courtneyk

Reached (NASDAQ:UPST) has seen a lot of volatility lately, likely due to less confidence in interest rate cuts. The company continues to struggle in the current interest rate environment, although it already appears poised to start benefiting from easier measures. comparable. Management has responded to the challenging macroeconomic environment by reducing costs, and I expect these efforts to bear fruit if and when the macroeconomic environment improves. The stock looks attractively priced at current levels, warranting an upgrade to its rating. I view the stock as a buy for investors, with above-average volatility.

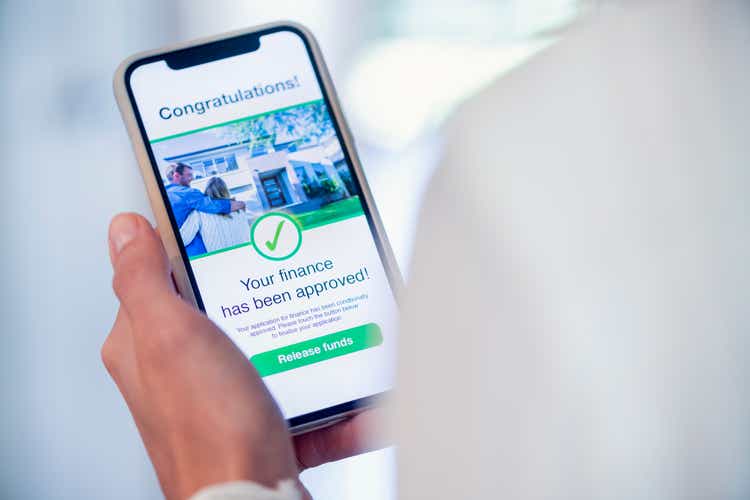

UPST stock price

I UPST last covered in December, where I explained why I was selling my position and withdrawing my buy rating for the stock. That report proved to be fortuitous timing, as the stock has since fallen 50% during a period in which the broader market has come back. 5%.

The relative underperformance has improved the value proposition, even if valuation isn’t really the issue here.

Key UPST Stock Metrics

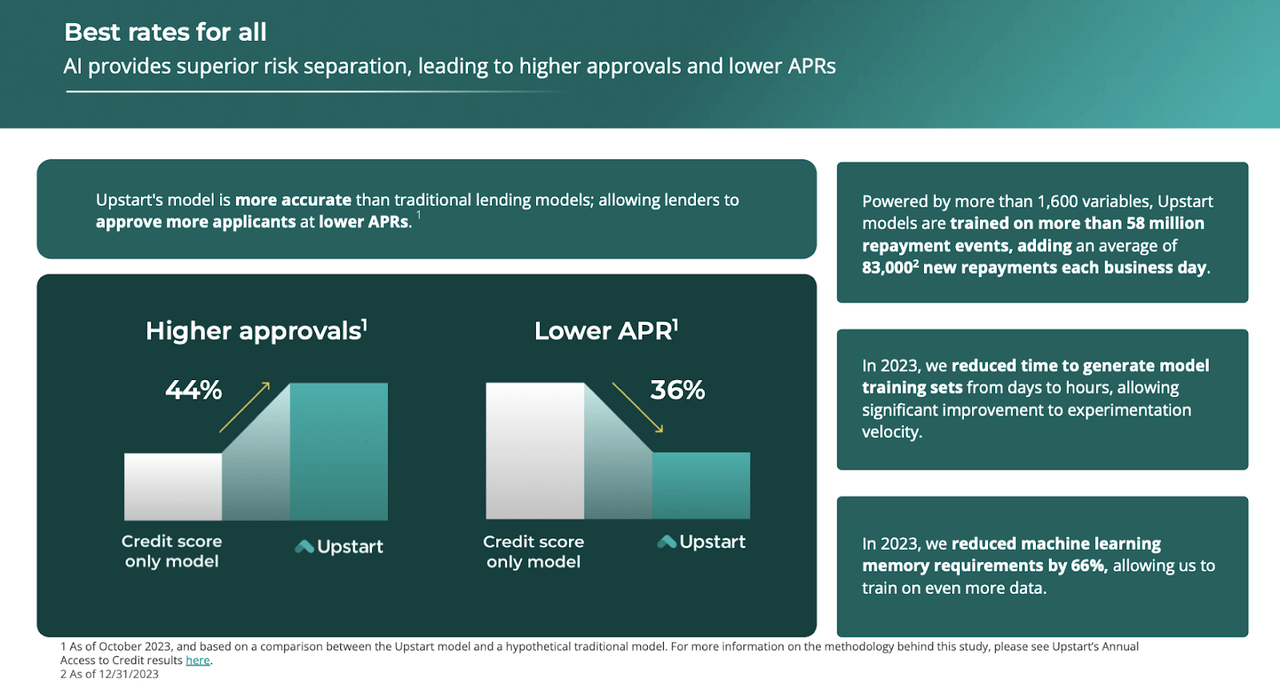

UPST was a hot tech stock during the pandemic, which investors (including yours truly) said was seizing a huge market opportunity by increasing the availability of credit. Specifically, UPST aims to use its artificial intelligence-based model to approve loans, which could lead to higher approval rates and lower APRs than the typical FICO model.

Presentation of the 4th quarter 2023

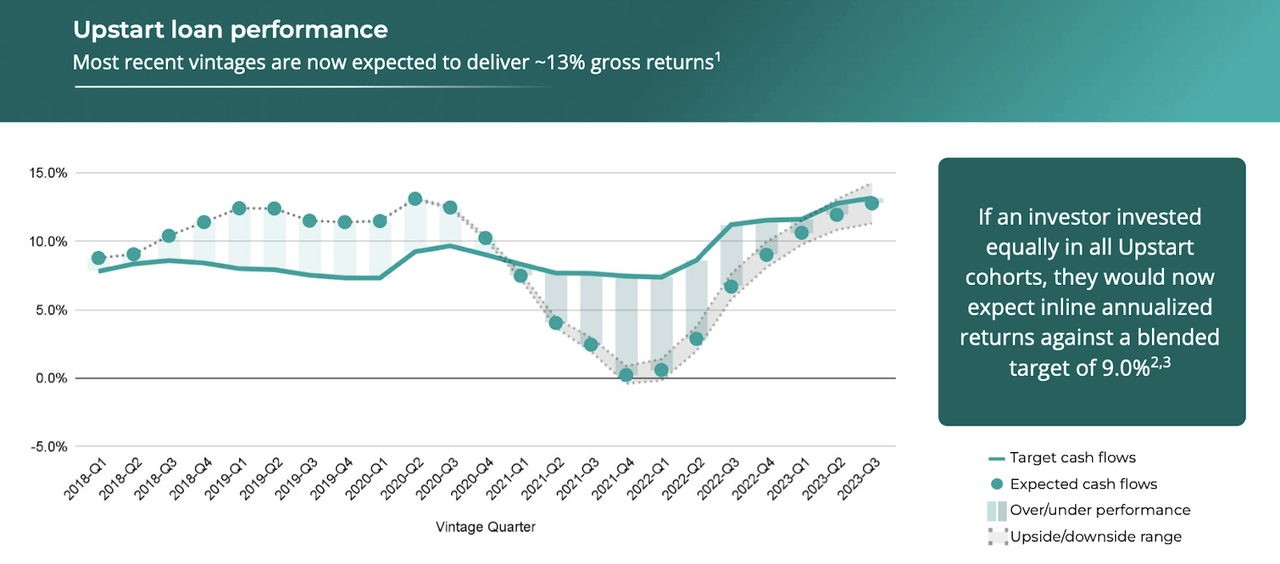

The idea was that UPST could have an asset-light model because it would be able to earn fees by selling its issued loans to institutional investors. Unfortunately for UPST, post-pandemic headwinds as well as rapidly rising interest rates have challenged their operating model as institutional capital has lost confidence in projected returns, severely limiting the company’s ability to grow. ‘business. That said, the company is making progress to bring expected ROI back to its target range.

Presentation of the 4th quarter 2023

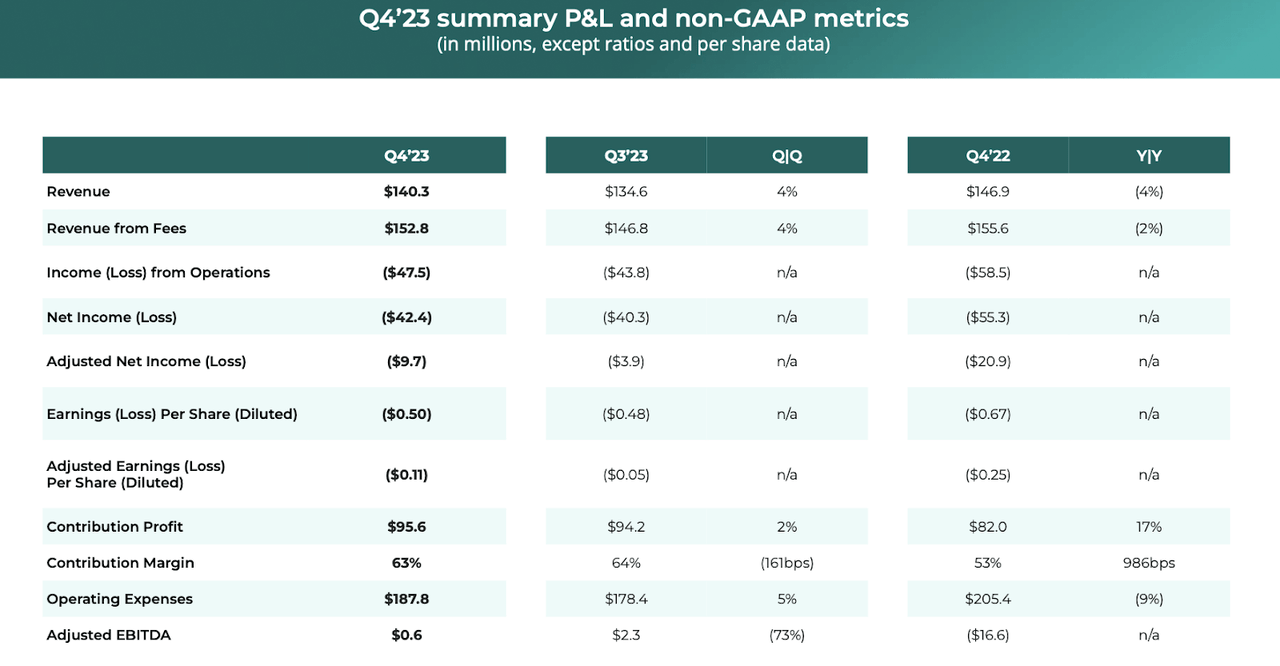

In its most recent quarter, UPST saw revenue fall 4% year-over-year to $140.3 million, beating forecasts of $135 million. UPST lost $9.7 million in adjusted net income, beating forecasts for a $14 million loss. As has been the case of late, the company generated strong contribution margins of 63% – pricing power was the bright spot amid falling origination volumes.

Presentation of the 4th quarter 2023

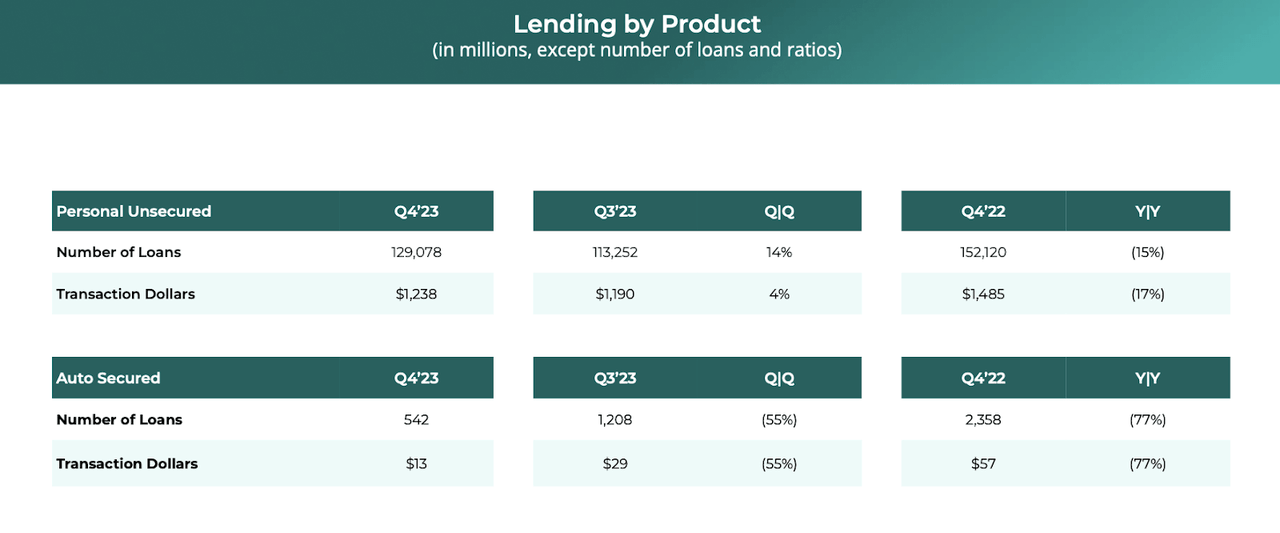

The company saw unsecured personal loans decline 15% year-over-year. This represents some stabilization compared to the 39% decline recorded in the third quarter. I attribute this stabilization to the fact that the company now benefits from easier bases of comparison and I expect this trend to continue in the coming year.

Presentation of the 4th quarter 2023

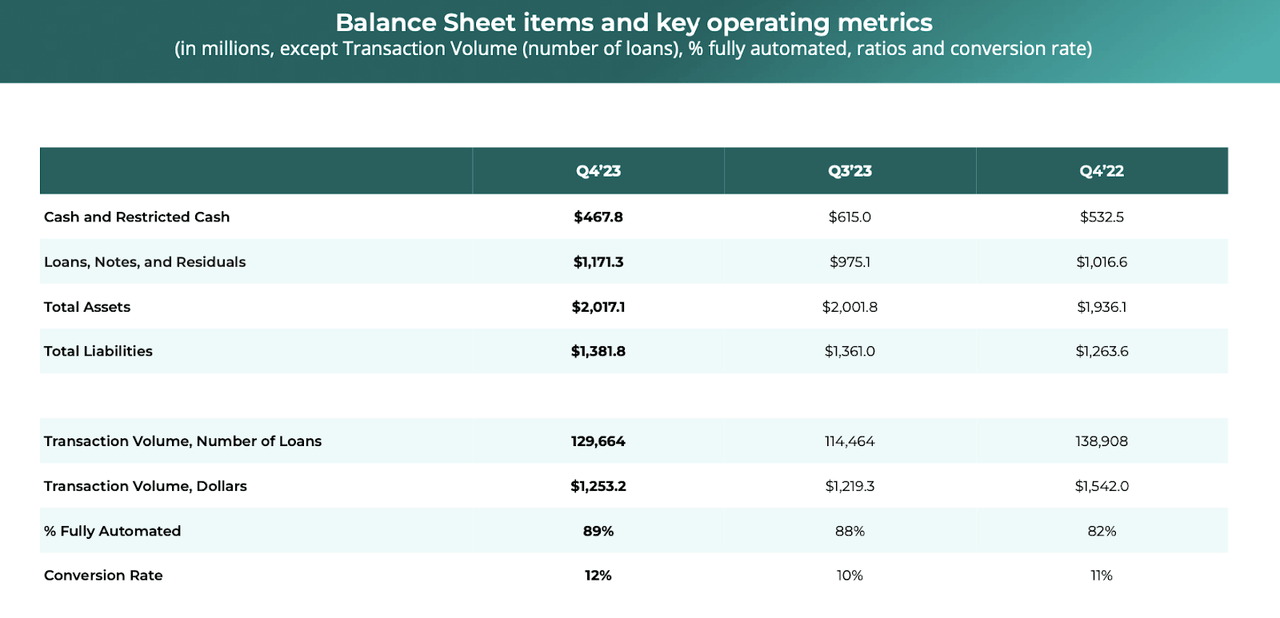

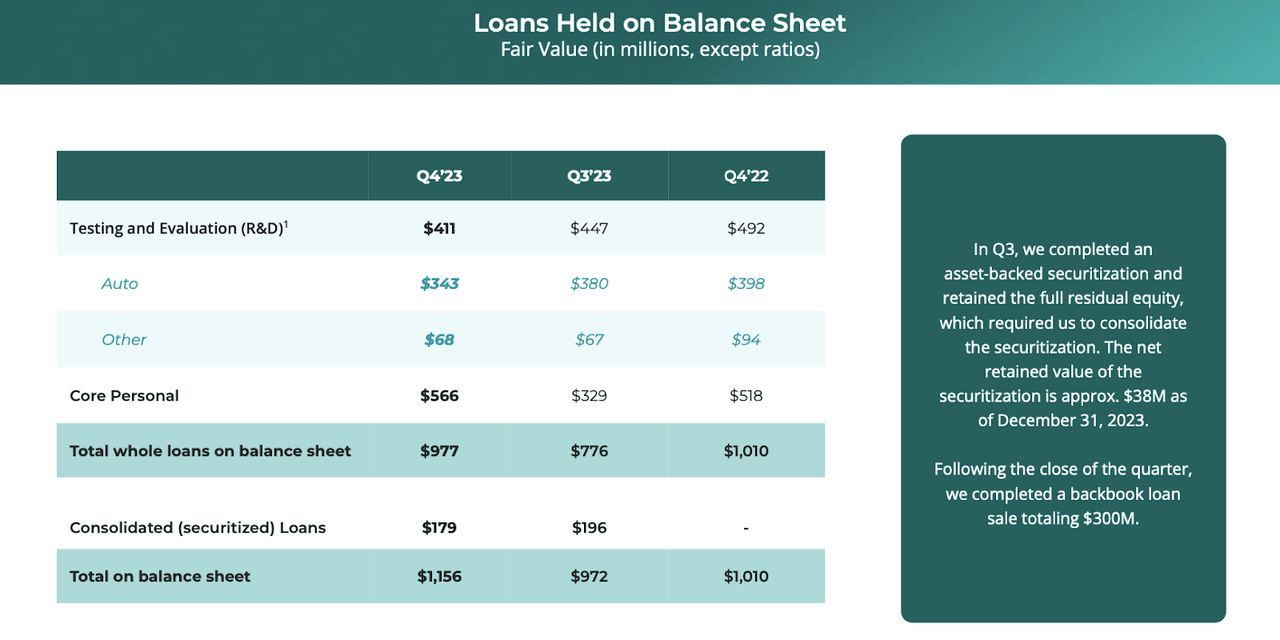

UPST ended the quarter with $467.8 million in cash versus $1.1 billion in debt. The company also had $1.17 billion in loans on its balance sheet.

Presentation of the 4th quarter 2023

Management considers $411 million of these loans to be held for “R&D purposes,” but investors may be concerned about the 19% quarter-over-quarter increase in loans held on balance sheet. UPST has been touted as being an asset-light operator in the loan origination space, but it appears the company has had to temporarily move away from that model in a volatile interest rate environment.

Presentation of the 4th quarter 2023

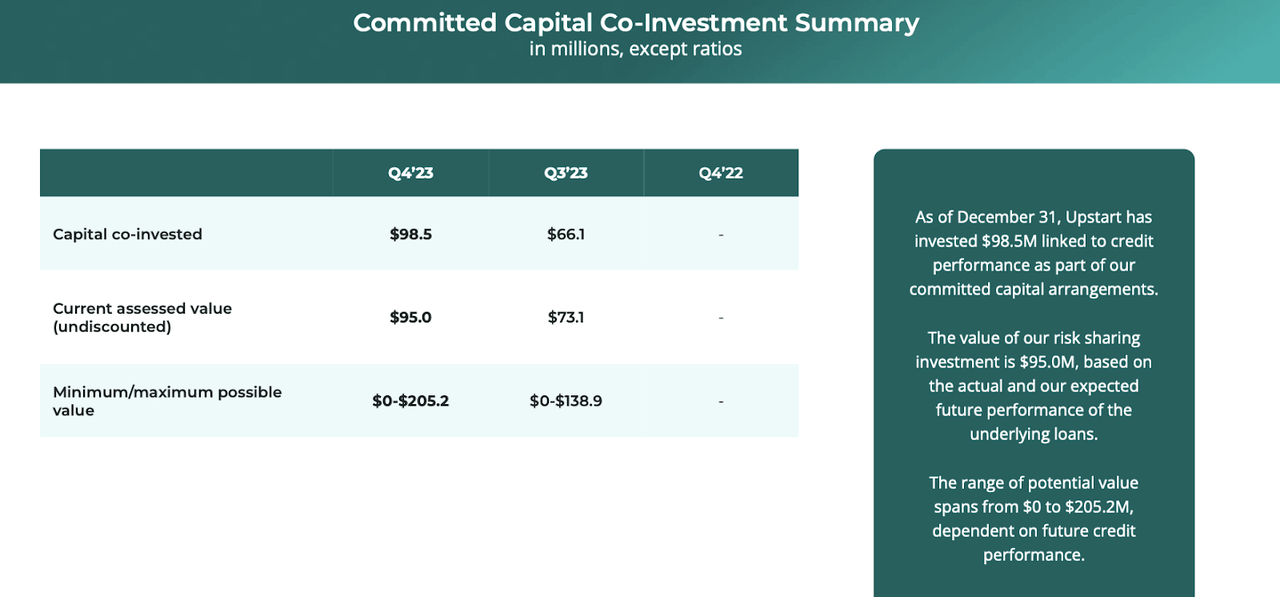

UPST previously revealed that it had signed committed capital agreements, but for now, these agreements still appear quite modest.

Presentation of the 4th quarter 2023

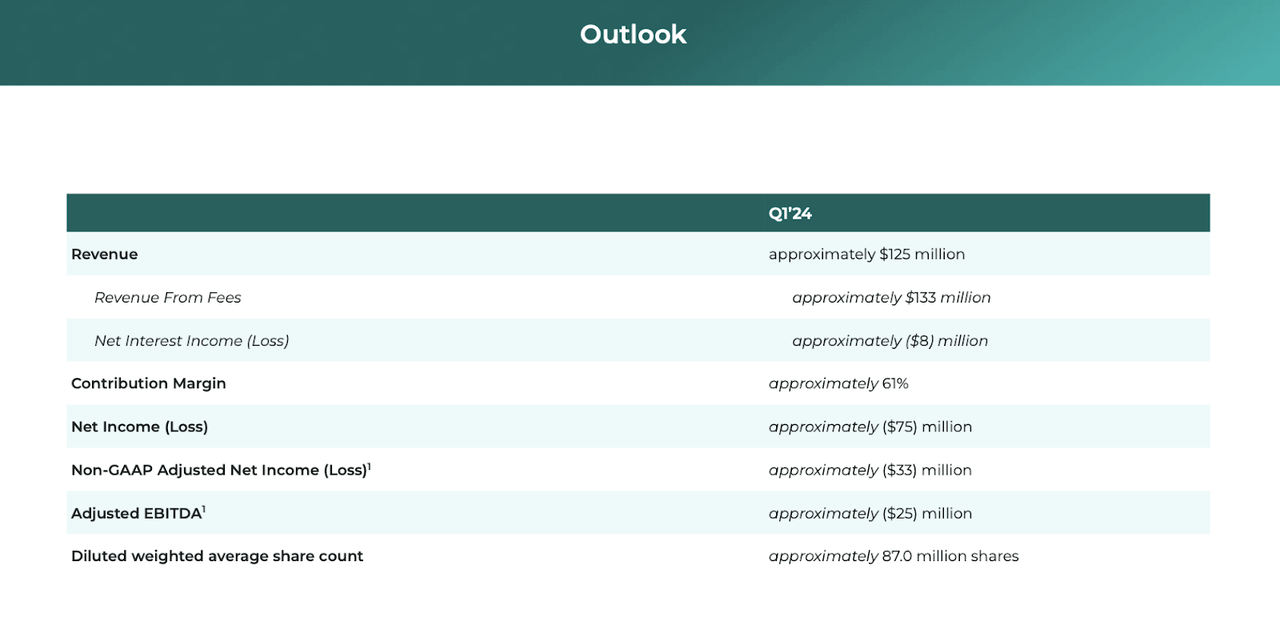

Looking ahead, management projected revenue growth of 21% on an annual basis to $125 million and 13.6% in revenue on an annual basis from fee growth to $133 million. This would be the company’s first quarter showing year-over-year revenue growth since the second quarter of 2022.

Presentation of the 4th quarter 2023

On the conference call, management once again blamed its weak revenue growth on a difficult macroeconomic environment, as it is constrained by its upper limit of 36%. Not only must the company automatically turn away many potential borrowers because of the limit, but it is possible (if not likely) that many potential borrowers will also be deterred by the higher interest rates offered.

This could lead some investors to question whether UPST is dependent on lower interest rates. Management appears very sensitive to this possibility and has made aggressive cost cuts to, in its words, ensure that it “can thrive in a wide range of economic conditions.” Even though the company is not yet profitable today, it is encouraging to see it continue to reduce its operating losses, even in the current environment. Management touted its 89% fully automated approval rate, as well as the fact that it ended 2023 with “26% fewer headcount than at the end of 2022.” The appeal of a fully automated loan approval process is compelling, as it would avoid the usual processes such as having to upload documents, schedule phone calls, or wait hours or days for a response. ‘a credit analyst’. This reminds me of my initial attraction to the stock, but the higher interest rate environment has clearly stopped growth.

Management noted its desire to break even on EBITDA this year, but used both “hope” and “priority” to describe that commitment. That said, I wouldn’t be surprised to see management succeed on this front, given that the company appears poised to benefit from easier revenue comparables, while benefiting from continued cost discipline.

Is UPST Stock a Buy, Sell or Hold?

UPST is not out of the woods yet, as interest rates have not yet come down and the company has not yet figured out how to be profitable in the current environment. As inflation remains stubborn, investors are grappling with the possibility of delay in planned interest rate cuts. Still, as I mentioned earlier, UPST is already expected to see higher revenue growth rates this year, if only because of the poor financial results of the recent past, which now represent easier comparables. Consensus estimates have the company growing 13% year-over-year this year, followed by 30% growth in 2025. I note that consensus estimates of $756 million in revenue in 2025 are still significantly lower at the mark of 907 million dollars earned in 2022.

The stock may not seem to offer as much value, given that the company is not yet profitable. But if the company can continue to make progress toward cost reduction and we benefit from some reduction in interest rates, then I see a real case for buying stock here. I see the company generating a net margin of 25% over the long term – I note that the company generated an operating margin of 18% in 2021. That would put the stock at just 13 times its long-term earnings power, and We could apply a trough income in this calculation. I could see the stock being revalued to 20x earnings or even a higher range if it can become a secular producer again – the secular thesis of the pandemic era centered on UPST earning fees on more and more loans as more and more financial institutions sought to do so. invest in its products. Because of its reliance on interest rates, UPST is the type of stock that might be considered a high-growth stock in a low interest rate environment and forgotten about when interest rates are higher. This dynamic raises the risk profile of the stock, which compensates for the low valuation.

What are the main risks? I’ve already mentioned interest rates as a critical risk for the business. UPST could deliver solid year-over-year revenue growth this year due to easier comparisons, but I suspect consensus estimates for 2025 and beyond factor in interest rate reductions. It is difficult to understand how UPST can generate sustainable revenue growth in this environment due to capital constraints (which may not ease unless interest rates fall). UPST is not yet profitable and so there is no implicit support for valuation in this environment. There have been many quarters over the past few years in which management has seemed committed to an asset-light model, but that commitment appears to have disappeared due to macroeconomic headwinds. It is possible that management is adding more loans to the balance sheet, which, due to the implied reduction in cash balance, could increase the stock’s risk profile.

Conclusion

There is no visible catalyst in sight for the UPST, apart from a reduction in interest rates, which could ease capital constraints and reignite the growth engine. The stock looks cheap in such scenarios, but the company remains unprofitable in the current environment. I believe the company can continue to make progress on the profitability front, which could enable it to produce strong results if or when macroeconomic conditions improve. It’s difficult to get conviction behind this name due to the reliance on lower interest rates, but I am raising the stock to a buy rating due to its low valuation.