It’s the song I was thinking about when I saw the WSJ headline, Trump allies hatch plans to weaken Fed independence:

Several people who spoke with Trump about the Fed said he appears to want someone at the helm of the institution who will, in effect, treat the president as an ex officio member of the bank’s rate-setting committee central. Under such an approach, the president would regularly seek Trump’s opinion on interest rate policy and then negotiate with the committee to guide policy on the president’s behalf. Some advisers to the former president have considered requiring that nominees for Fed chairman agree privately to consult informally with Trump on the central bank’s decisions, people familiar with the matter said. Others have argued that Trump himself could serve on the Fed’s board of governors in an acting capacity, an option that several close to the former president have called far-fetched.

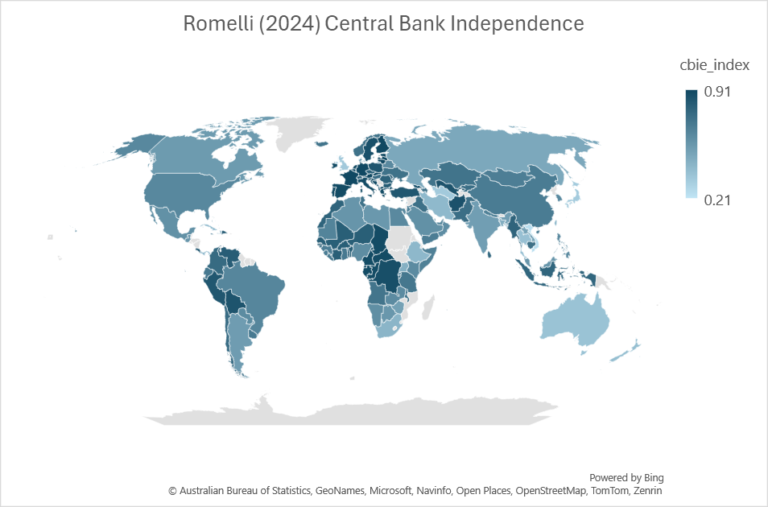

Then we wouldn’t have to worry r*, potential GDP, PCE versus CPI, etc. Just push those interest rates to zero (if Trump is president; as high as possible if he’s not – a simple algorithm!) No need for the Fed to hire expensive economists. We just need, say, Larry Kudlow or Steven Moore as Fed governors. And, more importantly, we would not need to waste valuable time trying to estimate the degree of independence of the Fed. For example, here is a map of Central Ban Independence (CBPI) in 2024, according to Romelli (2024).

Source: Romelli (2024). Higher values (darker blue) indicate greater central bank independence.

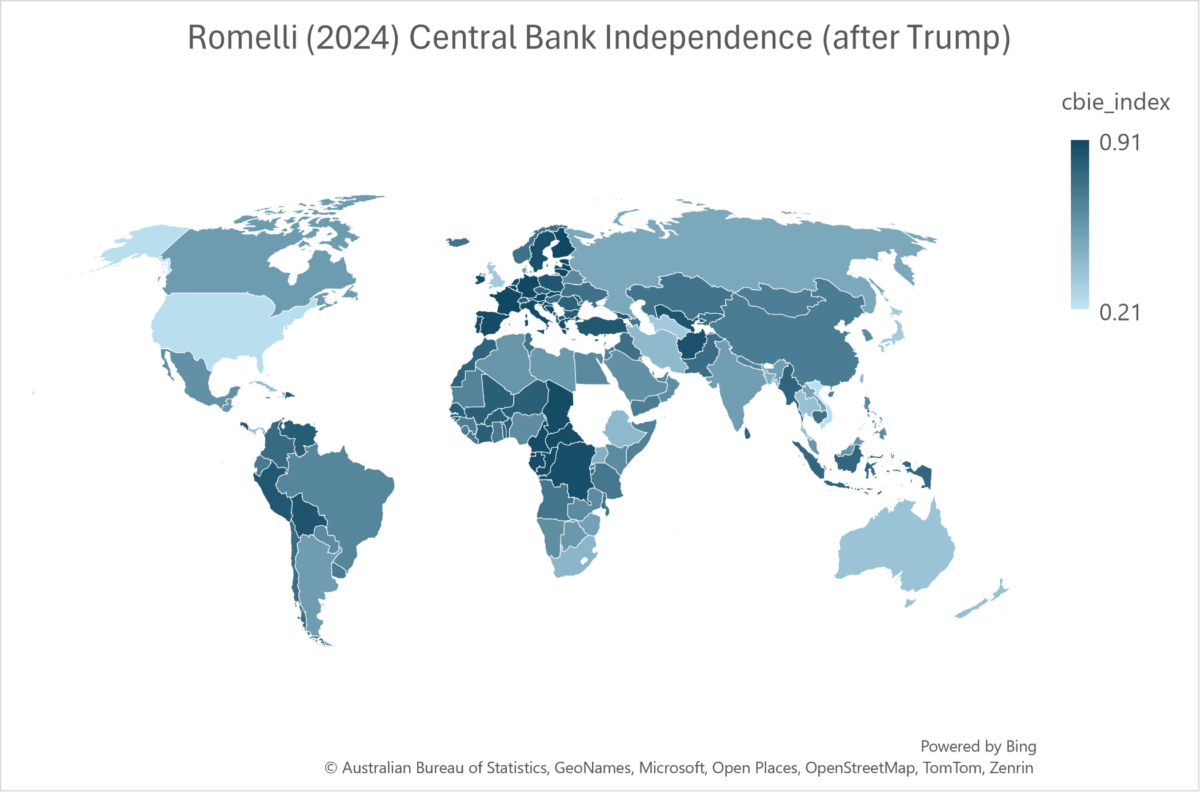

But with the reforms implemented by Trump, we can be like… Vietnam!

Source: Romelli (2024), with an American CBI set at the value of Vietnam. Higher values (darker blue) indicate greater central bank independence.

Carola Binder’s Central Bank Pressure Index (discussed in this job) indicates that pressure was placed on the Fed to ease monetary policy in the fourth quarter of 2018 (data extends through the first quarter of 2019, so we don’t know what Mr. Trump did during the second and fourth quarters of 2019). Mr. Trump in a second term, well, it will be easy for us to understand what the Fed will do…