DNY59

We have already covered Netflix, Inc. (NASDAQ:NFLX) in January 2024, explaining why its streaming outlook could remain strong as the macroeconomic outlook improves, helped significantly by a strong job market as discretionary spending increases.

Combined with the excellent performance of the FQ4’23 and impressive guidance for the first quarter of 2024, the stock had also advanced some of its upside potential, with interested investors better off awaiting more attractive entry points despite the long-term success (prospect) of the streaming company.

Currently, NFLX is already down significantly -12.7% from its recent high, as the market overreacts to the new subscriber reporting standard and the overall technology market declines at approaching the results season of the first quarter of 2024.

Despite the maturation of the streaming business, its inherent profitability, growing market share and strong shareholder returns continue to demonstrate NFLX’s long-term investment thesis, with market leaders rarely cheap.

This withdrawal only triggers an opportunistic entry point for investors looking to get closer to its fair value. We will discuss this further.

NFLX continues to be the king of streaming – A reporting pivot likely signals a maturing business profile

Before we get into the meat of NFLX’s sudden change in subscriber reporting, we’ll briefly discuss its double-beat call of Q1 2024 earnings, which further demonstrates why it remains the king so far streaming.

For now, the streaming leader has reported First quarter 2024 revenue of $9.37 billion (+6.1% QoQ/ +14.8% YoY), operating margins of 28.1% (+11.2 points QoQ/ +7.1 YoY) and adjusted EPS of $5.28 (+150.2 % QoQ/ +83.3% YoY).

Subscriber growth in the first quarter of 2024 to 269.6 million (+9.32 million quarter-on-quarter/+37.1 million year-over-year) and relatively stable average monthly revenue per membership (ARM) of 11 $.58 (+2.3% QoQ/-1% YoY) over the last quarter also demonstrates the streaming platform is very sticky, despite the inflationary and high interest rate environment.

Looking ahead, NFLX’s sudden change is indeed strange, given that it has already become the gold standard for streaming reporting method and has been similarly adopted by other incumbents , notably The Walt Disney Company (SAY), Warner Bros. Discovery, Inc.WBD) and Paramount Global (PARA), among others.

With NFLX management choosing to remove subscriber reporting, this is akin to Costco Wholesale Corporation (COST) do not report growth in their membership fees and Amazon.com, Inc. (AMZN) does not report AWS’s operating profit, as these key operating metrics are generally synonymous with its up/down performance thus far.

Growth in streaming share

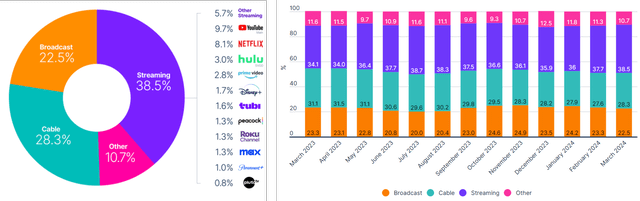

Despite this, NFLX remains an undisputed leader with 8.1% market share from March 2024 (+0.3 MoM points/ +0.8 over one year), while the overall streaming industry also gains at 38.5% (+0.8 MoM/ +4.4 YoY), further highlighting the secular shift in consumption habits.

As a result, while we may not agree with the sudden change in reporting standard from Q1 2025, we believe the company could continue on its path of profitable growth.

Rather, we believe NFLX management recognizes that its next growth opportunity lies in the advertising market, as opposed to increasing subscriber growth.

For example, part of the favorable results is attributed to the double-digit growth seen in the ad-supported tier at +65% QoQ in Q1 2024, building on the two quarters of +70% QoQ growth and +100% before. so that.

While NFLX’s ad-supported tier at $6.99 per month has still to be achieved the same ARM as the standard tier at $15.49 per month starting in the first quarter of 2024, with an average of “FY2023 at approximately $8.50 excluding subscription fees“, we think things will probably improve gradually.

eMarketer is already forecasting sustained growth digital ad spend at a CAGR of +9.6% to $870.85 billion through 2027, as more advertisers “increasingly shift their investments towards Pure play Internet channels“.

Due to this secular trend, it’s no surprise that NFLX has already offered a very promising 2024 revenue forecast of +14% YoY, while increasing its operating margin forecast to 25% (+4 points over one year), up from the initial midpoint of 22.5% (+1.5 points year-on-year).

These figures further underline management’s confidence in its ability to generate profitable and robust growth going forward, while maintaining a healthy balance sheet with a net debt to EBITDA ratio of 0.58x during the most recent quarter.

This is compared to its direct competitors, such as The Walt Disney Company (DIS) at 2.42x, Warner Bros. Discovery, Inc. (WBD) at 4.66x and Paramount Global (PARA) at 6.17x in Q4 2023.

Readers should also note that NFLX management will announce major subscription milestones on a one-time basis while continuing to provide geographic breakdown on a quarterly basis.

On the contrary, we believe this move could potentially be mirrored by its competitors, especially given the drastic drop in NFLX’s stock price of -21% after the Loss of subscribers in the 1st quarter of 2022.

As long as the streaming company continues to experience healthy top-line and bottom-line growth, as noted above, we believe the change to its reporting standard will not have a material impact on its overall performance.

So, is NFLX Stock a Buy?Sell or Keep?

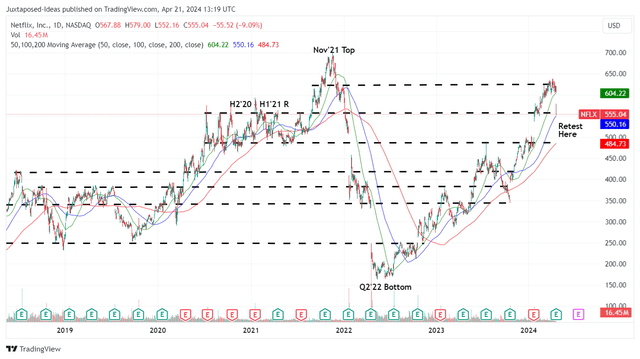

NFLX 5Y Stock Price

For now, NFLX has significantly lost much of its recent gains as the market overreacts to the new reporting standard and the overall tech market declines heading into Q1 earnings season 2024.

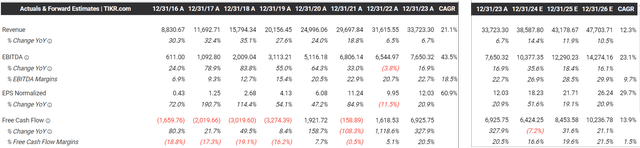

Forward-looking consensus estimates

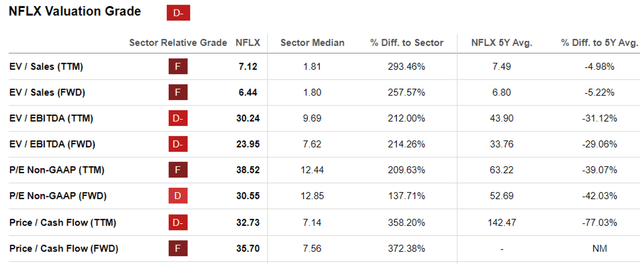

At the same time, as NFLX’s streaming business declines from high double-digit growth in the pre-pandemic period to low double-digit growth thus far, we believe the moderation seen in its EV/EBITDA FWD of 23.95x and its P/FWD Des E of 30.55x are in fact guaranteed.

This is compared to the 5-year historical average of 33.76x and 52.69x, respectively.

NFLX valuations

Again, NFLX’s premium over the industry median of 7.62x and 12.85x is also justified, due to the inherent profitability of its streaming business relative to its historical peers, further aided by the projected expansion of adjusted EBITDA and net margins of the former. until fiscal year 2026.

For now, based on the LTM adj EPS estimates of $14.41 and the 1-year average P/E of 31.79x, it is evident that the stock is still trading well above our fair value estimated $458, with a notable premium of +21.1% over current. levels.

Again, based on the consensus that has FY2026 adjusted EPS at $26.24, there appears to be excellent upside potential of +50.2% to our long-term price target of $834.10.

Thanks to previous SAG/WGA strikes and production delays, NFLX also used some of its strong free cash flow to retire $8.04 billion, or the equivalent of 10.7 million, of its shares over the last few years. last five quarters, thus returning a lot of value to existing shareholders.

Due to the attractive long-term risk/reward ratio, we reclassify NFLX as a Buy, but without a specific entry point as it depends on individual investors’ dollar cost averaging and portfolio allocation.

With the market correction still ongoing and likely to continue over the coming weeks, interested investors may want to monitor how the stock moves before increasing its previous support levels of $480 for an improved margin of safety , these levels also being close to our fair value. estimates.

Hold NFLX for a long time.