We are

PDD Holdings (NASDAQ:PDD), also known as Pinduoduo, is a leading e-commerce platform in China and one of the top three Chinese e-commerce companies, after Alibaba (BABA) and JD.com (JD), which dominate The Market. PDD Holdings offers a variety of e-commerce and related services such as order fulfillment and logistics, and Pinduoduo owns the highly popular, transaction-focused e-commerce platform Temu. PDD Holdings has strong tailwinds to its top and bottom lines and generates a ton of free cash flow. While not as cheap as Alibaba or JD.com, PDD Holdings is well-positioned to deliver sustainable growth to shareholders and increase its share buybacks in the future, making it a potential return-on-capital play for investors!

PDD Holdings is a China-based e-commerce growth player

China has a population of 1.4 billion people and the amount of Consumers buying products and services online are growing rapidly. PDD Holdings is well positioned to benefit from this growth as the company is heavily focused on the Chinese e-commerce market. PDD Holdings owns Temu.com, a discount and discovery-driven shopping site that primarily caters to retail shoppers, but not just in China. Temu caters to the shopping needs of an international audience and enables Chinese manufacturers to sell directly to their customers. Temu was founded in 2022 and competes directly with Alibaba’s Aliexpress. Temu offers discount deals on kitchen appliances, clothing, shoes, jewelry, and beauty products as well as any other category that comes to mind. With its focus on discount deals, PDD has earned a loyal following and is one of the fastest growing e-commerce companies in China.

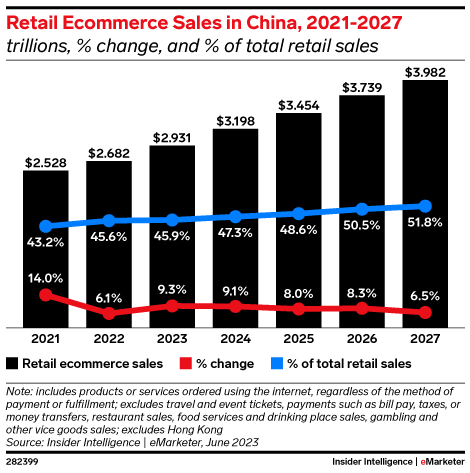

Clearly, with such a large population, China is a strong market for e-commerce growth investors. In China, according to eMarketer, the online retail market is expected to grow 8% annually over the next four years, which should provide sustainable tailwinds for gross profit and EPS growth for PDD Holdings.

eMarketer

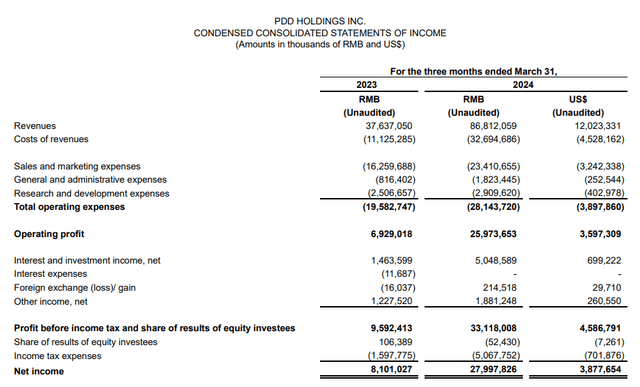

PDD Holdings generated 86.8 billion Chinese yuan ($12.0 billion) in revenue in the first fiscal quarter, up 131% from a year earlier. Revenue from online marketing services jumped 56% year-on-year to 42.5 billion Chinese yuan ($5.9 billion), while transaction-related revenue reached 44.4 billion Chinese yuan ($6.1 billion), up 327% year-on-year.

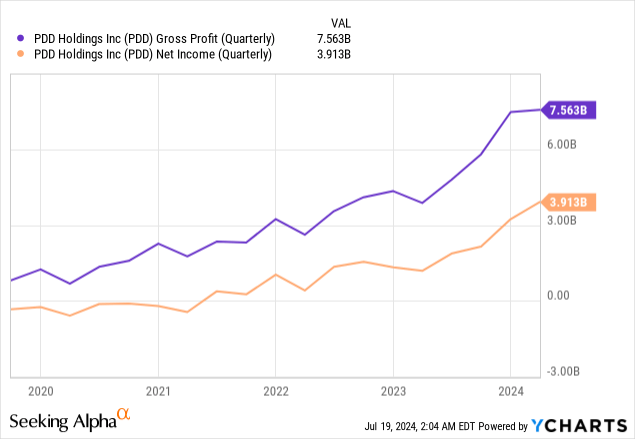

Pinduoduo’s focus on discount offers has helped the company build a loyal customer base and the e-commerce platform has seen impressive growth in recent years. PDD Holdings’ gross and net profits are both in a long-term upward trend given the company’s continued expansion in the e-commerce market, innovation and use of artificial intelligence to optimize its discovery-based shopping suggestions. Effective use of artificial intelligence, for example in the context of shopping recommendations and personalized shopping flows, could be a conversion driver for e-commerce platforms in the future.

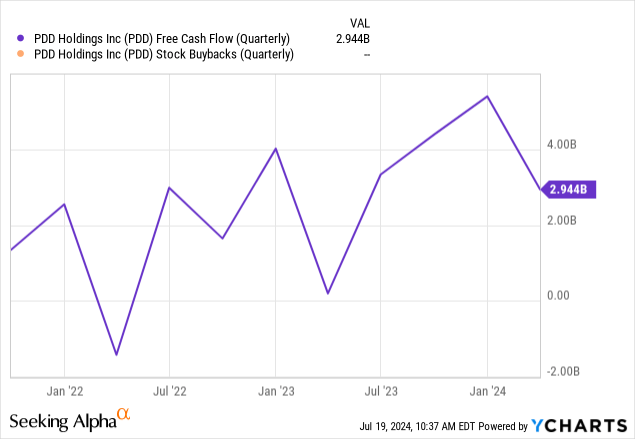

Free cash flow and return on capital potential

Pinduoduo generates a lot of excess cash from its e-commerce operations. Some of that money is being invested in building great language models that will support conversion initiatives on the company’s e-commerce platforms. However, Pinduoduo isn’t actually buying back shares, unlike Alibaba, for example, which authorized a $25 billion stock buyback earlier this year. Given that Pinduoduo is already profitable in terms of free cash flow, I can certainly see the e-commerce company following in Alibaba’s footsteps and launching share buybacks in the future, which, given the stock’s low price-to-earnings ratio, would be a good use of cash flow.

Valuation of PDD Holdings

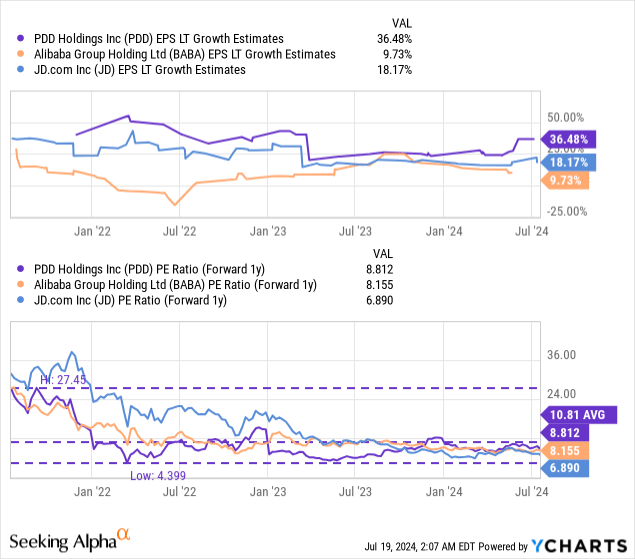

PDD and other large-cap Chinese e-commerce platforms are cheap due to a number of factors, including structural problems in the Chinese economy and increasing competition in the e-commerce market. increased by only 4.7% in the second quarter, below expectations of 5.1%, due to slowing consumer spending and a struggling real estate sector that has suffered from excessive speculation in recent years.

Moreover, American investors are wary of investing in large Chinese companies, largely because Beijing has a history of meddling in corporate affairs. Issues related to the rule of law and corporate governance have had a hugely negative impact on investor attitudes toward Chinese companies.

While these risks are not entirely unwarranted, growing e-commerce in China is very inexpensive. China is the second largest market in terms of population (after India), which clearly makes it a long-term growth stake for e-commerce.

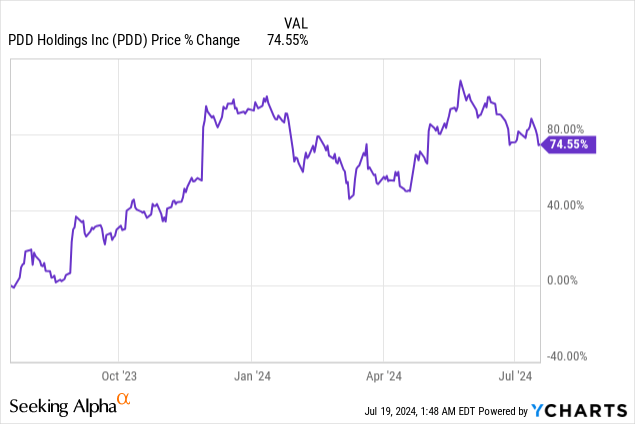

PDD Holdings is currently valued, despite a long-term expected EPS growth rate of 36%, at a price-to-earnings ratio of just 8.8X… which is about 19% below the company’s long-term valuation average. I believe Chinese e-commerce platforms could at least trade at 10X FY2025 earnings given their growth potential and generally positive gross margin dynamics.

A 10X P/E ratio is likely a low estimate for PDD, given its above-average EPS growth. A 10X earnings multiplier also implies an upside revaluation potential of just 14% and a fair value of $150. Longer term, I can see Pinduoduo revaluing to a 12-13X P/E ratio – comparable to what I consider reasonable for Alibaba, also given its strong free cash flow – implying a much higher fair value of $180-195.

Risks related to PDD Holdings

The biggest risk for PDD Holdings is a slow recovery in the Chinese economy that could weigh on consumer spending and thus online sales. This risk is partially offset by what I expect from an aggressive rollout of AI products that could help boost conversions and average order value. What would change my view on Pinduoduo is if the e-commerce company were to experience negative gross margin dynamics or a decline in free cash flow.

Final Thoughts

Pinduoduo, owner of the popular e-commerce site Temu, has a lot going for it. The company is generating very strong top-line growth as its focus on discounted and discovery-based shopping offers is paying off. Pinduoduo is also seeing positive gross profit momentum and could follow in the footsteps of Alibaba, which is now more focused on returning free cash flow to shareholders, primarily through its share repurchase plan. What I like most about Pinduoduo is that the e-commerce company’s shares are trading at a deep discount to fair value, while PDD should maintain significant EPS growth momentum going forward. With a price-to-earnings ratio of 8.8X, share repurchases would also make a lot of sense!