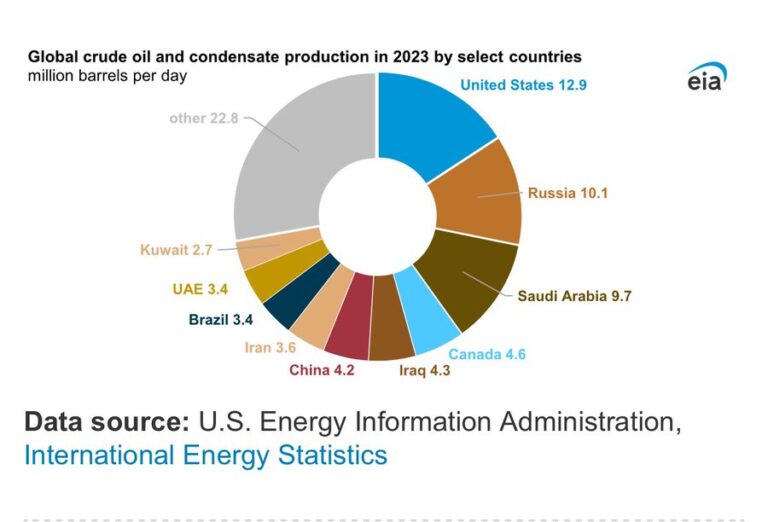

From the EIA and BEA NIPA:

Source: EIA via Forbes.

By WSJwe pump so much that parts of Texas are warping and swelling.

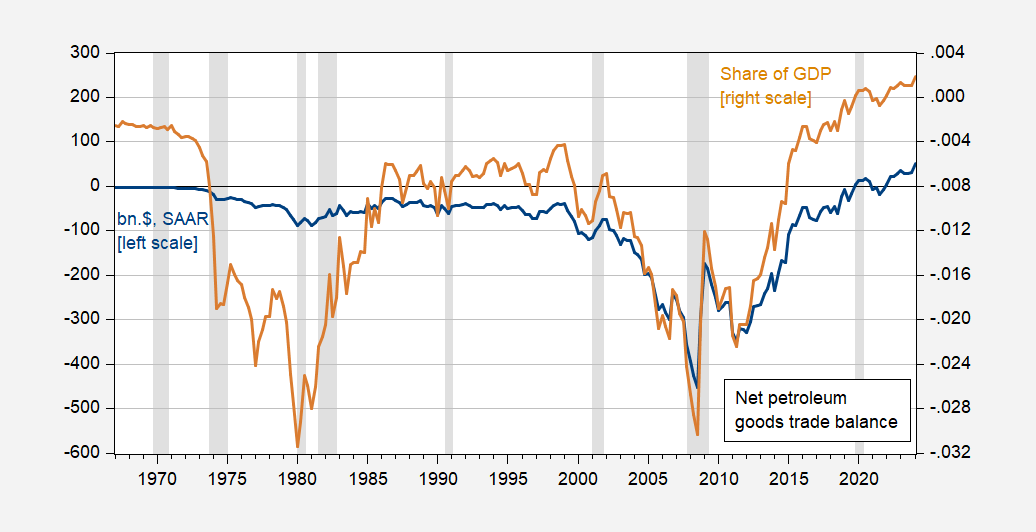

And here are the US net exports of petroleum products (in $) from NIPA.

Figure 1: U.S. net exports of petroleum products, in billions. $, SAAR (blue, left scale) and as share of US GDP (beige, right scale). The NBER has defined the peak to trough dates of the recession in gray. Source: BEA, advance release of first quarter 2024, NBER and author’s calculations.

From an economic point of view, the increase in the production of petroleum products does not necessarily modify the impact on inflation of an oil shock (consumption per unit of GDP and the credibility of the central bank could play a role). more important role). However, as the United States becomes an increasingly important exporter of petroleum products, a rise in oil prices becomes less and less of a negative shock to the terms of trade. Furthermore, in terms of aggregate demand, the rise in oil prices will be less negative.