On-chain data shows that Bitcoin mining revenues have moved closer to their annual average, a sign that the capitulation may be coming to an end for miners.

Bitcoin Miners’ Revenues Now Near Their 365-Day Moving Average

In a new job On X, analyst James Van Straten discussed the current state of BTC miners. There are different ways to assess the state of miners, one of the most popular being the hash ratewhich is a measure of the total computing power connected to the Bitcoin network.

Here, however, the analyst made use of the everyday total income of these chain validators. Miners’ revenues are divided into two parts: block subsidy and transaction fees.

The first of these refers to the BTC rewards that miners receive as compensation for solving blocks on the network, while the second is the flat fee that users pay for individual transactions. Historically, the block subsidy has accounted for a much larger share of miners’ revenue than transaction fees.

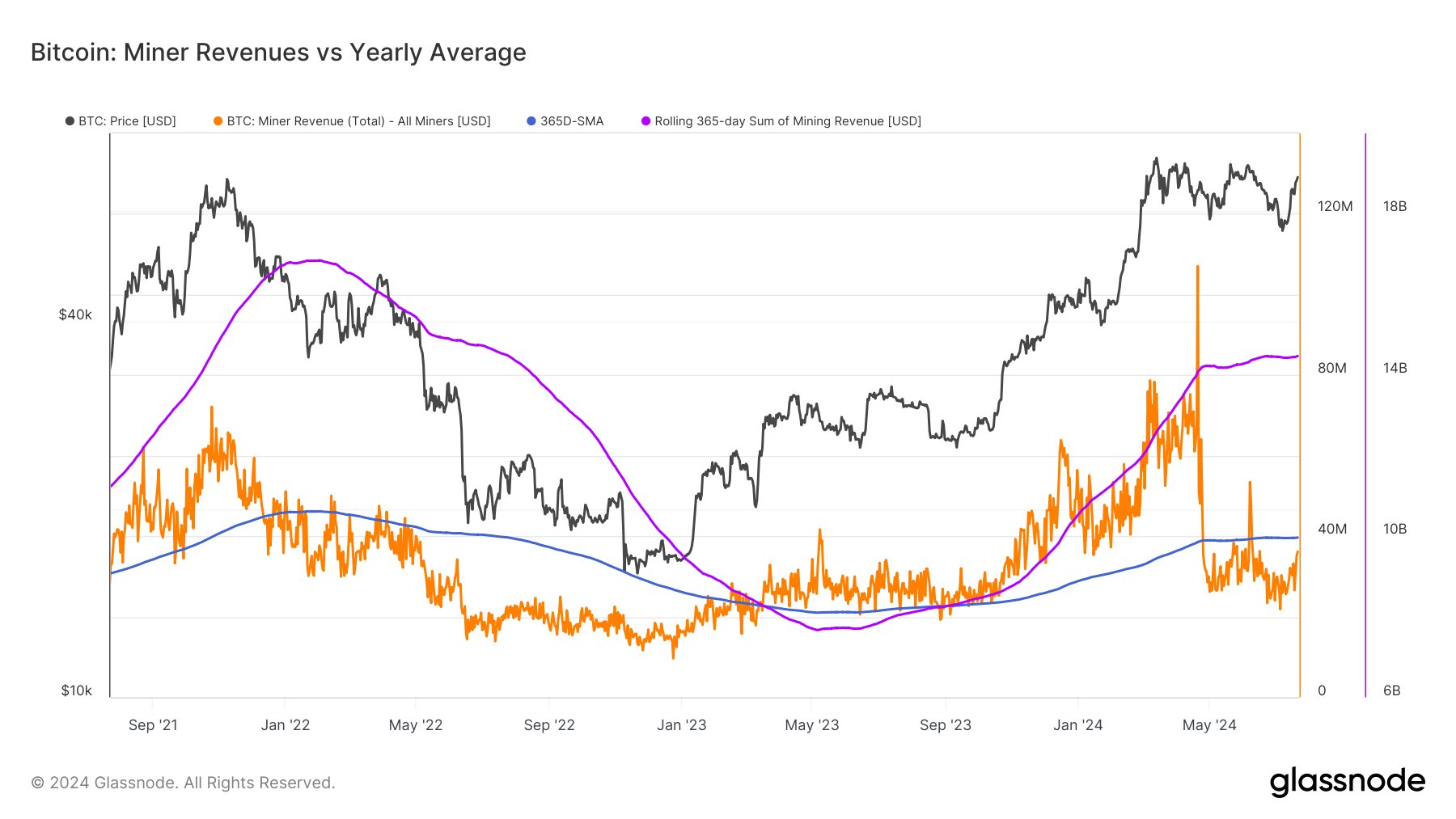

The chart below shows how the combined revenue of Bitcoin miners has changed over the past few years.

The value of the metric appears to have registered a sharp drop in recent months | Source: @jvs_btc on X

As the chart above shows, Bitcoin miners’ revenues started to climb alongside the price rally that began in October last year and reached a new all-time high (ATH) in April this year.

This increase is due to two reasons. First, the block grant, which is paid in BTC, is usually fixed in value and periodicity, so the only variable linked to it is the USD price of the asset. It therefore makes sense that revenue increases when the price increases.

At the same time, the network has also become very crowded due to the increase in bull market traffic. Transaction fees depend on the conditions of the blockchain, as the available space in blocks is limited. This space naturally becomes more expensive as competition for transfers intensifies.

The increase in ATH revenues, in particular, was fueled by the arrival of The Runeswhich is a new on-chain technology that allows users to create fungible tokens. Rune-related transactions are similar to all others on the network, so they also affect the network economy.

From the chart, it is visible that miners’ revenues saw a sharp drop right after this ATH, with their value falling below the 365-day Simple Moving Average (SMA).

The reason behind this was the Fourth Halving. While block rewards remain fixed in value most of the time, there is one exception in the form of halving events. These periodic events, which occur every four years, permanently reduce these rewards by half, dramatically disrupting miners’ income.

Since that drop, Bitcoin mining revenue has remained below the 365-day moving average, putting pressure on many miners and forcing some to capitulate.

With the latest recovery, however, miners’ revenues have climbed to $35 million, not far from the annual average of $40 million. “This is another way of showing that the miners’ capitulation is almost over,” says Van Straten.

If the metric manages to reclaim the 365-day moving average, then Bitcoin could continue to trend higher, according to the analyst.

BTC Price

Bitcoin has stalled in its recovery, with its price still trading around the $66,200 level.

Looks like the price of the asset has slumped to sideways movement over the last few days | Source: BTCUSD on TradingView

Featured image by Dall-E, Glassnode.com, chart by TradingView.com