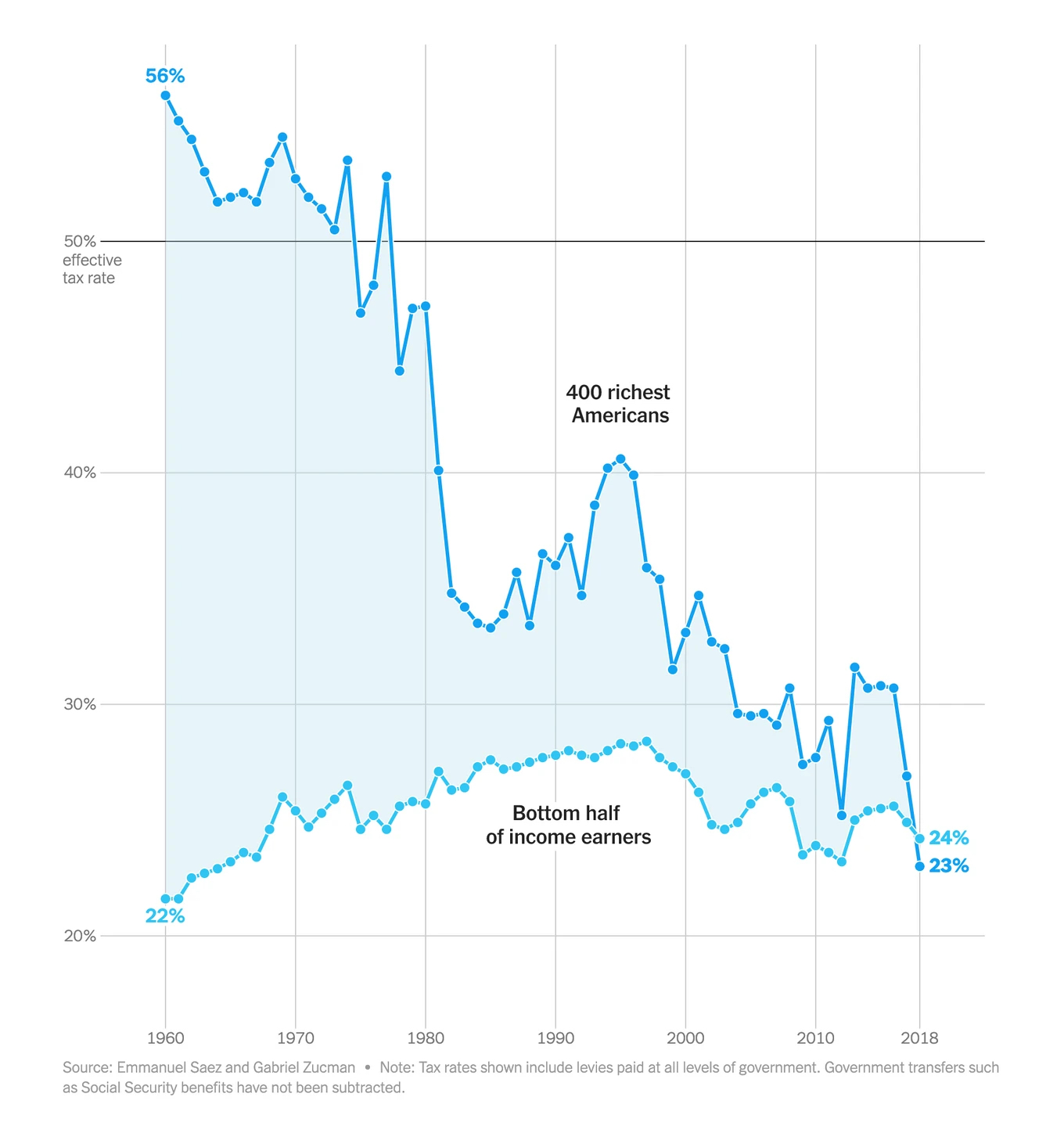

A analysis published Friday by famed economist Gabriel Zucman shows that in 2018, America’s billionaires paid a lower effective tax rate than working-class Americans for the first time in the country’s history, a data point that has sparked a new wave of calls for bold levies on the public sector. ultra-rich.

Published in The New York Times Under the headline “It’s Time to Tax the Billionaires,” Zucman’s analysis notes that billionaires pay so little in taxes relative to their immense wealth because they “live off their wealth” — mostly in the form of actions – rather than wages and salaries.

Stock market capital gains are currently not taxed in the United States until the underlying asset is sold, leaving billionaires like Amazon founder Jeff Bezos and Tesla CEO Elon Musk – two men who often compete to become the richest man on the planet – with very little taxable income.

“But they can still make eye-popping purchases by borrowing against their assets,” Zucman noted. “Mr. Musk, for example, used his shares in Tesla as collateral to raise about $13 billion in tax-free loans to put toward his acquisition of Twitter.

Begin to reverse the decades-long trend of rising inequality that has weakened democratic institutions And mine critical programs such as Social Security, Zucman has advocated for a minimum tax on billionaires in the United States and around the world.

“The idea that billionaires should pay a minimum amount of income tax is not a radical idea,” Zucman wrote Friday. “What is radical is continuing to allow the richest people in the world to pay a lower percentage of income tax than almost everyone else. In liberal democracies, a wave of political sentiment is growing, focused on eliminating the inequalities that plague societies. A coordinated minimum tax on the very rich will not fix capitalism. But it is a necessary first step.

Responding to those calling for a minimum tax would be impractical because “wealth is difficult to measure,” Zucman wrote that “this fear is exaggerated.”

“According to my research, about 60% of the wealth of American billionaires resides in the shares of publicly traded companies,” observed the economist. “The rest is mostly stakes in private companies, which can be assigned a monetary value by looking at how the market values similar companies.”

Since 2018, the last year examined in Zucman’s analysis, the wealth of the world’s billionaires has continued to explode while workers’ wages have declined. largely stagnant. Last month there was a record 2,781 billionaires in the world with combined assets of $14.2 trillion.

The United States has more billionaires than any other country, with 813 individuals worth a combined $5.7 trillion.

“The ultra-rich pay less tax than the poorest half of income earners. This is absurd!” Rakeen Mabud, chief economist at Basic collaborative work, wrote in response to Zucman’s analysis. “We need to raise taxes on the rich and big businesses. Enough with the hoarding of wealth. It is high time for us to take back what is ours.

US Senator Sheldon Whitehouse (DR.I.), Chairman of the Senate Budget Committee, called the numbers Zucman put together are “shameful” and said that “not only can we solve this problem, we can make Social Security and Medicare safe as far as the eye can see.”