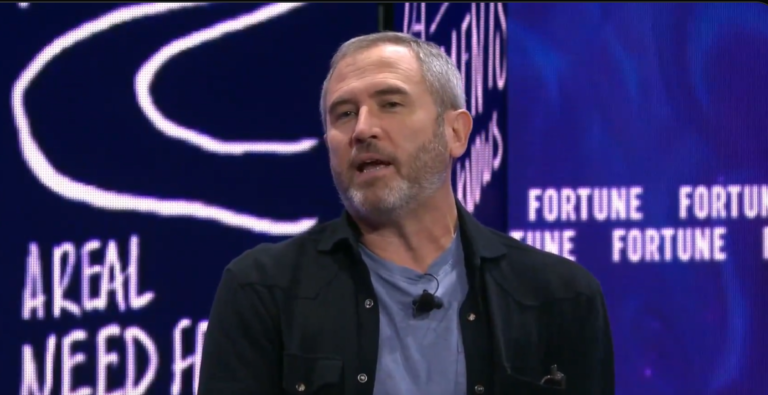

In a interview Along with Fortune’s Andrew Nusca, Ripple CEO Brad Garlinghouse provided insight into the company’s strategic roadmap, its cautious approach to an initial public offering (IPO), and Ripple’s competitive advantage over the traditional SWIFT network.

A Ripple IPO is not currently on the agenda

Garlinghouse has been outspoken about Ripple’s decision to delay its IPO amid a tough regulatory environment. He said, “We’ve publicly stated that we have no imminent plans for an IPO. I mean, why would you do that in the current SEC? We’re not. I’m not very popular within the walls of the SEC.”

The sentiment underscores the friction between Ripple and the regulator, especially after the landmark court ruling in July last year that determined XRP is not a security. for an IPORipple pursued a different strategy that Garlinghouse made public during the interview.

“I’ve always viewed an IPO as a step in the journey, not the end of a journey. What we did instead, and this is actually new news, which we haven’t shared publicly, is we did a series of tender offers in which we were share buyback “From investors and employees,” the Ripple CEO revealed, adding, “We are now in the middle of another tender offer and when this is complete, we will have repurchased $4 billion worth of stock from our shareholders.”

Ripple vs SWIFT

Garlinghouse also commented on the company’s competitive position against SWIFT, the global standard for financial messaging and cross-border payments. He criticized the outdated nature of current wire transfer systems, noting: “The SWIFT network, I imagine everybody here at some point in their life has done a SWIFT transfer, a SWIFT-enabled transaction, what you call a wire transfer.” He noted the historical context: “The term wire transfer, the etymology of that is a telegram, right, it’s not a technology that evolved with the Internet.”

Garlinghouse championed Ripple’s transformative approach, which can dramatically reduce the friction of international money transfers, similar to advances in digital communication. “Are we competing with SWIFT? Yes, there are many payment networks, and when I think about what Ripple is trying to do, we’re essentially trying to let value move in the same way that information moves today,” he explained. Drawing an analogy to the evolution of email protocols that connected isolated platforms, he emphasized Ripple’s goal of facilitating similar interoperability across various payment networks.

When will the XRP trial end?

Garlinghouse also discussed the protracted legal battle with the SEC over the status of XRP, which resulted in substantial legal fees but ultimately a favorable decision for Ripple. “I’ve always considered it a currency, and we engaged in a three-and-a-half-year legal battle that culminated last summer. We won on the fundamental issue that XRP is not inherently a security,” he noted. But the legal bill for that victory was enormous. “But it was $150 million in legal bills along the way,” Garlinghouse revealed.

Speaking on the final appeals and sanction decisionGarlinghouse expressed optimism that the trial would be resolved soon. “There are a few things that I would call cliffhangers that the judge should rule on shortly, you know, maybe less than a month, maybe two months. I can’t know, but I look forward to a full resolution.”

At press time, XRP was trading at $0.58336.

Featured image of X, chart from TradingView.com