The U.S. economy continued to grow early this year, but at a significantly slower pace, as strong consumer spending was offset by rising prices and pockets of weakness in other sectors.

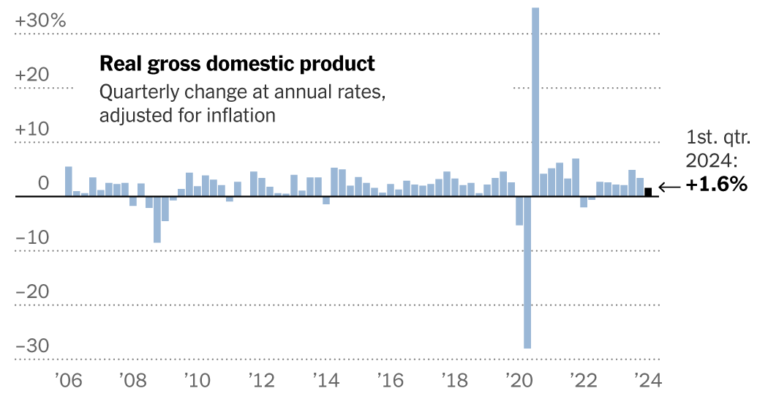

Gross domestic product, adjusted for inflation, grew at an annual rate of 1.6% in the first three months of 2024, down 3.4 percent the end of 2023, the Commerce Department announced Thursday.

On its own, slowing growth isn’t necessarily a cause for concern, especially as the Federal Reserve attempts to calm the economy. And the weaker first-quarter figures are partly explained by large swings in business inventories and international trade, which often fluctuate considerably from quarter to quarter. Underlying growth measures were stronger.

“That would suggest some moderation in growth but a still strong economy,” said Michael Gapen, chief U.S. economist for Bank of America. He said the report contained “overall few signs of weakness”.

Still, the growth rate was lower than economists expected, and the slowdown came just as the Fed’s fight against inflation has stalled: Prices rose faster in the first quarter than in late last year, and Thursday’s data showed a faster acceleration than forecasters had expected. This raises the uncomfortable possibility that high interest rates will weigh heavily on economic activity but fail to fully control inflation.

“It increases the chances of a harder landing,” said Constance L. Hunter, an economist at MacroPolicy Perspectives, a forecasting company.

For now, consumers are ensuring that growth continues. Spending increased at a rate of 2.5% in the first quarter as low unemployment and rising wages helped shoppers shrug off high interest rates and rising prices. After-tax income continued to grow faster than inflation, although consumers also saved less as they continued to spend.

“The sentiment is not that strong – people don’t view the economy as healthy – but personally they are going out and spending,” said Brian Rose, senior economist at UBS. “They seem to somehow defy gravity.”

However, if consumer spending comes back down to earth, the economy as a whole could be vulnerable. Companies invested less in new facilities in the first quarter and increased their inventories less, a sign that they remain cautious despite strong sales.

“The consumer is still king – he is the engine of growth – and yet businesses are very reluctant to invest,” said James Knightley, chief international economist at ING. “If something were to happen to the consumer, the growth story could collapse very quickly. »

Spending was boosted particularly by wealthier consumers, whose low debt and fixed-rate mortgages shielded them from the effects of rising interest rates, and who benefited from a beating stock market until recently records.

However, low-income households are showing increasing signs of strain. They are increasingly turning to credit cards to pay for their expenses, and with high interest rates, more and more of them are falling behind on their payments.

“There’s a sense that low-end households are increasingly stretched right now,” said Andrew Husby, senior U.S. economist at BNP Paribas. “We are witnessing a bifurcation of the American economy.”