Here’s what Ethereum futures market data suggests about whether sentiment around ETH looks bearish or bullish.

Ethereum Takers’ Buy-Sell Ratio Has Recently Seen a Sharp Increase

In a new CryptoQuant Quicktake jobAn analyst talked about Ethereum’s outlook based on futures market data. The main indicator here is the “Taker/Buy/Sell Ratio”, which tracks ETH taker buying and selling volumes on derivatives platforms.

When the value of this measure is greater than 1, it means that the taker’s buying or long position volume exceeds the taker’s selling or short position volume and therefore, a majority bullish sentiment is present in the market.

On the other hand, the fact that the indicator is below the bar implies the dominance of a bearish mentality among future users, as more sellers are willing to sell at a lower price.

Now here is a chart that shows the trend of Ethereum’s 14-day Simple Moving Average (SMA) Taker Buy Sell ratio over the past few months:

The 14-day SMA value of the metric appears to have been sharply going up in recent days | Source: CryptoQuant

As seen in the chart above, the Taker Buy Sell Ethereum 14-day SMA ratio has recently observed a rapid increase, implying that the market balance has shifted.

Along with this rise in the indicator, the price of the asset also saw a sharp rise. The chart shows that a similar trend was also observed in the measure preceding the price increase in the first quarter of the year.

Based on the recent trend, the quant comments:

This rise indicates strong buying interest in the perpetual market, suggesting a notable bullish sentiment. If this upward trend in the taker bid/sell ratio continues, it confirms a potential medium-term bullish trend in the market, with the price likely moving back up towards higher values.

It remains to be seen whether the 14-day Taker Buy Sell SMA ratio will continue to rise in the coming days, confirming this possible bullish setup for the cryptocurrency.

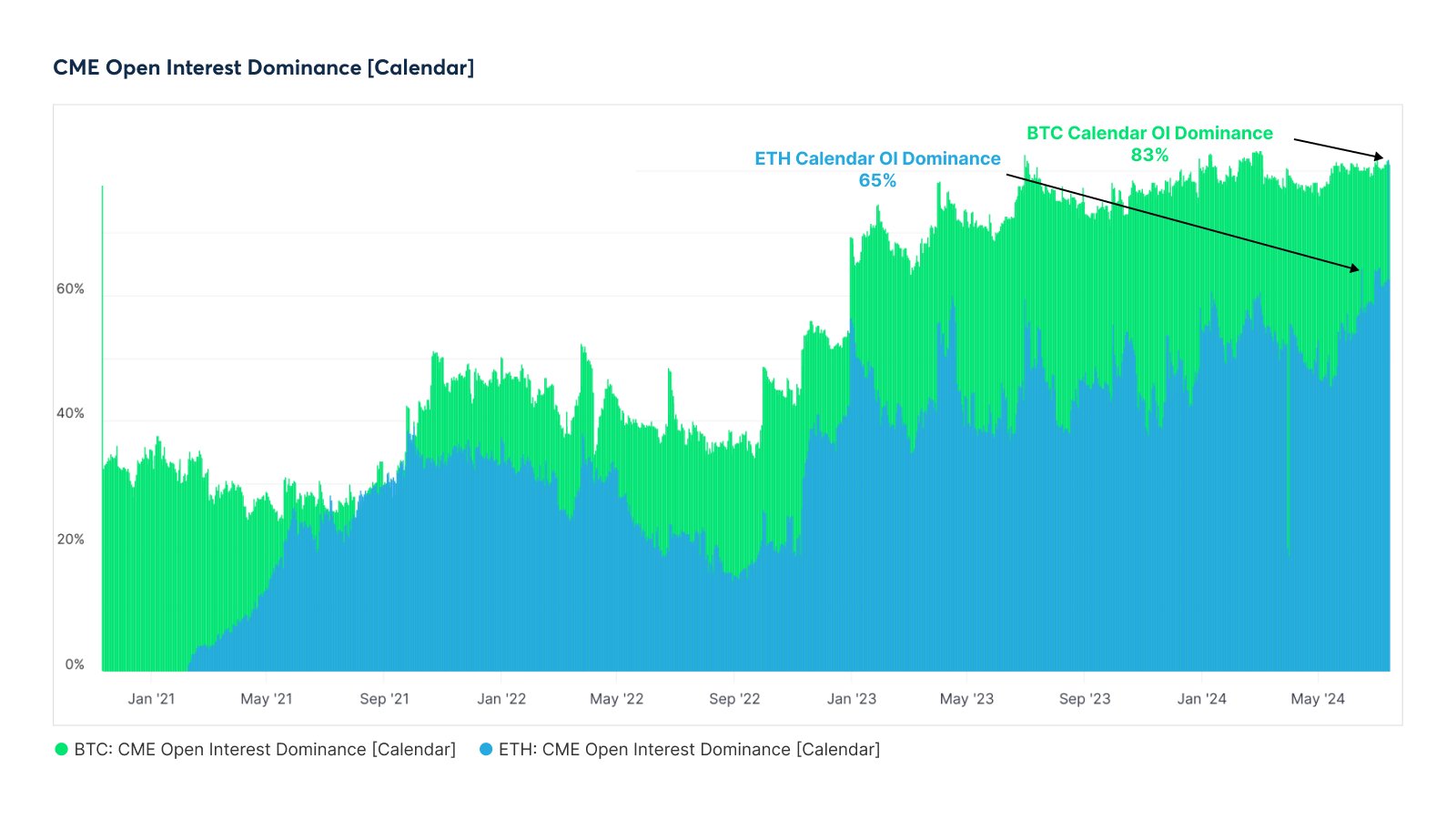

Speaking of the futures market, the CME Group has recently seen its dominance increase in the calendar futures market for Ethereum and Bitcoin, as analytics firm Glassnode highlighted in an article by X job.

The trend in the Open Interest dominance of the CME group in the BTC and ETH calendar futures market | Source: Glassnode on X

The chart above displays data relating to CME Group’s open interest dominance. Open interest refers to the number of contracts currently open in the calendar futures market.

It appears that CME Group now holds 83% and 65% of the open interest on the Bitcoin and Ethereum calendar, respectively.

ETH Price

Ethereum’s recovery has stalled over the past few days, with the asset’s price still trading around $3,400.

Looks like the price of the coin has been moving sideways since its surge | Source: ETHUSD on TradingView

Featured image by Dall-E, CryptoQuant.com Glassnode.com, chart by TradingView.com