It is the almost joyful conclusion of a article in the Washington Examiner last December. It’s true that they based this conclusion on a Report from the Office of the Legislative Analyst. However, this conclusion was based on the (inappropriate) use of the Sahm rule (at the national level) to determine state-level unemployment rates. And like Dr. Sahm notedThis is not the right way to go: rather, one should examine the appropriate threshold for a given state before using it to infer a recession.

Well, let’s take a look at some indicators.

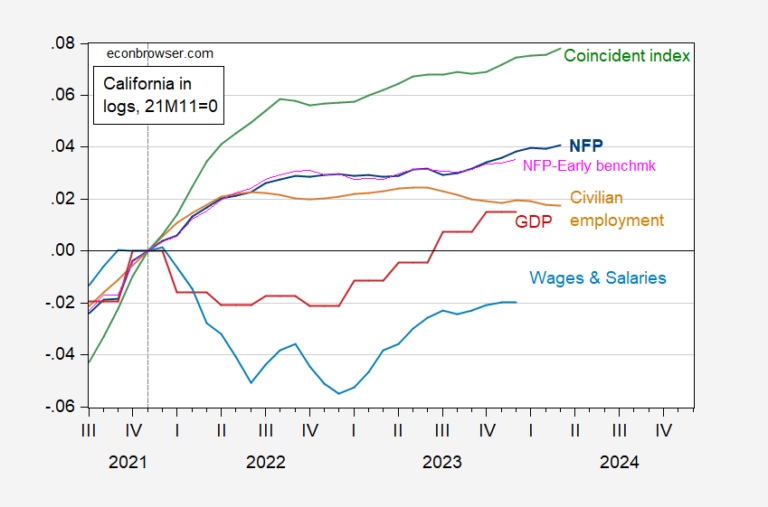

Figure 1: California nonfarm payroll employment (dark blue), Philadelphia Fed’s first NFP benchmark measure (pink), civilian employment (beige), linearly interpolated real wages and salaries deflated by national chain CPI (sky blue) ), GDP (red), coincident index (green), everything in the logs 2021M11=0. Source: BLS, BEA, Philadelphia Fed (1), (2)and the author’s calculations.

We have a somewhat split picture – similar to that at the national level – where employment measures (NFP, first benchmark NFP and coincident index) show growth through 2023, while deflated wages and salaries are only not returned to 2021M11 levels by the end of the year. GDP, however, increased until 2023.

It should be noted that the index coincides – based on non-farm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate and wages and salaries deflated by the CPI – significantly exceeds other measures. For what it’s worth, the Philadelphia Fed State-Level Business Cycle Timeline does not indicate a recession in 2023.*

As for the coming recession, the UCLA Anderson School Forecast (March 13) note:

California’s economy is expected to continue to grow faster than the United States, but not by much. The risks weighing on the forecast are the same as those weighing on the nation: political and geopolitical. It is possible that interest rates will disrupt the current downward expansion, and that increased international immigration and accelerated reshoring of technical manufacturing will be on the rise.

The unemployment rate for the first quarter of this year is expected to average 4.7%, and the average for 2024, 2025 and 2026 is expected to be 4.6%, 3.8% and 3.9%, respectively. Forecasts for 2024, 2025 and 2026 call for total employment growth rates of -0.6%, 2.1% and 1.5%. Nonfarm payroll employment is expected to grow at a rate of 1.4%, 1.7% and 1.2% over the same two years.

Real personal income is expected to grow by 2.0% in 2024, 2.9% in 2025 and 2.7% in 2026. Despite rising interest rates, demand continues for limited housing stock, associated with public policies encouraging the construction of new housing, should lead to an increase in real personal income. the start of a recovery this year, followed by solid growth in new housing production thereafter. We expect 123,000 net new homes to be permitted in 2024, and the number of new homes could reach 159,500 by the end of 2026. Needless to say, this level of home construction means that the prospect for the private sector to build from The housing affordability problem over the next three years is zero.

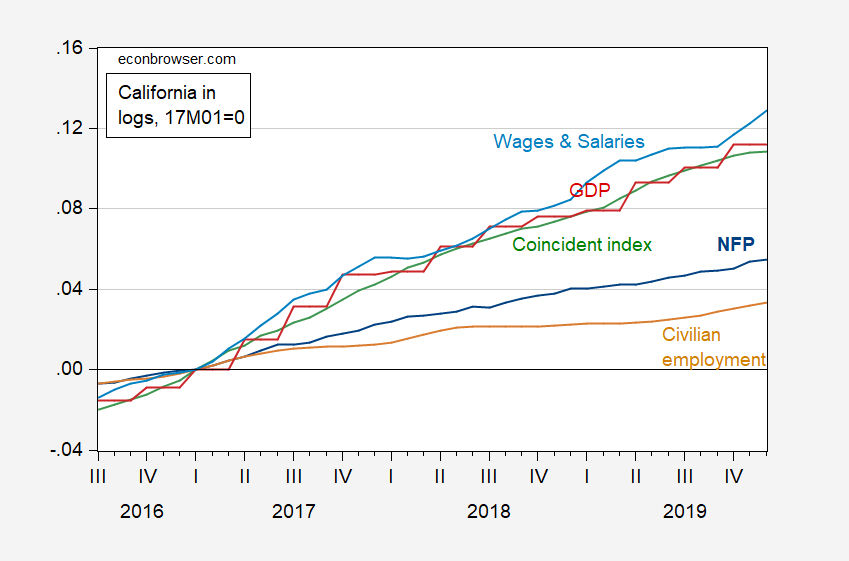

*Some readers may remember the great 2017 debate over California in recession with Political calculations, here. The Philadelphia Fed fails to identify a recession for California in 2017-2018.

Ironman speculated that a recession had begun, based on a 12-month moving average based on a series based on the household survey. Here is the actual result.

Figure 2: Nonfarm payroll jobs in California (dark blue), civilian jobs (beige), linearly interpolated real wages, deflated by national chain CPI (sky blue), GDP (red), coincident index (green), all in logs 2021M11=0. Source: BLS, BEA, Philadelphia Fed (1)and the author’s calculations.

Conclusion: Pay attention to the series of household employment surveys at the state level.